|

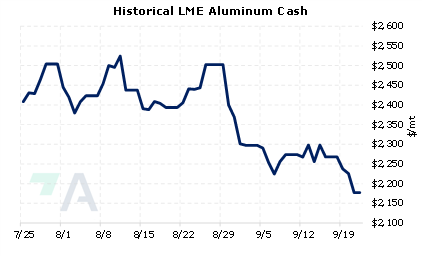

Russian aluminum producer Rusal is developing a plan to deliver aluminum directly into the LME’s Asian warehouses, according to Bloomberg. Even though Rusal has not been sanctioned by Western governments due to the Russia-Ukraine conflict, Western buyers have shunned the company’s aluminum supplies, thereby leading to excess production as Rusal struggles to find alternative buyers. Traders have worried that large Russian deliveries direct to LME warehouses could suppress global prices. However, Rusal, fearing a negative price reaction, is only contemplating a test program, according to unnamed sources interviewed by Bloomberg. It is rare for smelters to sell directly onto an exchange, as most seek out long-term contracts. |

|

|

|

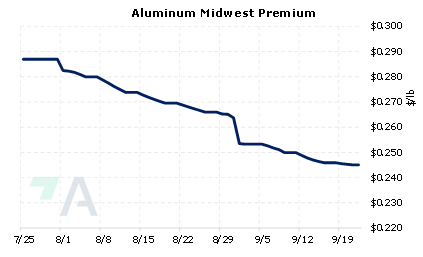

Can Russia’s Rusal sell its excess aluminum production without pressuring global prices? Aluminum prices have already tumbled in recent months, setting a new low of $2,198/mt for the year just yesterday. With last trade on the 3M Select contract at $2,225/mt (7:00 AM CST), prices are down nearly 21% for the year. Aluminum end-users might utilize the recent price drop by applying hedges that provide upside price protection, such as buying swaps or call options, both of which would establish a maximum price. Such positions are standard for end-user hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (9/22/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

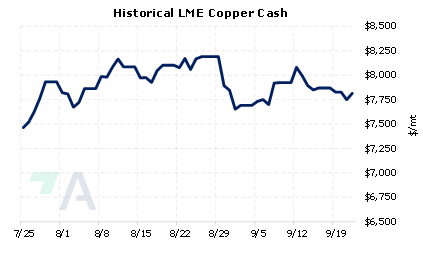

9/21/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices 8/16/2022: Zinc Prices Are On The Rebound Due To Supply Issues 8/9/2022: Aluminum prices are finding support: Consumers can lock in lower costs in 2023 and beyond |

||

|

|

||

| Important Headlines | ||

|

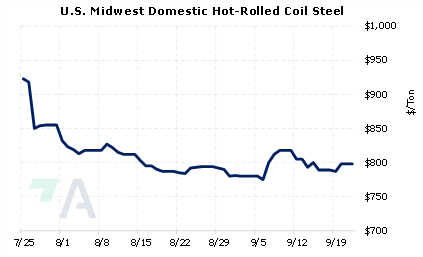

9/21/2022: LME says no sign of metal offloading after report about Rusal 9/20/2022: Russian aluminium giant Rusal mulls selling directly on LME -Bloomberg News 9/20/2022: Europe upstages China as main driver for copper outlook 9/18/2022: China's August aluminium imports fall 19% on-year as domestic output rises 9/18/2022: Column: Zinc caught between weakening demand and sliding supply 9/15/2022: US Steel idles Indiana blast furnace |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||