|

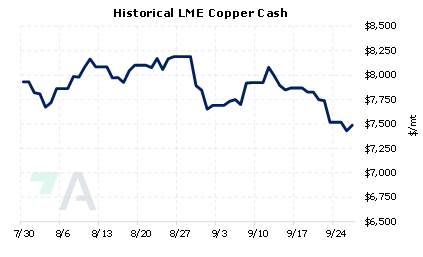

Could Chinese copper imports drop over the coming months? Maike Metals, which is responsible for nearly 25% of China’s copper imports and one of the country’s largest trading houses, is restructuring and selling assets as it fends off a liquidity crisis, according to the Financial Times and Reuters. Maike and other trading firms rely upon short-term financing, using its metals inventory as collateral. However, the company is currently experiencing a liquidity crisis as banks have stepped away from financing physical metals trading. Maike is not only alone in this situation, at least two other major Chinese metals trading companies have had credit lines frozen in recent weeks, according to Bloomberg reports from earlier this month. Maike also has substantial real-estate assets that have deteriorated in value due to China’s ongoing real-estate demand crisis, further exacerbating the company’s dire financial situation. The company is currently meeting with various banks and seeking government investment as it restructures and sells assets. |

|

|

|

The woes that Maike and other trading firms are facing could have global implications, as the supply that Maike and its competitors normally purchased will likely need to seek a new outlet. However, with both Chinese and global copper demand on the decline, it is unclear who might pick up the potential slack in demand. This could further weaken global prices. LME Copper prices have already dropped significantly lower in recent months. The last trade on the 3M Select was $7,420.00/mt (7:00 AM CST), down almost $2,400/mt from the June 7 high of $9,805.50/mt. This could provide a better opportunity for end-users to hedge future needs into 2023 and beyond by buying swaps, as this strategy would establish a maximum copper price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (9/27/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

9/21/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices 8/16/2022: Zinc Prices Are On The Rebound Due To Supply Issues 8/9/2022: Aluminum prices are finding support: Consumers can lock in lower costs in 2023 and beyond |

||

|

|

||

| Important Headlines | ||

|

9/26/2022: Grim demand outlook pushes copper prices to 2-month low 9/25/2022: Chinese copper trader Maike will sell assets and restructure, Financial Times reports 9/25/2022: China’s Maike Metals will sell assets and restructure, says chair 9/23/2022: China's manufacturing steel demand rebounds in August, further improvement to be modest 9/23/2022: Steel makers fear deepening crisis from energy crunch as output halted |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||