|

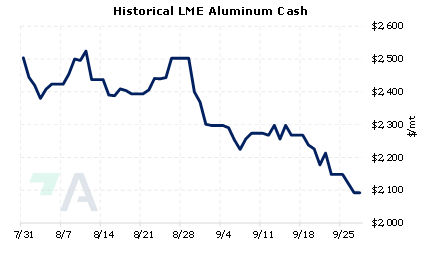

With Norsk Hydro's announcement late yesterday that two of their Norway plants will soon cut production, AEGIS now estimates that approximately 1.14 million mt, or 25.4% of Europe’s annual smelter capacity has gone offline since late 2021 due to falling demand or high electricity prices. The two Norsk plants, Karmøy and Husnes, will curtail production by a combined total of 110,000 to 130,000 mt due to falling European aluminum demand. According to the press release, the two plants will begin production cuts “shortly,” and the company expects the plants will reach new production levels by the end of 2022. |

|

|

|

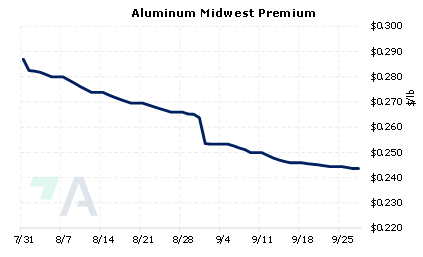

Aluminum prices have largely trended down since early August. However, further curtailments in Europe and elsewhere could begin to push prices higher. Aluminum end-users that are concerned about increasing prices could consider buying swaps or call options, as either would establish a maximum aluminum price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (9/28/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

9/21/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices 8/16/2022: Zinc Prices Are On The Rebound Due To Supply Issues 8/9/2022: Aluminum prices are finding support: Consumers can lock in lower costs in 2023 and beyond |

||

|

|

||

| Important Headlines | ||

|

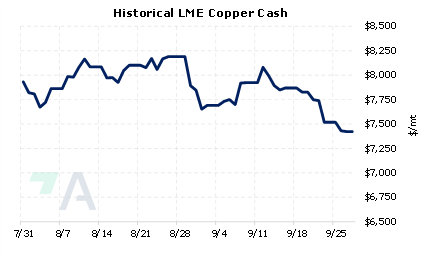

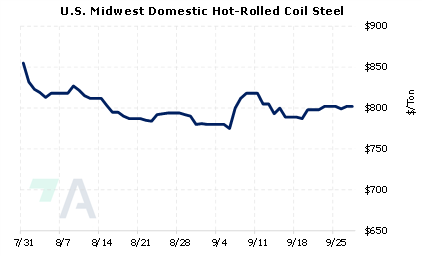

9/27/2022: Hydro responds to reduced aluminium demand, partially curtails production 9/26/2022: NorthAm auto cut estimates continue to rise 9/26/2022: Grim demand outlook pushes copper prices to 2-month low 9/25/2022: Chinese copper trader Maike will sell assets and restructure, Financial Times reports 9/25/2022: China’s Maike Metals will sell assets and restructure, says chair 9/23/2022: China's manufacturing steel demand rebounds in August, further improvement to be modest 9/23/2022: Steel makers fear deepening crisis from energy crunch as output halted |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||