|

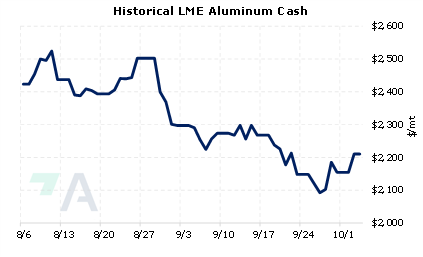

The premium for 4Q 2022 aluminum deliveries into Japan will likely be approximately $99/mt, a 33% price drop from the prior quarter and the lowest in nearly two years, according to Bloomberg. This is the premium over the London Metal Exchange (LME) cash price that Japanese importers agree to pay for primary aluminum shipments. These premiums, which are set on a quarterly basis, are negotiated directly between Japanese end-users and global aluminum producers. At least two Japanese aluminum buyers have agreed to this $99/mt premium, thereby signaling what pricing other buyers are likely to pay. This premium has dropped in recent quarters as demand, specifically from the automotive sector, has softened. However, this premium could rebound in spring 2023 if automotive demand returns, according to recent comments by Sumitomo Corp. Japan imported approximately 2.793 million mt of aluminum in 2021, or about 4% of global production, according to the Japan Ministry of Finance and USGS data. |

|

|

|

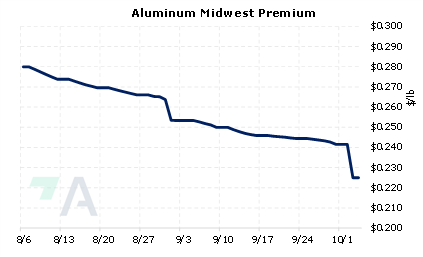

Aluminum prices have largely trended down this year as demand in Japan and elsewhere has fallen. However, LME could push prices higher if automotive demand returns, as Sumitomo suggests. Aluminum end-users that are concerned about increasing prices could consider buying swaps or call options, as either would establish a maximum aluminum price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (10/4/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

9/28/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices 8/16/2022: Zinc Prices Are On The Rebound Due To Supply Issues 8/9/2022: Aluminum prices are finding support: Consumers can lock in lower costs in 2023 and beyond |

||

|

|

||

| Important Headlines | ||

|

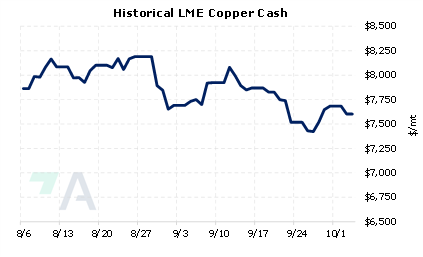

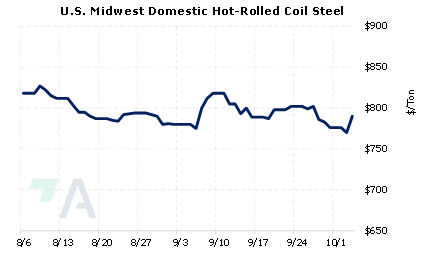

10/3/2022: US Steel idles Mon Valley blast furnace 10/3/2022: BHP lifts steel consumption forecast on surging demand from renewable power farms 10/3/2022: Copper price pressured by crumbling demand |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||