|

LME could limit Russian metal via a quota system or ban it all, under two alternatives proposed, according to their press release. These options were outlined in the discussion paper the exchange launched last Thursday. The paper aims to gather market opinion to treat Russian metal that is currently on the exchange, and potentially might be delivered. The LME has given market participants until October 28 to respond. |

|

|

|

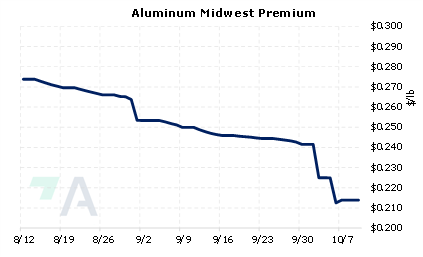

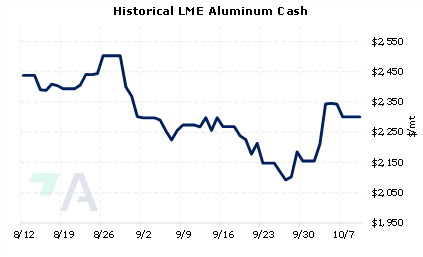

Aluminum prices jumped over 8% on September 29 after the first reports that the LME could ban Russian aluminum and other metals from being delivered against LME contracts. The market has held strong and is up approximately 2% since the September 29 close, with last trade at $2,278/mt (7:00 AM CST). However, allowing Rusal to sell large volumes of metal onto the LME could push prices lower. Aluminum producers that are concerned about decreasing prices could consider selling swaps or buying put options. Such positions are standard for producer hedging; however, they can result in opportunity costs or cash costs if metal prices increase. Please contact AEGIS for specific strategies that fit your operations. (10/10/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

10/05/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices |

||

|

|

||

| Important Headlines | ||

|

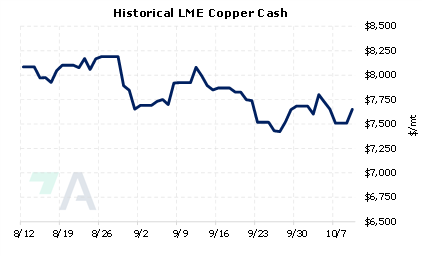

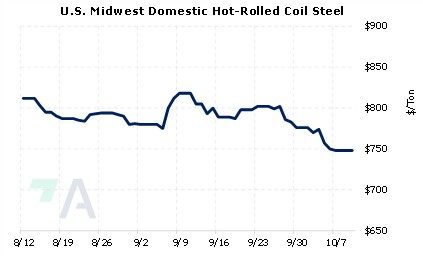

10/6/2022: LME seeks market opinion on possible Russian metal ban 10/6/2022: Russia may build alumina plant to cut costly dependence on China 10/5/2022: Glencore to place Nordenham zinc smelter on care and maintenance from Nov 1 10/4/2022: Column: London Metal Exchange ducks Russian sanctions pressure 10/3/2022: AutoForecast cuts NorthAm production outlook further 10/3/2022: US Steel idles Mon Valley blast furnace 10/3/2022: BHP lifts steel consumption forecast on surging demand from renewable power farms 10/3/2022: Copper price pressured by crumbling demand |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||