|

The Institute of Scrap Recycling Industries (ISRI), a US-based trade organization, is trying to dissuade Mexico from banning aluminum and steel exports to the US. ISRI recently stated they understand the Mexican government’s aim to reduce food inflation, but the organization does not understand why scrap steel and aluminum that are used in food packaging should be targeted. The proposed export ban stems from a set of anti-inflationary laws introduced by the Mexican government last week. Aluminum cans are one packaging product that could be affected more than others. So far this year, Mexico was the second biggest supplier of aluminum scrap and ferrous scrap to the US, according to Argus. Mexico exports most of its used beverage cans to the US, as it does not have a rolling mill that produces rolling can sheets (Source: Argus) |

|

|

|

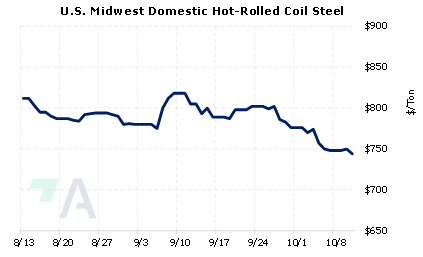

The US scrap industry likely fears reducing the supply of scrap imports into the US could fuel inflation. This could happen, as the US is a large importer of scrap steel and aluminum from Mexico and elsewhere. Busheling Ferrous Scrap can be hedged via CME MW Busheling Fe Scrap swaps. Prompt month (November) CME MW Busheling Fe Scrap last settled at $385/gross ton (7:00 AM CST), down over 50% from the late-March highs. This could be a good time for busheling scrap buyers to hedge future needs via swaps while prices are depressed. This will help a scrap steel consumer, such as a steel mill, ensure a fixed raw materials cost. The CME MW Busheling Fe Scrap market is thinly traded, so we would suggest limit orders. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decline. Please note there is no options market for CME MW Busheling Fe Scrap. Please contact AEGIS for specific strategies that fit your operations. (10/11/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

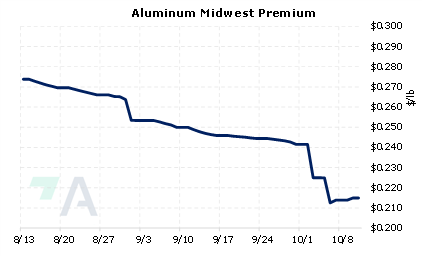

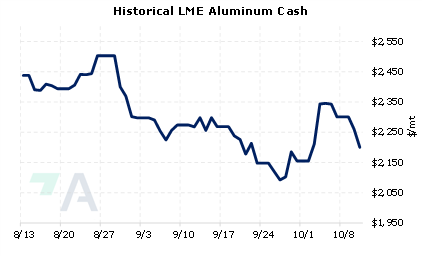

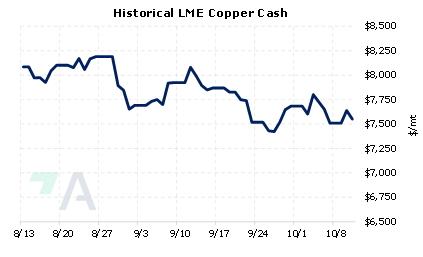

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

10/05/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices |

||

|

|

||

| Important Headlines | ||

|

10/10/2022: How a ban on Russia’s mining giants could shake the metals world 10/7/2022: ISRI opposes Mexico Fe, Al scrap export ban

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||