|

To aid its planned 2024 restart of the San Ciprian smelter, Alcoa has signed an additional power purchase agreement with Spanish electricity producer Endesa, according to a press release from late last week. Alcoa had closed the 225,000 mt/year smelter in December 2021 after soaring electricity prices made production unprofitable. The agreement with Endesa runs from 2024 through at least 2030 and will provide approximately 30% of the smelter’s electricity needs. Alcoa now has 75% of the smelter’s electricity needs met, as they signed an earlier agreement with Greenalia. Negotiations are ongoing for the remaining 25%. |

|

|

|

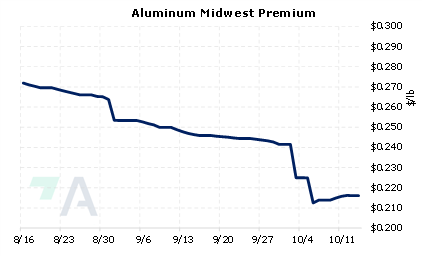

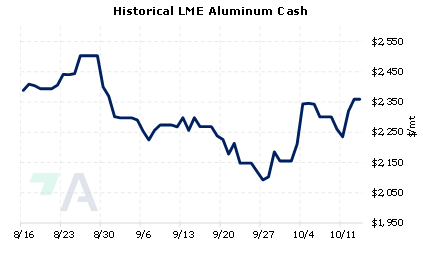

AEGIS has been tracking the European smelter curtailment situation for several months, and this is the first announcement we have seen where a smelter details how and when it will restart production. However, since the San Ciprian smelter won’t restart until 2024, this likely won’t make an impact on prices in the foreseeable future. Even though nearly 26% of Europe’s aluminum capacity is now offline, aluminum prices at the LME are down over 40% from the highs of late March. Aluminum end-users could utilize this recent price drop by buying swaps or call options, as either would establish a maximum aluminum price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (10/14/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

10/05/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices |

||

|

|

||

| Important Headlines | ||

|

10/13/2022: Codelco offers 2023 European copper premiums at record high -sources 10/13/2022: Aurubis raises 2023 copper premium 85% to $228 a tonne 10/13/2022: Explainer: Will market mayhem erupt if US bans Russian aluminium? 10/12/2022: U.S. may block Russian aluminum imports -source 10/12/2022: USW ratifies agreement with steelmaker Cliffs 10/11/2022: Column: Supply hits catch up with lead as LME stocks shrink 10/10/2022: How a ban on Russia’s mining giants could shake the metals world 10/8/2022: Alcoa Inks 131 MW Wind Power Agreement For 2024 Restart Of San Ciprián Aluminium Smelter 10/7/2022: ISRI opposes Mexico Fe, Al scrap export ban |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||