|

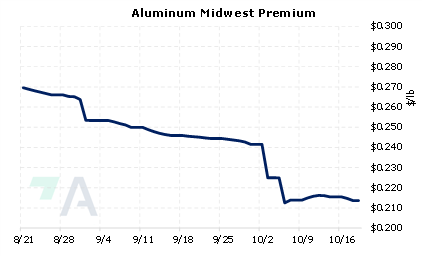

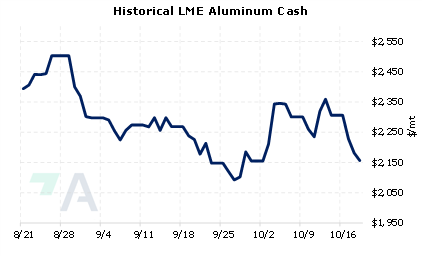

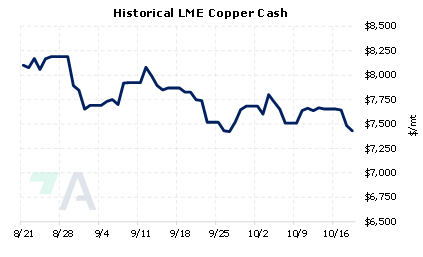

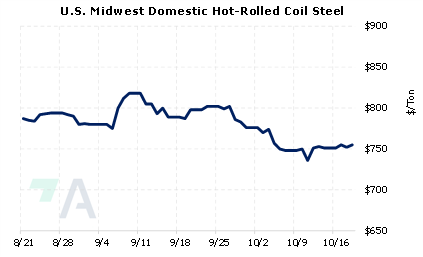

China’s weakening property sector, recession fears in Europe and the US, and waning consumer confidence could weigh commodity prices and demand according to Rio Tinto. The company also stated that China’s exports could drop as global demand slows. Regarding aluminum, Rio proclaimed that smelter curtailments in Europe and China were not enough to offset weakening European demand, thereby leading to lower prices. However, aluminum demand in the US and Canada has remained strong, demand is improving in China. As for copper, the company cited the strengthening US dollar, interest rate hikes, and poor economic outlook have suppressed market sentiment. Nevertheless, supply concerns and low LME copper stocks have partially supported prices. Rio Tinto stated these comments in its 3Q production results, released on Tuesday. |

|

|

|

Are your concerns about weakening demand and prices similar to Rio Tinto’s? Those that are carrying inventory and are concerned about decreasing prices might consider hedges that provide downside protection, such as selling swaps or buying put options. Such positions are standard; however, they can result in opportunity costs or cash costs if metal prices increase. Please contact AEGIS for specific strategies that fit your operations. (10/19/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

10/05/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices |

||

|

|

||

| Important Headlines | ||

|

10/17/2022: Aluminium price drops on jump in LME stocks and Russian metal 10/16/2022: Codelco offers 2023 European copper premiums at record high -sources

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||