|

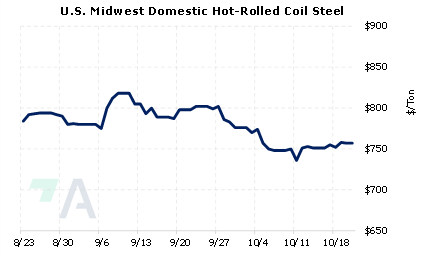

Market prices for steel show mill profitability have eroded, and forward prices don’t look much better. The HRC to busheling scrap spread was last $424/st, based on Argus’s most recent HRC and #1 busheling ferrous scrap price assessments from earlier this week. The price spread between HRC steel and busheling ferrous scrap is often used as a gauge for steel mill profitability. After reaching a record $1,441/st in September 2021, this spread has steadily dropped throughout 2022, even during a brief price spike for both assessments in February and March. During February and March, prices for busheling scrap rallied sharply as steel mills feared the Russia-Ukraine conflict could cause a pig iron shortage. Pig iron, which can be substituted for busheling scrap in certain furnaces, is a key export of both Russia and Ukraine. However, those concerns over a pending pig iron shortage came to pass, causing prices for busheling scrap, to plummet since late March. In a similar motion, prices for HRC steel surged in February and March as service centers, fearing the forthcoming raw material shortage would suppress steel production, scrambled to buy finished inventory. However, since then, service centers have largely stopped buying as they attempt to draw on excess inventories, thereby suppressing HRC prices. |

|

|

|

Do you need to hedge this spread? Based on today’s forward curves, this spread averages about $390/st through April 2023. Both sides of this spread can be hedged via CME HRC Steel and Busheling Scrap swaps. Since both HRC steel and Busheling scrap swaps are thinly traded, we suggest using limit orders to establish a specific price. Such positions are standard for producer hedging; however, they can result in opportunity costs or cash costs if HRC prices increase or busheling scrap prices decrease. Please note there is no options market for CME MW Busheling Fe Scrap. Please contact AEGIS for specific strategies that fit your operations. (10/21/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

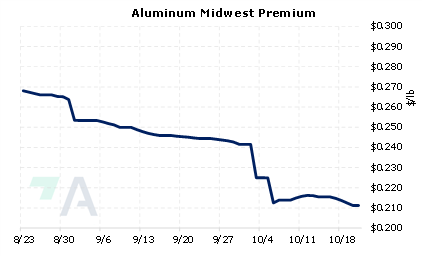

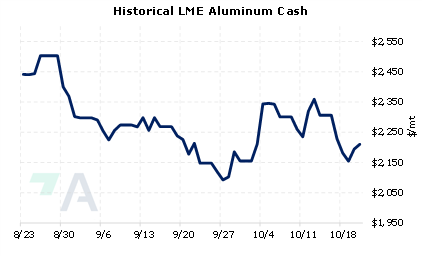

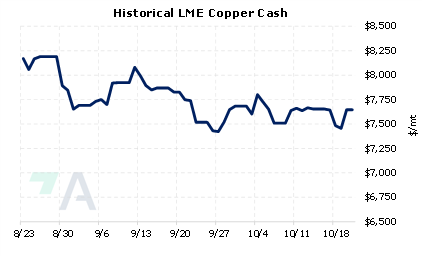

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

10/19/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? 8/24/2022: Chinese Aluminum Supply Issues Could Rally Prices |

||

|

|

||

| Important Headlines | ||

|

10/19/2022: EXCLUSIVE Glencore delivers Russian-origin aluminium into LME system -sources 10/19/2022: LME copper stocks plunge again as metal heads to China 10/19/2022: Global steel demand to drop 2.3pc this year 10/17/2022: Aluminium price drops on jump in LME stocks and Russian metal 10/16/2022: Codelco offers 2023 European copper premiums at record high -sources

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||