|

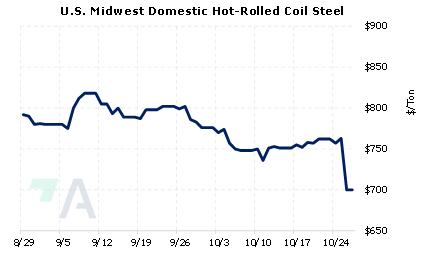

Argus's US HRC assessment has fallen 8% since September 20, now at $736.25/st. Oversupply of steel is already suppressing prices, and Cleveland Cliffs now says it will increase production. On Tuesday, Cleveland Cliffs announced that they will increase production by 300,000 to 400,000 st in 4Q 2022, as demand from its automotive customers increased by 100,000 st in 3Q. The company now expects 4Q production to be 3.9 to 4.0 million st, up from an average of 3.6 million st in the first three quarters of this year. According to Argus, oversupply continues to be a “top issue” for the industry, as more supply will come online in the next six months. |

|

|

|

The currently oversupplied steel market has pressured steel prices lower, as the prompt month (November) CME HRC futures are down nearly 56% from the highs of mid-March, as the last settle was $700/st (7:00 AM CST). This could be a good time for steel end-users to hedge future needs into 2023 by buying HRC swaps. Using swaps converts a variable cost into a fixed cost, thereby ‘locking in’ a price for the hedged steel. Since HRC swaps are thinly traded, we suggest using limit orders to establish a specific steel price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (10/27/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

10/26/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? |

||

|

|

||

| Important Headlines | ||

|

10/26/2022: US steel imports lowest since Feb 2021 10/26/2022: Whirlpool cuts production by 35pc as demand falls 10/25/2022: US HRC: Prices flat, market sees lower offers 10/25/2022: Cliffs aims to increase quarterly steel production 10/25/2022: Norsk Hydro calls for EU, US sanctions on Russian aluminium 10/24/2022: China Sept aluminium output rises 9.3% y/y as power restrictions ease 10/24/2022: LME Week: Al market braces for the unknown 10/21/2022: Alcoa reduces 2022 alumina, bauxite outlook |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||