|

US aluminum producer Alcoa sent three letters to the LME in September and October requesting that Russian metal be banned from the exchange. The company also requested better clarity on how much metal of Russian origin is in LME warehouses. Alcoa feels that allowing large volumes of Russian metal into the LME system could exert undue influence on LME aluminum prices and might upset the global aluminum supply and demand balance. According to the letters, Alcoa believes that 250,000 mt of aluminum that was delivered to LME warehouses last month could be Russian. Moreover, they fear that 1,000,000 mt/yr of Russian aluminum could be delivered to the exchange. These letters are in response to the discussion paper the LME launched in late September outlining possible actions against Russian metals producers, including an outright ban on their metals. The deadline for responses was last Friday, October 28. (Source: Reuters) |

|

|

|

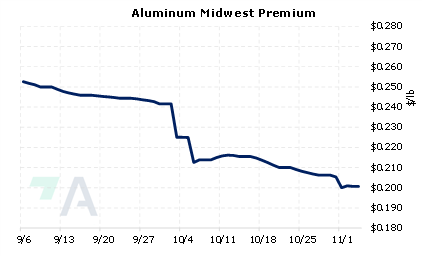

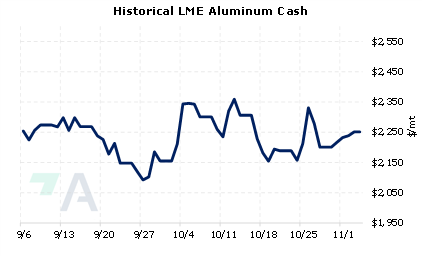

Aluminum prices have largely trended down since early August. However, allowing large volumes of Russian metal onto the LME could push prices lower. Aluminum producers that are concerned about decreasing prices could consider selling swaps or buying put options. Such positions are standard for producer hedging; however, they can result in opportunity costs or cash costs if metal prices increase. Please contact AEGIS for specific strategies that fit your operations. (11/04/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

11/02/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? |

||

|

|

||

| Important Headlines | ||

|

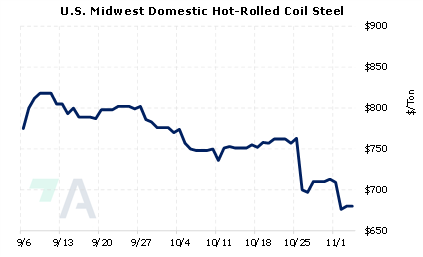

11/3/2022: Alcoa sent three letters to the LME requesting action on Russian metal 11/3/2022: Blockades at Peru’s Las Bambas copper mine hit operations 11/2/2022: UK sanctions four Russian steel and petrochemical tycoons 11/1/2022: US HRC: Prices continue to fall, market weak 10/31/2022: China shows the LME there are still buyers for Russian metal 10/31/2022: LME Week: Nickel market looks for stability 10/28/2022: Ford North American sales fall sequentially 10/28/2022: Glencore cuts zinc output guidance after production drops 18% in nine months 10/27/2022: US Steel earnings, steel production drop 10/27/2022: Glencore to stick with Rusal's aluminium in 2023 -sources |

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||