|

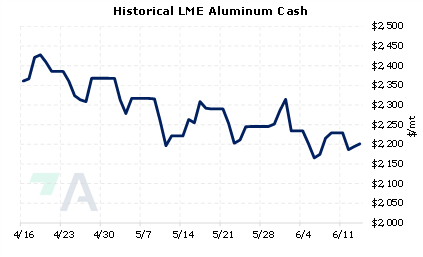

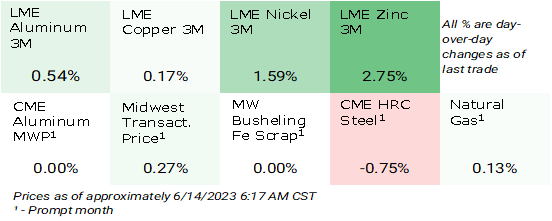

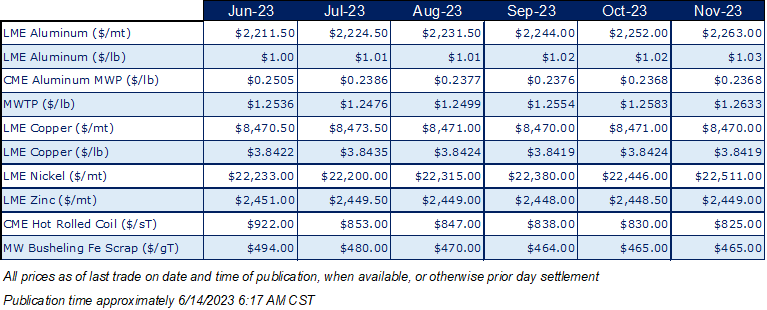

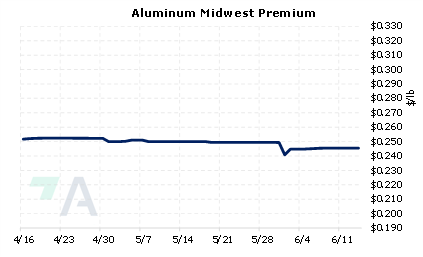

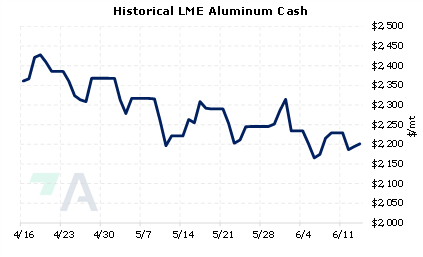

- LME Aluminum 3M Select is up $7/mt and is holding technical support.

- Last trade was $2,239/mt (6:45 AM CST)

- On Tuesday, government officials in China’s Yunnan province stated that previously curtailed aluminum smelters can restart production later this month, according to Bloomberg and Shanghai Metal Market (SMM). This confirmation follows Shanghai Metal Market’s previously reported rumors from late last week that authorities would soon grant 2 million Kw of power to restart curtailed production, but no specific target was given at that time. Of the 2 million mt that has been temporarily shuttered, approximately 1.1 million mt will be restarted, according to SMM. (Sources: Bloomberg, Shanghai Metal Market)

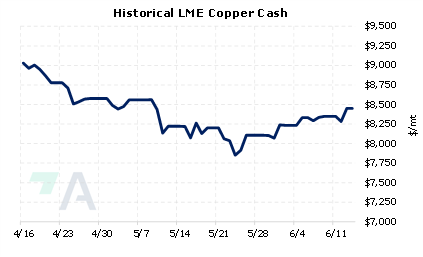

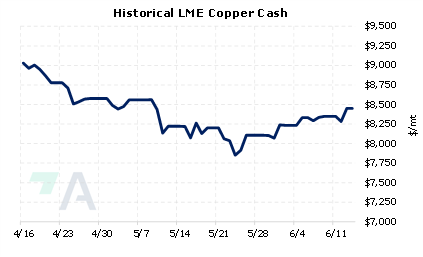

- LME Copper 3M Select is up $10/mt, adding to yesterday’s gains.

- Last trade was $8,451/mt (6:45 AM CST)

- China is once again trying to boost its economy with additional stimulus measures, which in turn pushes copper prices higher. On Monday night, the Chinese central bank lowered interest rates, a move that aims to boost borrowing and consumer spending.

- The Chinese government is also considering a much broader, larger stimulus package that will target the sagging real-estate sector. This potential stimulus package could include further interest rate adjustments, sources told Bloomberg. (Source: Bloomberg)

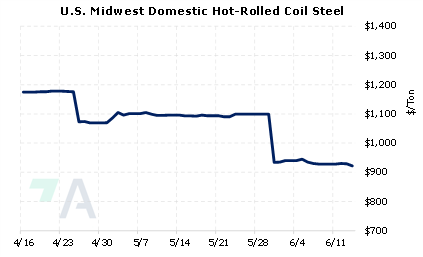

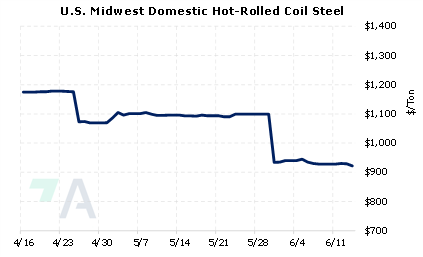

- Prompt month CME HRC Steel last traded at $922/st, down $7/st on the day (6:45 AM).

- Prices for CME busheling scrap have tumbled nearly 20% since mid-March. This is likely due to more supply reaching scrapyards, according to recent comments from Bloomberg. Busheling scrap is an essential raw material for steel producers and a key driver of steel mill profitability. (Source: Bloomberg)

|

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here.

|

|

|

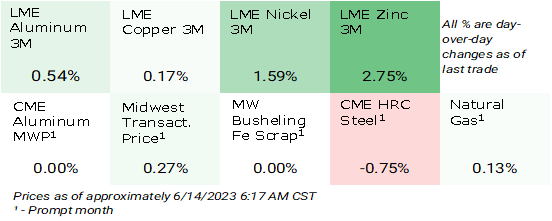

Price Indications

|

|

|

|

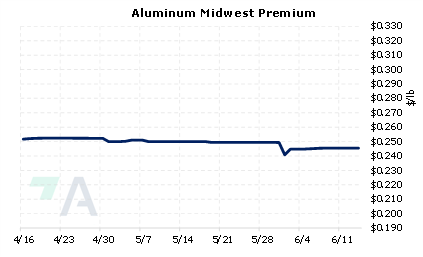

Today's Charts

|

|

|

|

|

AEGIS Insights

|

|

06/07/2023: AEGIS Factor Matrices: Most important variables affecting metals prices

05/17/2023: Cobalt End-Users Should Hedge While Market Is Oversupplied

05/3/2023: Copper Producers Can benefit From Hedging Both Inputs and Production

|

|

| Important Headlines |

|

6/13/2023: China's Yunnan set to boost power to aluminium smelters, sources say

6/12/2023: Rio Tinto to invest $1.1 billion to expand aluminum smelter in Canada

6/12/2023: Russian aluminium stocks at LME grow, boosting demand for Indian alternative

6/12/2023: Glencore, automakers to back $1 bln nickel, copper SPAC deal in Brazil

6/8/2023: NorthAm auto production estimate increases

|

|

|

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|