|

| |

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here.

|

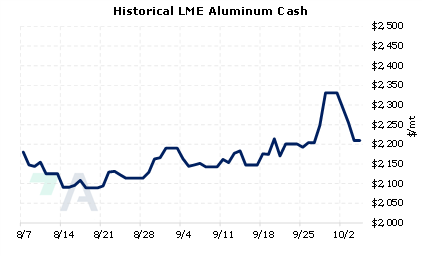

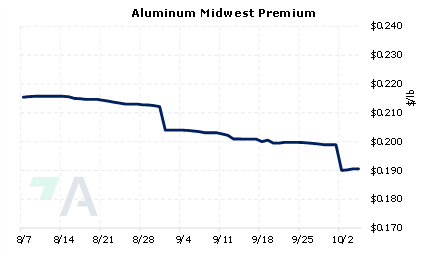

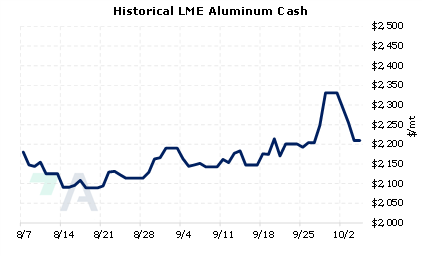

- LME Aluminum 3M Select is down $13.5/mt and has given up all last week’s gains.

- Last trade was $2,231/mt (6:45 AM CST)

- Japan’s aluminum buyers have agreed to an import premium of $97/mt this quarter, down from $127.50/mt in Q3. According to S&P Global, this significant drop in premium is due to continually lackluster demand. Market participants also told S&P Global that prospects remain grim due to excessive inventories and little to no expected pickup in demand. This import premium (above LME prices) is set quarterly between global suppliers and Japanese aluminum importers. Effective October 2, S&P Global’s quarterly Japan import premium will not include Russian-origin aluminum. (Source: S&P Global)

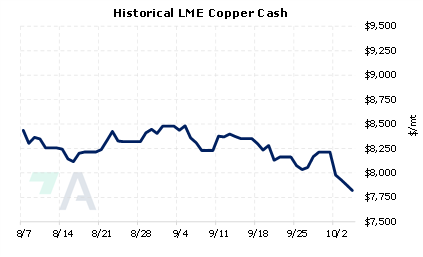

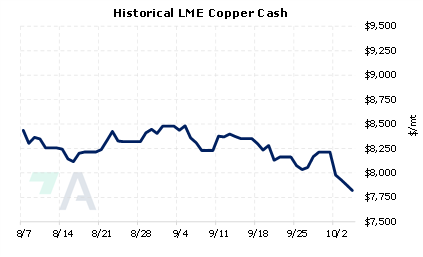

- LME Copper 3M Select is down $26/mt, hovering nearly unchanged.

- Last trade was $7,895/mt (6:45 AM CST)

- LME Copper’s price slump continued on Wednesday, closing the $8,000/mt level for the first time in May as global manufacturing remains sluggish. The US manufacturing sector continues to contract and has been contracting for 11 consecutive months. Meanwhile, China’s manufacturing sector is barely growing. With China on holiday this week, traders will look for cues on any demand pick-up after the Golden Week holiday ends. (Source: Bloomberg)

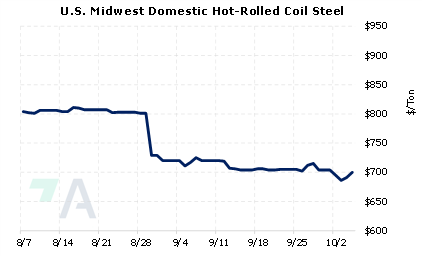

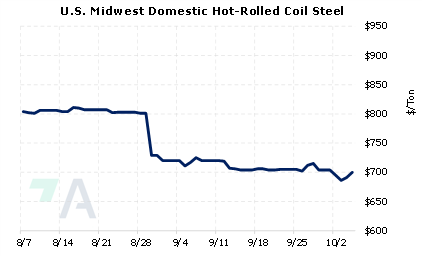

- Prompt month CME HRC Steel last traded at $700/st, up $9/st (6:45 AM CST).

- Physical HRC steel prices could be trying to stabilize. On Tuesday, Argus stated that its weekly domestic HRC assessment jumped by $30/st to $700/st. This is the first week-over-week price increase since July and could be a direct result of price hikes by steel mills. On September 27, Cleveland Cliffs announced it was raising its minimum HRC steel price to $750/st. Several other competitors, including Nucor, followed Cleveland Cliffs’ lead with similar price hikes. These recent price hikes could be meant to stop or slow the recent price slump. Market participants expected rising prices after the UAW strike gets resolved so that these price hikes could be in anticipation of a UAW strike resolution. (Source: Argus)

|

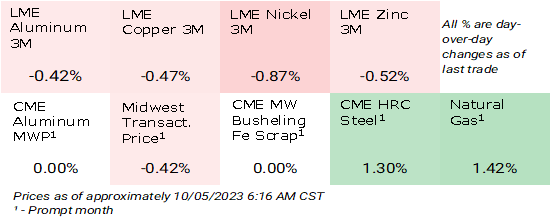

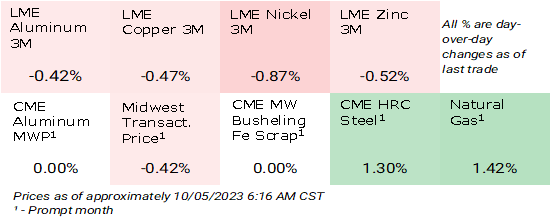

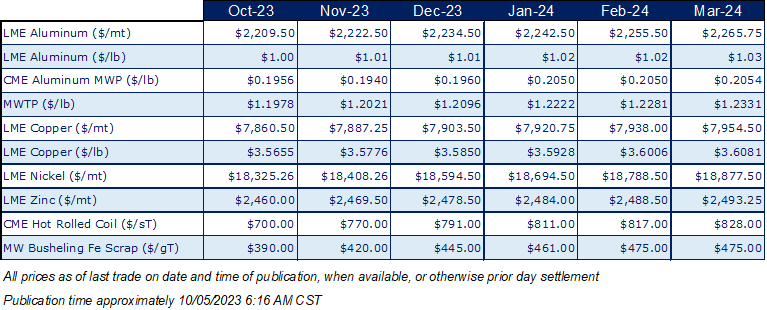

Price Indications

|

|

|

|

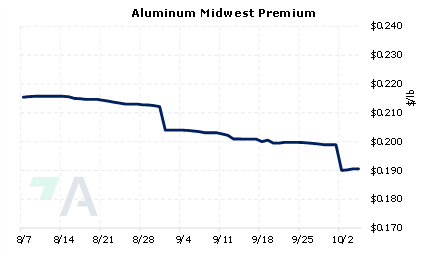

Today's Charts

|

|

|

|

|

AEGIS Insights

|

|

10/02/2023: Important US Economic Data (AEGIS Reference)

09/28/2023: Aluminum Buyers Should Hedge Alongside Chinese Importers

09/27/2023: AEGIS Factor Matrices: Most important variables affecting metals prices

09/08/2023: Despite Price Slump, Hedging is Still Feasible for Steel Producers

08/25/2023: Growing Secondary Aluminum Supply Could Further Weigh on Prices

|

|

| Important Headlines |

|

10/3/2023: US HRC: Prices rise despite strike headwinds

10/3/2023: Nucor keeps plate prices flat

10/2/2023: Japan's Mitsubishi Materials sees H2 copper output up 34% y/y

10/1/2023: Glencore may look elsewhere for recycling hub after Italy rejects fast-track approval

9/29/2023: Quebec in talks with battery, auto makers for C$15 billion in EV-related investments

|

|

|

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|