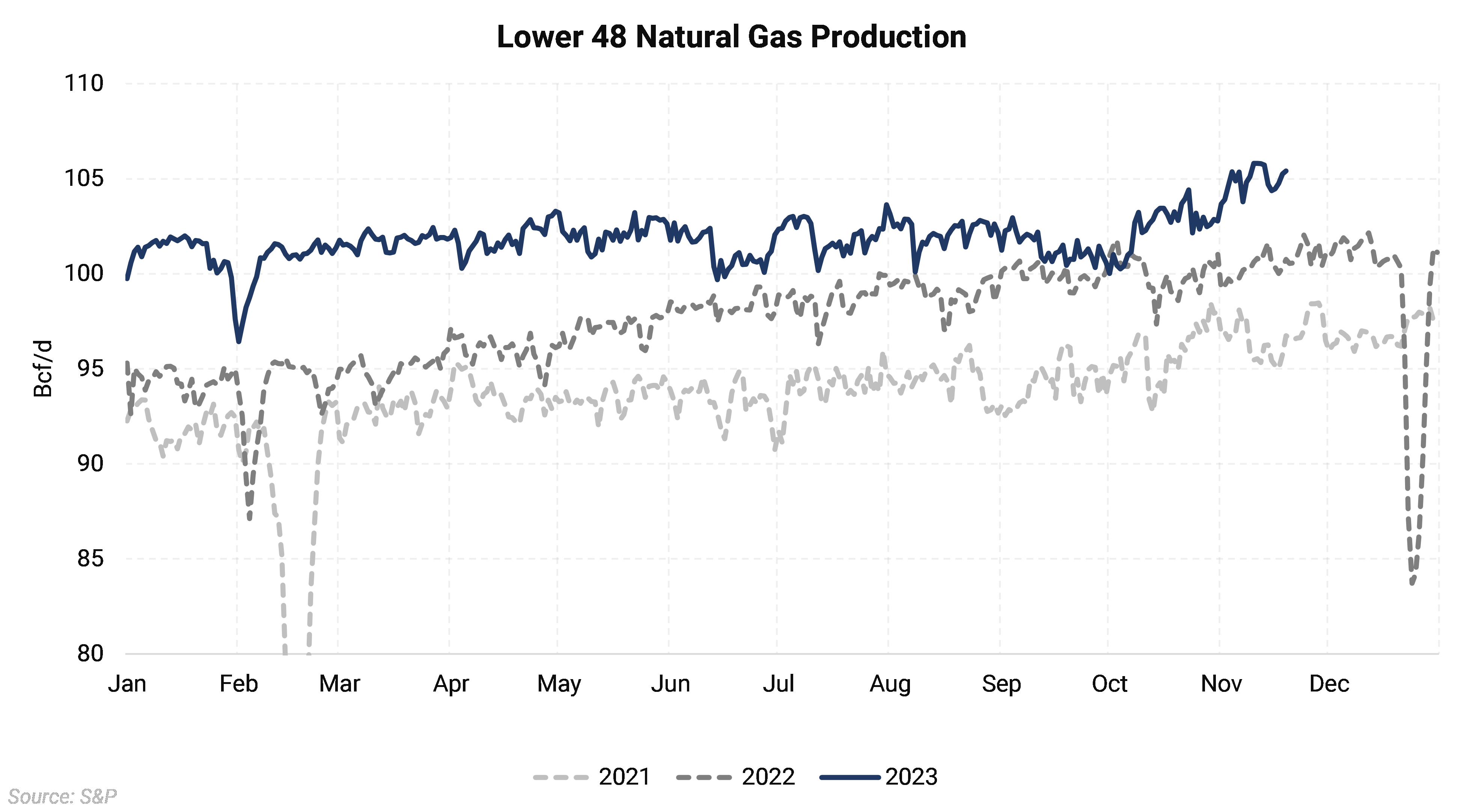

From January through October 2023, natural gas production averaged 101.6 Bcf/d. Most forecasters anticipated production would remain flat through the end of the year and into 2024, with some even expecting a decline in output. However, gas production started to ramp up in October and further accelerated in November, reaching a new all-time high of 105.8 Bcf/d, according to data from S&P Global. During this period, the December Henry Hub contract began a decline of more than 90c, falling from $3.66/MMBtu to $2.70/MMBtu, likely driven by a combination of higher supply and average weather-driven demand.

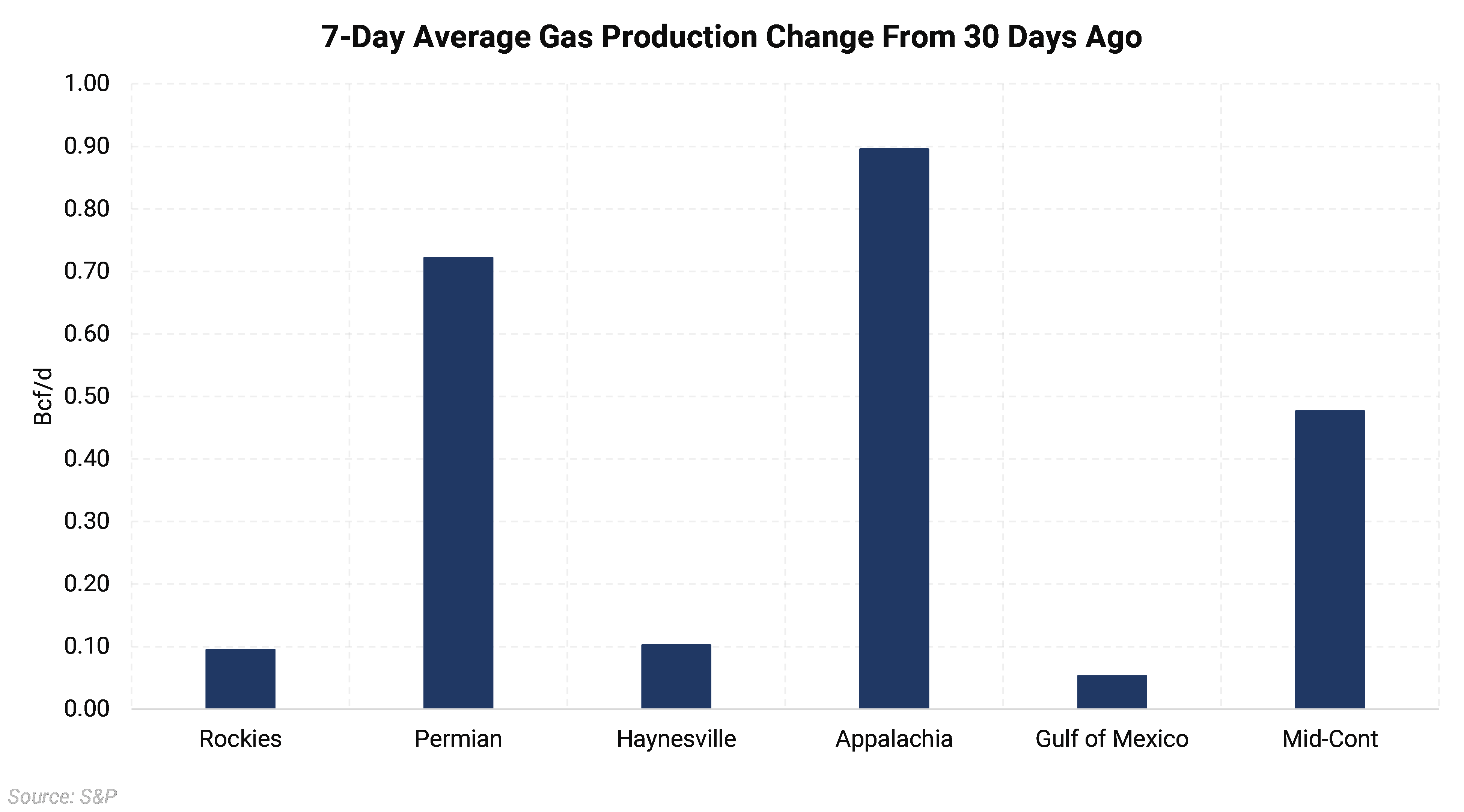

Appalachia and the Permian Basin have primarily led the production increase, although most regions have shown higher output. The chart above shows the change in the 7-day average gas production from 30 days ago to now. The Permian, Appalachia, and Mid-Cont regions have grown the most, but the Rockies, Haynesville, and the Gulf of Mexico all recorded output gains. Bakken gas produced in North Dakota is included in the Mid-Cont region, while Montana has been allocated to the Rockies. Production from the Bakken is near all-time highs of 2.65 Bcf/d and is up about 200 MMcf/d over the past 30 days.

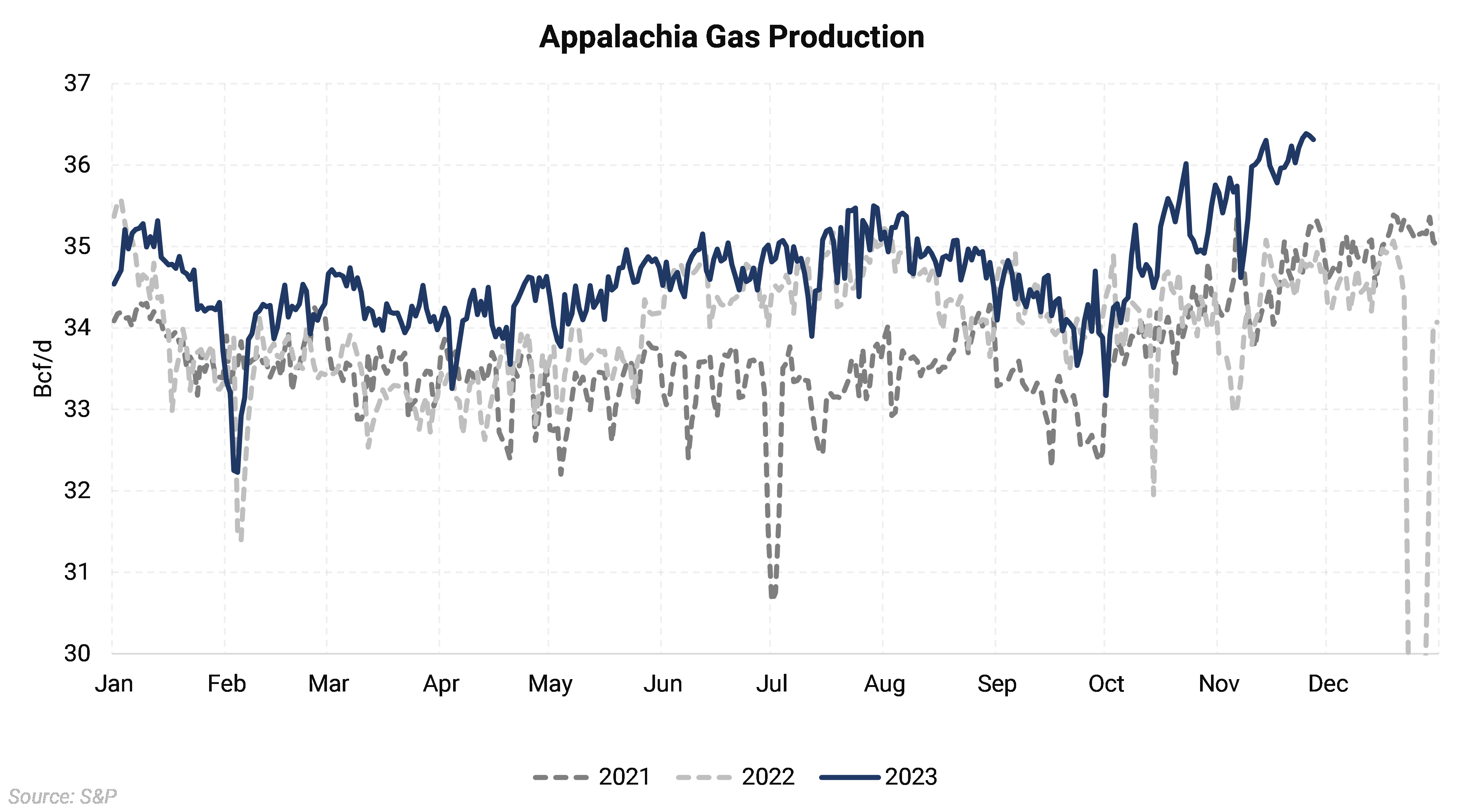

The most notable increase was from Appalachia. The region is able to ramp up production in the winter as higher demand from the Northeast US will lead to higher available pipeline egress, which is normally constrained. Small capacity increases, such as the 115 MMcf/d East 300 upgrade project and the partial startup of the 829 MMcf/d Regional Energy Access project, have contributed to additional room for production growth. With colder weather still to come in the Northeast, Appalachian production could rise further, although it would not last into Summer when demand declines.

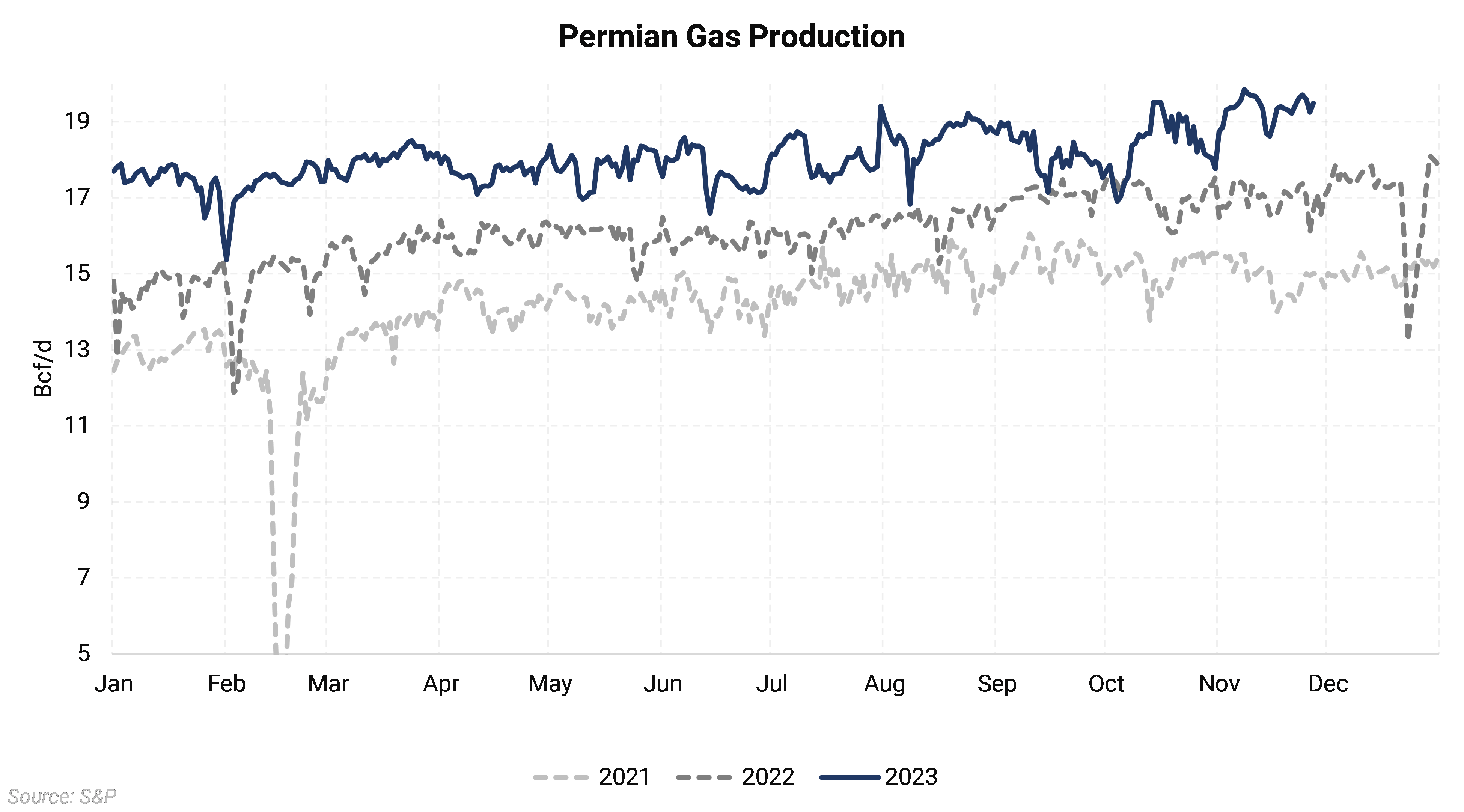

Production from the Permian Basin climbed to a new high of 19.72 Bcf/d in November. The recent startup of the Whistler pipeline expansion has enabled additional production growth from the Permian by expanding egress by about 500 MMcf/d. The Permian Highway Pipeline is entering service soon which should add an additional 500 MMcf/d of gas egress and potentially supply growth.

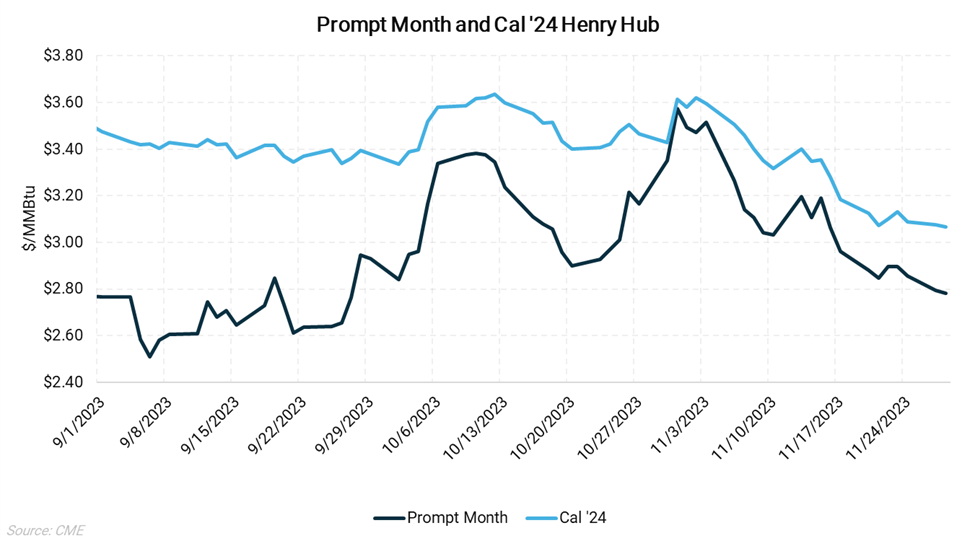

Prompt month prices have fallen more than 90c from the October peak of $3.66/MMBtu to $2.70/MMBtu. The entire Cal ’24 strip has sold off by 54c over the same period to its most recent value of $3.07/MMBtu. The pace of the supply growth likely caught many market participants off guard and may continue to pressure prices lower as the gas market moves toward further oversupply. This could also lead to weaker prices in 2024 if production levels remain elevated.