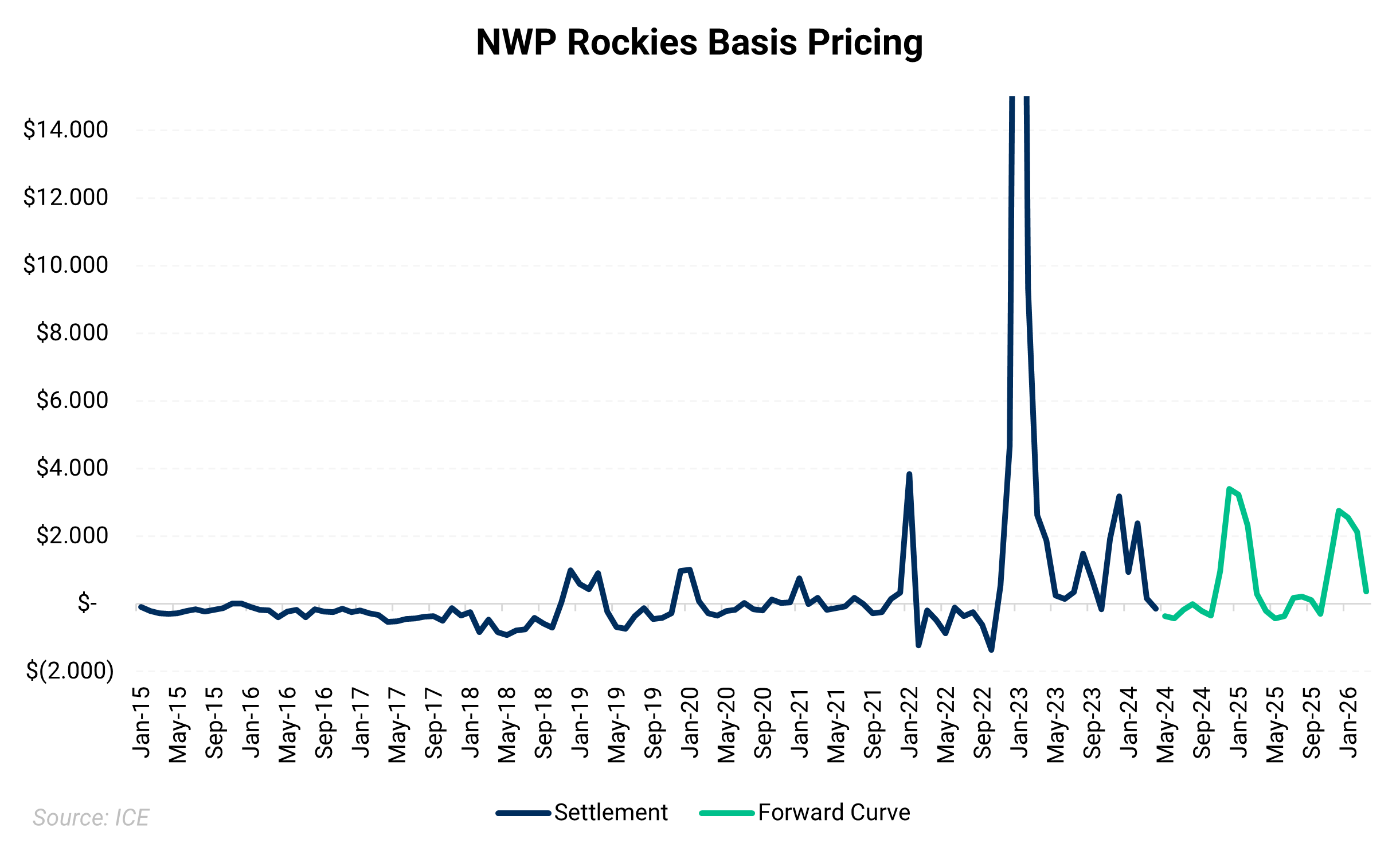

NWP Rockies basis pricing blew out in January 2023, settling at a lofty $44.86. Several factors in the lead up to Winter ‘22/’23 set the stage for this massive rally. The forward curve is pricing in some risk premium in the next few winters even though the likelihood of another massive blowout has lessened.

Unlike most other producing regions, hedgers within the basin have flexibility in determining the best approach to hedging regional basis risk. Producers with stronger balance sheets that can weather greater market volatility may want to take advantage of the unique regional dynamics and only hedge basis during the summer months. This would provide some downside protection in the less desirable demand months while allowing for upside participation in the premium winter months. Playing for another major blowout is a low probability but high impact event. On the other hand, producers whose balance sheets are more sensitive to price should take advantage of the current market premium and lock in returns.

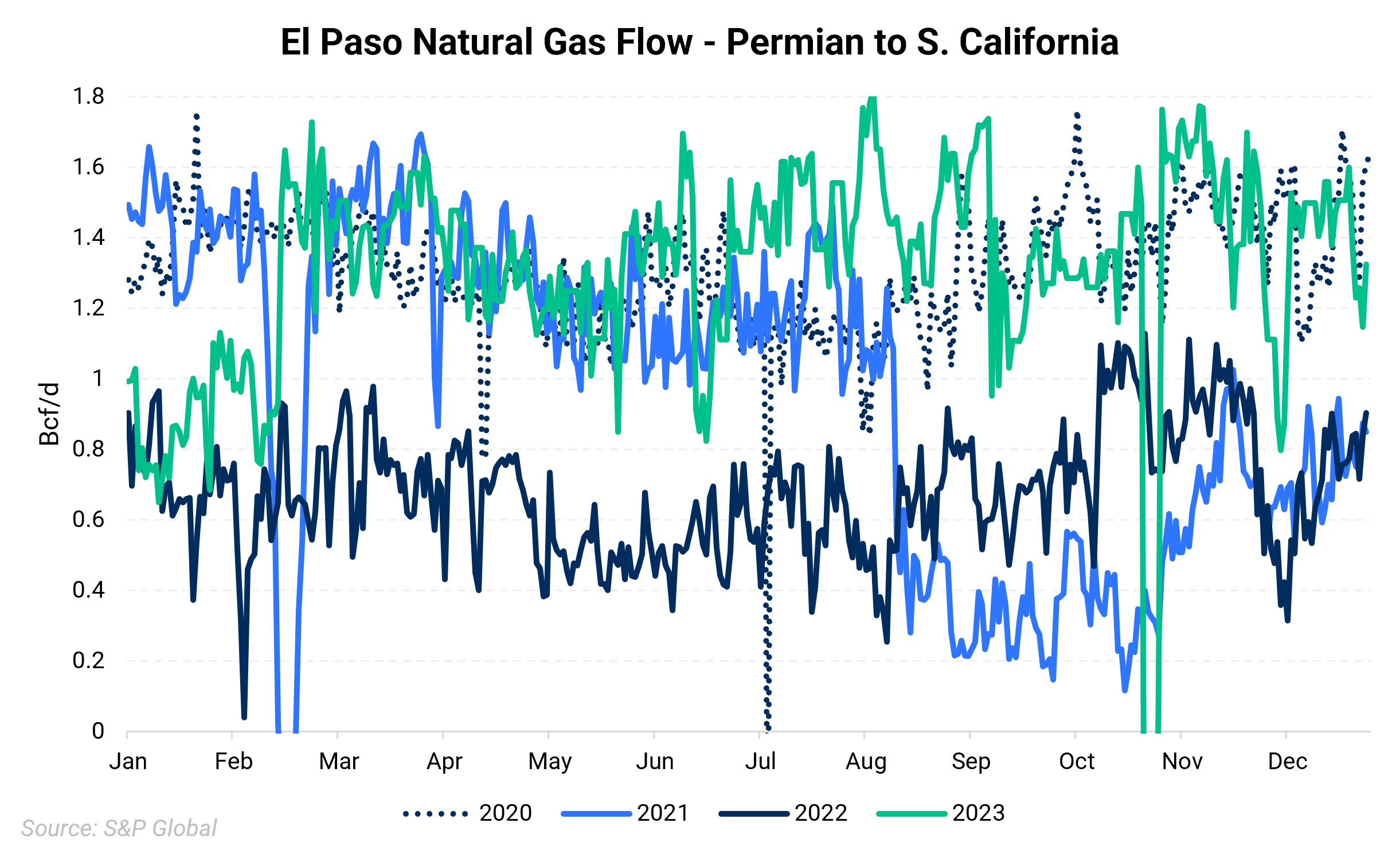

Events as far back as June 2021 had a material impact on the supply/demand fundamentals which affect western Rockies pricing. It’s important to note that the geographic location of the basin provides both opportunities and challenges for producers. Those on the eastern half of the basin, contracted to CIG/Cheyenne pricing typically do not participate in the premium price spikes that those near Opal do. The ability for gas to flow east to west in the Rockies is limited and therefore eastern Rockies gas is tied closer to midcontinent and Midwest pricing. Gas on the western portion of the basin, subjected to Opal/NWP Rockies pricing, is better placed to participate in higher prices tied to the West Coast. This is due to the influence western gas prices have on the basin. Western gas is severely starved of in basin production, so it relies on imports from Canada, Rockies and the Permian. Acute supply shortages or unexpected demand spikes pull not only regional prices higher but also prices for surrounding basins, one of which is NWP Rockies.

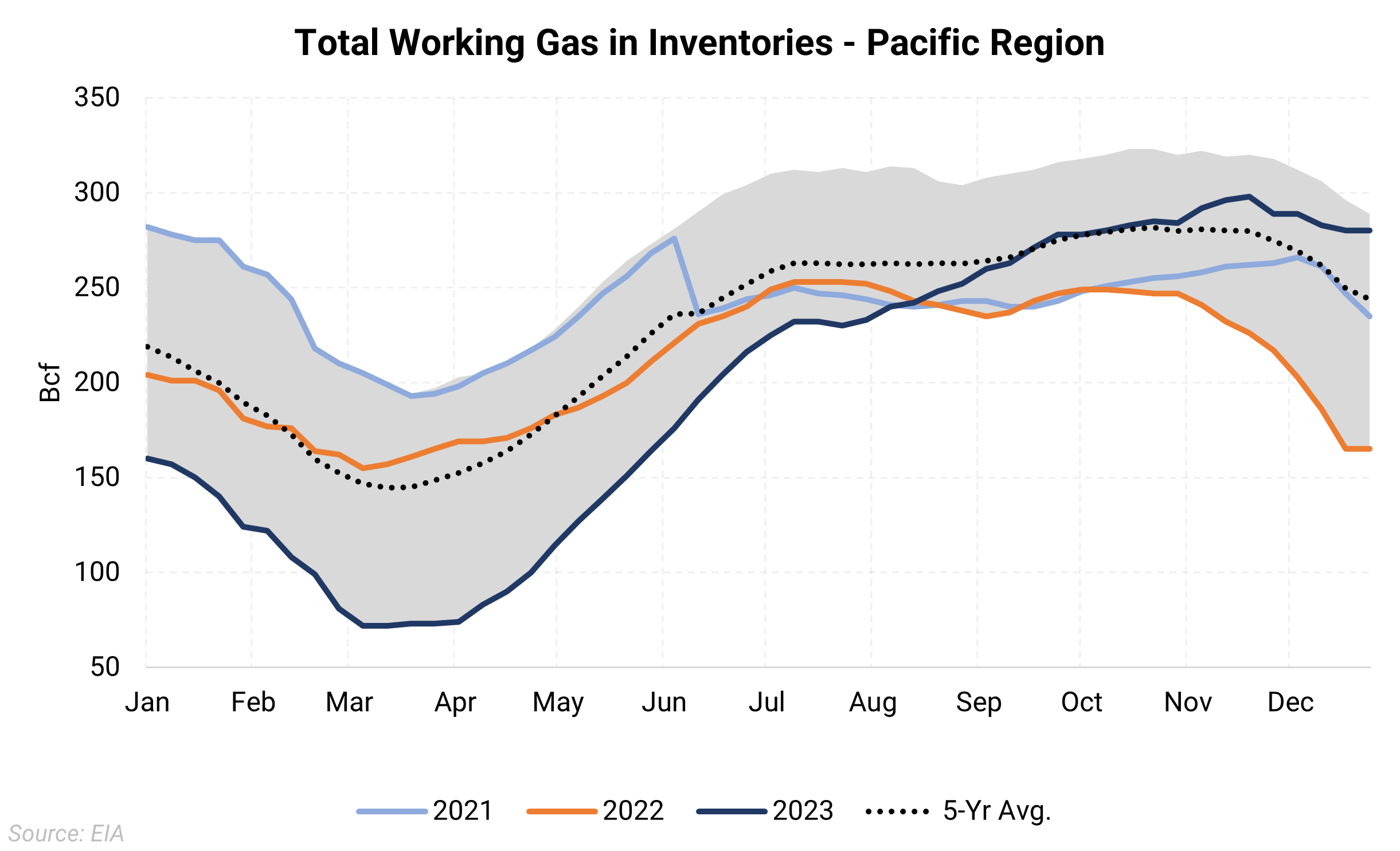

As we look back to the years preceding the price blowout, there were several factors which had a material impact on both supply and demand. Going back to 2021, gas inventories in the western region were setting a high-water mark compared to the 5-year average. In June 2021 PG&E reclassified 51 Bcf of working gas to cushion gas. This dramatically lowered the working gas inventories down to the 5-year average as shown in the chart below.

This in and of itself may not have been a big problem, however, in August 2021 line 2000 on the El Paso Natural Gas system reduced flows of roughly 600 MMcf/d following an explosion near Coolidge, AZ. The El Paso Natural gas system is a major artery for Permian gas to flow west into California. Full capacity was not restored until February 2023, resulting in 18 months of reduced flows. The chart below shows the drop in flows in mid-2021 through early 2023 via the El Paso Natural Gas system from the Permian basin into southern California.

The reclass of gas in storage combined with 18 months of reduced flows from the Permian resulted in inventories going from the 5-yr high to the 5-yr low by late Summer 2022. The scarcity of gas in storage ended up lasting until Fall 2023 when inventories finally built back to the 5-yr average.

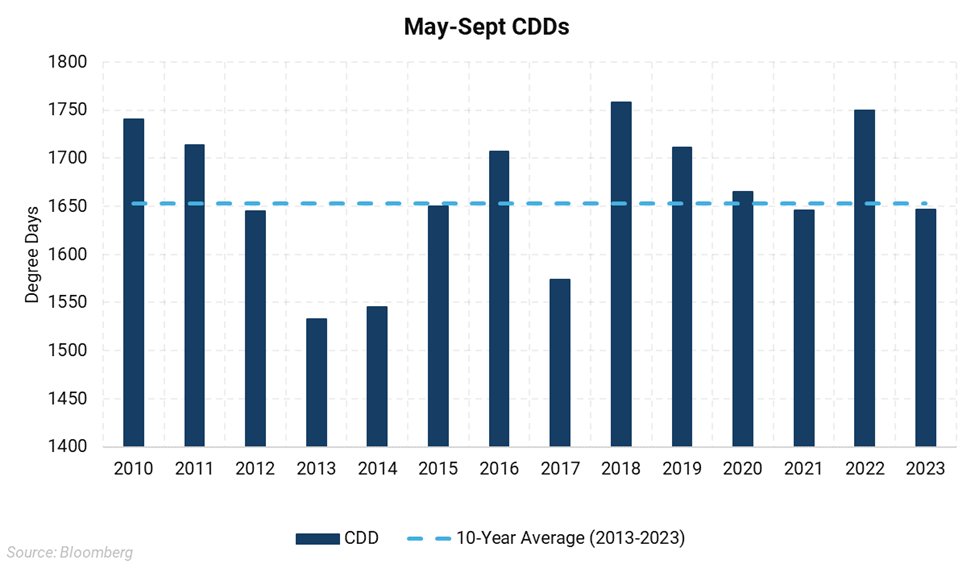

As is inevitable, you cannot speak about natural gas pricing without touching on weather. A natural gas producer’s dream weather scenario played out in 2022. As shown in the chart below, nationally summer 2022 was quite warm with May-September registering the second highest CDDs going back to 2010.

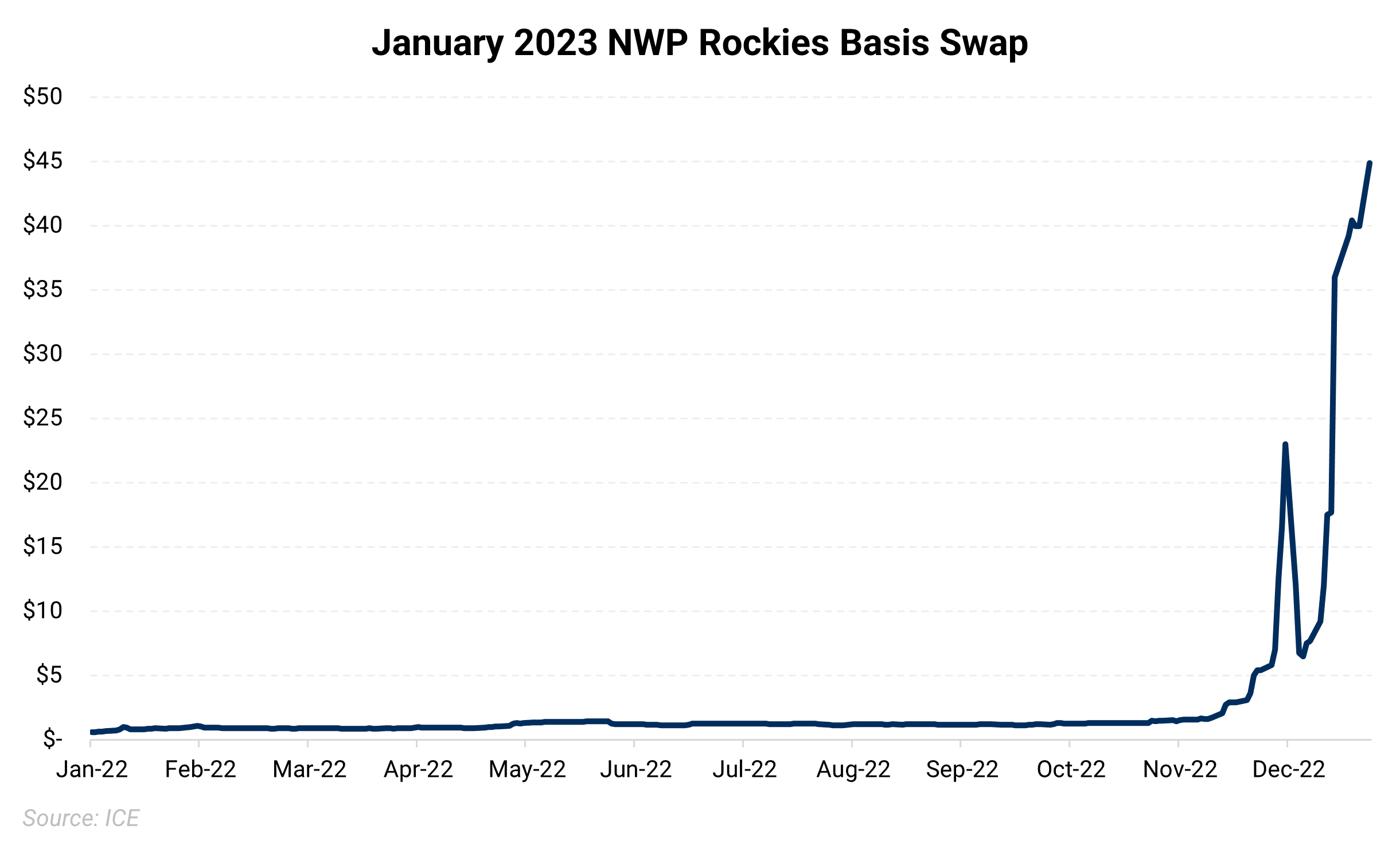

The warm weather nationally was also affecting drought conditions out west. As we wrote about in early 2023, the west coast’s Energy Mix was in a state of transition. Throughout the summer 2022 California was utilizing natural gas for roughly 45% of the power mix as hydro power and natural gas imports fell. They say, ‘timing is everything’ and following the warm summer came well timed cold in the form of Winter Storm Elliot blanketing the country in late December. You’ll see in the chart below how the Jan23 NWP Rockies basis swap traded throughout 2022. The January contract didn’t trade over $2.00 until November 21, 2022. After that point the contract traded violently on updated weather forecasts.

As of the middle of April, both the Rocky Mountain and West regions have seasonally high storage levels. Currently gas in storage in the Rockies is 86% higher than the 5-year average while gas in storage on the West Coast is 43% higher than the 5-year average. This should help alleviate some of the price volatility of the past couple of winters. However, because of the western basin’s reliance on pipeline imports from the three adjacent basins, there is still opportunity for prices to pop on acute demand events. Producers and consumers should be aware of their financial risk tolerance and mitigate potential winter price volatility accordingly. Financially secure producers may want to hedge less and hope to participate in a future price spike while more price sensitive producers should take advantage of the current winter premium.