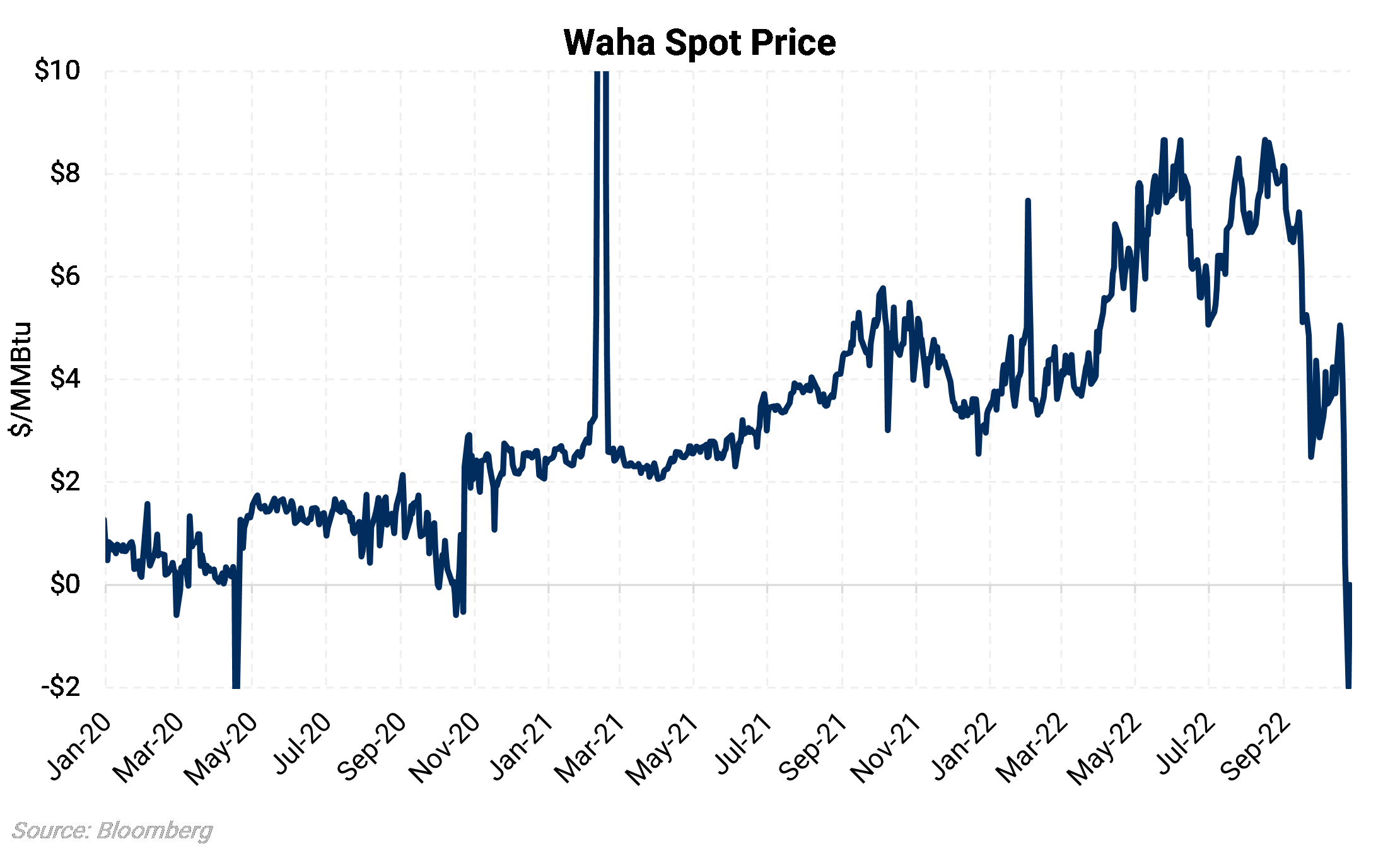

Waha day-ahead cash price traded in negative territory for the first time in over two years as pipeline maintenance, rising production, and low demand have softened the market. The spot Waha market weakness could foreshadow future problems for Permian producers: supply continues to expand, and new takeaway capacity is not scheduled until at least 3Q 2023.

To see our reference post on the Waha market click here.

Negative prices imply the seller has to pay the buyer to take away the gas. Negative Waha daily cash prices is not normal, but it does happen. Waha prices have historically traded negative when testing the limits of outbound pipeline capacity.

Pipeline maintenance has likely pushed the Permian gas market to its takeaway limit. Several pipelines responsible for carrying gas from the Permian basin to other demand centers are currently running at limited capacity. Throughput on the Gulf Coast Xpress Pipeline and the El Paso Natural Gas Pipeline are down by around 0.7 Bcf/d and 0.5 Bcf/d, respectively.

The Gulf Coast Xpress (GCX) pipeline allows Permian gas to reach markets in South Texas, near the Agua Dulce area. At the same time, the El Paso Natural Gas Pipeline (EPNG) ultimately flows west to Southern California markets. Southern California ("SoCal") natural gas is trading at a $7 premium to Henry Hub, as it is being starved of Permian gas.

Why would negative-price transactions be possible? Because Permian-basin wells receive most revenue from crude oil, it is the oil prices that drive production economics. Natural gas is a secondary contributor to revenue; therefore, a negative gas price can be tolerable if the oil revenue is good.

We don't expect negative prices to persist in the short term, as the GCX outage should only last a few days. However, the negative prices could be a glimpse of the road ahead if associated gas production continues to rise and test current outbound and processing capacity.

As oil production grows in the Permian basin, so does the associated-gas production. Enverus forecasts Permian crude oil production to grow by 1 MMBbl/d from December 2022 to December 2023, equating to approximately 2.88 Bcf/d of additional Permian dry gas production at a time when outbound capacity on some outbound pipelines is already full.

The forward curves already show some distress. Permian gas forward prices, as measured by the Waha basis hub, are trading at much larger discounts in 2023 and 2024 than they were just a few months ago. The chart below shows how the Waha basis Summer '23 strip is trading around $-2.36 behind Henry Hub, a discount three times larger than it was at the beginning of this year (then, at about -$0.70 below Henry Hub).

If Waha cash prices are already this weak, dipping below zero, how bad could it be next year as more production arrives? Near-term weakness in the Waha cash market could be a glimpse at a bumpy road ahead for the Waha forward curve, especially within the Summer '23 strip. New egress capacity isn't due to come online until at least 3Q 2023.

As it stands, we think Summer '23 Waha basis prices are more likely to move lower than higher. To read more background on Waha, read our basis reference post here click here.