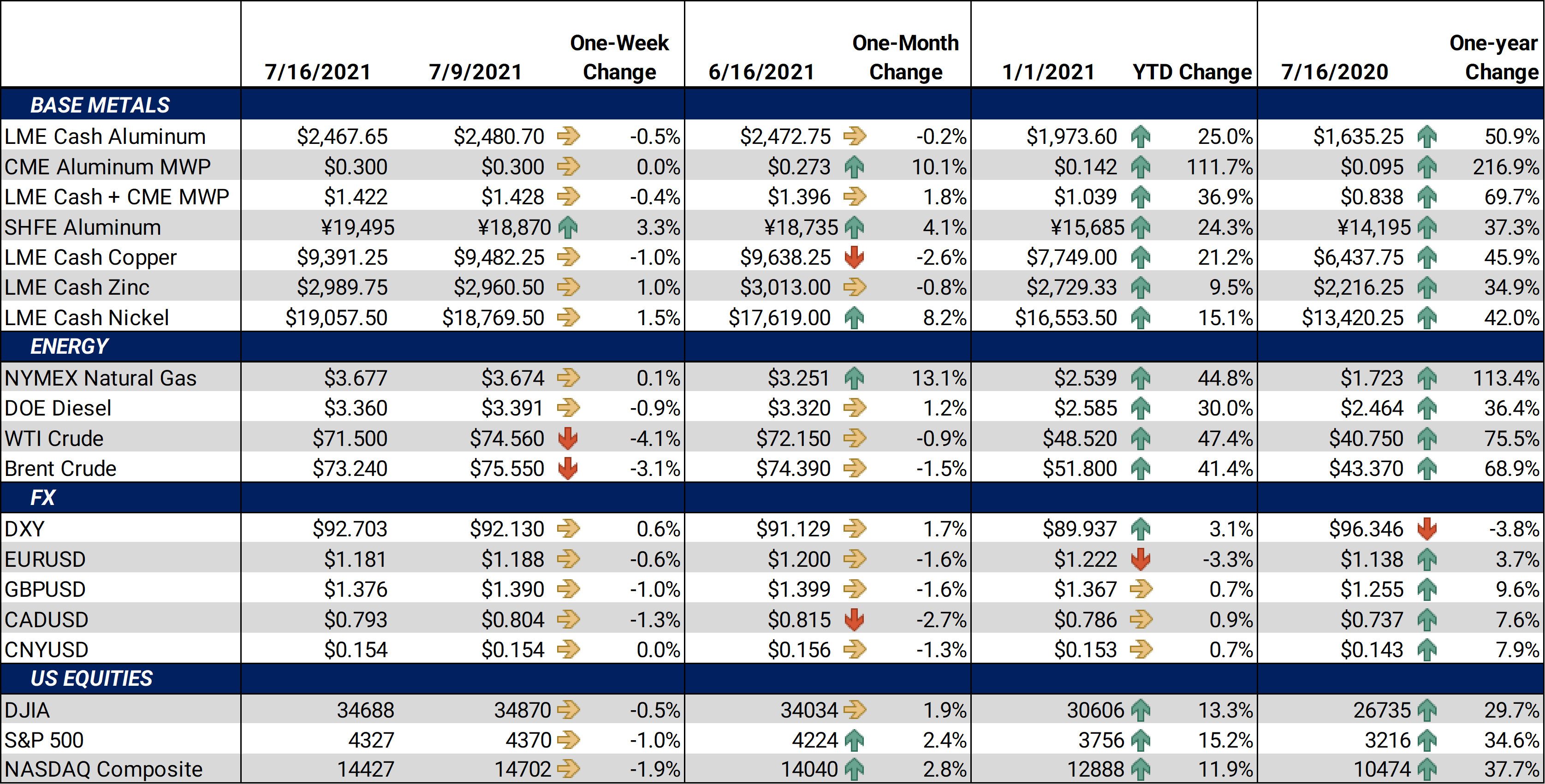

Metals markets started on a down note this week, as a slew of economic data from the US and abroad confirmed that economies are slowing and inflation is a meaningful impact on consumers. Tuesday’s release of CPI data by the US Labor Department showed a 5.4% y/y increase, up from 5.0% last month and beating analysts’ estimates of 4.9%. Specifically, the index for new vehicles was up 2.0% in June, the largest 1-month increase since May 1981. The index for used cars and trucks, up 10.5% in June, was the largest ever monthly increase for that specific index, which started in 1953. As expected, food and energy were up as well. |

|||||

|

Copper and several other base metals fell on this news. Markets view this rapid rise in inflation as not only unsustainable but as also having a negative impact on consumers. It may be as real average hourly earnings were down 0.5%, confirming that inflation is eating into consumers' take-home pay. Released several hours before US CPI data were China’s export and imports numbers, and China beat on both. Exports were 32.2% y/y in June, higher than trade estimates at 21.4%. Likewise, imports were up 36.8% y/y in June, better than trade estimates at 26.2%. Although this data shows life in China’s economy and should be supportive for metals markets, the aforementioned US CPI data overshadowed this normally positive news from China. GDP data from China, released Wednesday night, proved to be of little consequence. GDP was up 7.9% y/y, slightly below the trade estimate of 8.0% y/y. Most base metals bounced on the news, but not enough to offset losses seen earlier in the week. Steel production in China was 93.8MM metric tonnes in June, down from an all-time high of 99.45MM tonnes in May. We note that elevated production, in concert with opening state metal reserves, could keep a cap on prices. There has been little discussion in trade about the potential supply disruptions in iron ore due to South Africa's violent protests and political crisis, which flared up this week. The country is the sixth largest producer of iron ore in the world. Iron ore exports for the country were 378,000 mt last week, the third-lowest amount so far this year. Exports in the prior week were the lowest since October 2019. The bullish camp believes that any disruptions in production or exports could further tighten the iron ore and steel markets. We have not heard if iron ore production or trade has been greatly affected; however, at least three ports have been shut down, and ArcelorMittal South Africa has declared force majeure. (For more on the South African iron ore production and trade, please check out our recent blog post here). A bright spot did appear for US steel manufacturers on Tuesday, as the U.S. Court of Appeals for the Federal Circuit (CAFC) overturned a lower-court ruling that that President Trump did not have the authority to raise the Section 232 tariffs on Turkish steel from 25% to 50%. The court concluded that a President can use Section 232 to adjust imports based on national security concerns and that President Trump was justified in increasing the tariffs against Turkey. Also of note is the ongoing shortage of semiconductors, which has dramatically slowed US car production. Motor vehicle and parts production dipped by 22.5% in Q2, according to Federal Reserve data released on Thursday. Taiwan Semiconductor Manufacturing Company, the world’s largest contract chip manufacturer, claims that chip shortages for autos should slowly resolve beginning this quarter. If this proves true, the market might be able to maintain a floor underneath aluminum and steel prices. |

|||||

|

Bottom Line: Metals prices are likely contributing to inflation figures as supply remains inadequate to meet global demand, and supply chains are disrupted. However, as input costs rise, they threaten the demand that led to the shortage in the first place. On the macro front, the dollar index has maintained a very tight range over the past several weeks. Further strength in the dollar could keep a lid on metal prices. A strengthening dollar makes our products more expensive for foreigners to purchase. Exports of finished goods could stall should the dollar strengthen prices beyond the appetite of foreign demand. As always, COVID fears continue to dominate headlines, as the delta variant is creating havoc in Asia and certain areas of the US. Any ramp-up in delta variant shutdowns could slow the demand for base metals. We continue to recommend that metal consumers layer in hedges in a disciplined manner and select between swaps or call options depending on their risk-management objectives. However, option structures are generally preferred due to the recent rise in volatility. Call options premiums have increased during this rally, so collars (selling put options to offset the cost of call options) are a logical strategy. We also suggest using limit orders along with reasonable stop-loss targets to add incremental protection if prices trend higher.

|

|||||

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

The LME 3M Select finished lower for the week, with last trade at $2487.00/mt, and trade ranging from $2,466.50/mt to $2,547.00/mt. Chartists would note that this week’s trade was inside last week’s “bearish engulfing candle” (meaning that week’s bearish move “engulfed” the prior week’s smaller bullish move), suggesting indecision in the market. Cash-3M last traded at a $20.85/mt contango (where cash is cheaper than 3M), slightly narrowing from $21.80/mt during last week’s trade. Farther down the curve, Dec ‘21/Dec ‘22 continued to show backwardation, suggesting that there are still few buyers for long-dated contracts. In general, we have seen less long-dated consumer hedging with both premiums and LME at high levels.

|

|||||

Midwest Premium |

|||||

|

The aluminum MW US Transaction premium stalled this week as the CME MWP contract for July had a last trade of 29.75¢/lb at time of writing, unchanged for the week. Sky-high freight costs and other logistical issues have caused the movement of metal to slow to a crawl. Likewise, market sources are stating that end users have purchased their short-term needs. With the market running in place this week, we have to ask if this is merely a pause in the rally or signs of a top. As we stated last week, there is some chatter that this rally is unsustainable; but we have heard those thoughts throughout this rally. This premium has nearly tripled since June 2020, with little bearish news to halt the advance. Mimicking the activity we have seen over the past several weeks, there was little MWP trading activity in Cal ‘22; the backwardation in the forward curve remains significant and makes inventory hedging expensive. |

|||||

|

|

|||||

|

|||||

|

LME Copper 3M Select traded sideways this week, with last trade at $9,447/mt. The LME 3M contract traded in a fairly tight range this week, from $9,311/mt to $9,543/mt. We have bounced slightly off the $9,011/mt low set during the week of June 21, but it appears that trade needs a new catalyst to break us out of the $9,000/mt to $10,000/mt range. In two recent blog posts (here and here) we noted that copper has diverged from the Hang Seng Index, and that inflation due to ever-increasing commodity prices is beginning to have a negative effect on the Chinese economy. Moreover, efforts to jump-start the economy have potentially both inflationary and deflationary effects on copper specifically and metals in general. Copper prices might be in a “wait-and-see” mode as the market accesses China’s ability to get their economy going again.

|

|||||

|

|

|||||

LME Nickel |

|||||

|

Nickel continued its march higher this week, trading at levels not seen since February. Last trade on the LME 3M Select contract was $19,080/mt, with a trade range of $18,425/mt to $19,205/mt for the week. Like other base metals, nickel tends to benefit from industrial demand. However, the dollar’s recent rally and lower trade in copper has kept the price of nickel range bound. New, positive fundamental news will likely need to occur to break nickel out of the narrow range we have seen since late April. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

HRC steel traded in a very tight band this week, as outside markets weighed on the metal. The CME HRC futures contract for July ’21 last traded at $1784/t, up $4/t from last week. Trade range was from $1,780/T to $1,790/T. Deferred, or longer-dated, contracts through the remainder of the year and into 2022 continue to show signs of backwardation, and there is little reason for this to change in the near term. As we mention in the opening comments, let’s keep a close eye on the situation in South Africa. Opportunities remain open for HRC consumers to hedge future prices below the current spot price. For both producers and those carrying inventory, we continue to believe that buying put options remains the best structure to achieve protection against a major market correction. From a consumer perspective, buying calls can be used to protect against a continued rally. Using options with staggered strike prices allows for participation in a downward price correction. |

|||||

|

|

|||||

|

|

|||||

Notable News |

|||||

|

Inflation climbs higher than expected in June as price index rises 5.4% US aluminum futures bid as imports continue to decline South Africa's mining industry expands 22% in May South Africa Zuma riots: Queues form in Durban due to shortages Africa’s Iron Ore Output Down By 4.7 Percent In May From April More than 70 killed in South Africa protests after former leader Jacob Zuma is jailed U.S. manufacturing output dips as chip shortage weighs on motor vehicles TSMC’s revenues surge as it warns chip shortage will continue into next year GM drops wireless charging from some SUVs due to chip shortage Court of Appeals Upholds Increases to Section 232 Tariffs on Turkish Steel |

|||||