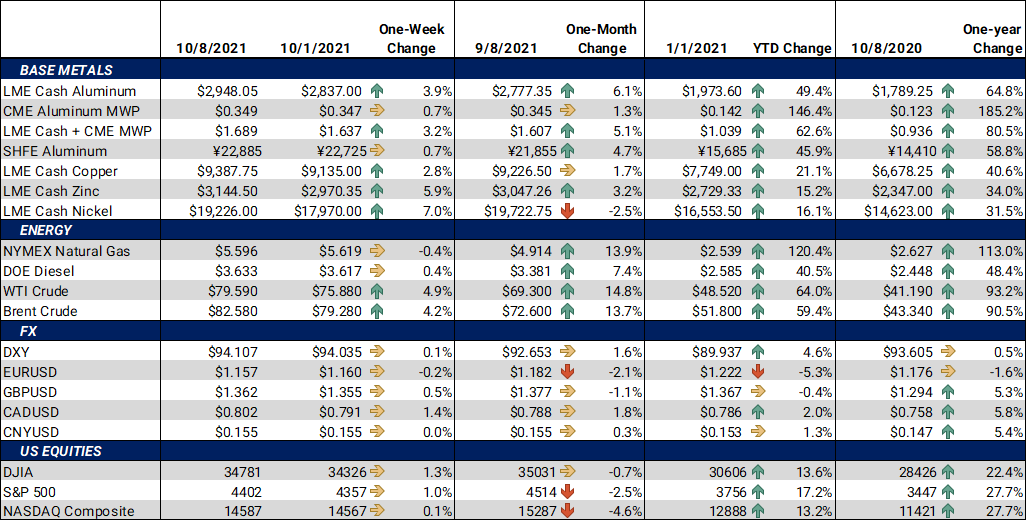

With China on its Golden Week holiday from October 1-7, most base metals saw tight trading ranges this week. LME Copper 3M, Nickel 3M, and even the USD Index all traded within last week’s range.Aluminum set a new high weekly close for the year. The bullish fundamentals for aluminum remain intact, as supply-chain bottlenecks persist. The potential restart of Rio Tinto’s Kitimat aluminum smelter is bearish supply-side news. However, freight costs and trucking shortages could prevent this returned production from reaching the market in a timely fashion.We note that the USD Index had minimal (if any) influence on this week’s trade. LME Copper, Aluminum and Nickel all traded higher despite a quiet, nearly unchanged value of the USD Index. Metals prices typically move inversely to the USD Index. |

Notable Metals News

The labor union at Rio Tinto’s Kitimat aluminum smelter in British Columbia, Canada has finally reached a deal with the company. The joint agreement, which was negotiated two weekends ago, was ratified earlier this week. The company will now begin “return to work” procedures with the workers.

Industry groups are disagreeing on the usefulness of Section 232 tariffs. Contrary to recent comments by other US aluminum industry organizations, the American Primary Aluminum Association (APAA) believes that the Section 232 tariffs should be continued. In a statement released October 5, the APAA suggests that a tariff-rate quota is a positive for the industry. A tariff-rate quota is a two-tiered tariff mechanism in which a pre-determined quantity of a good is set at one tariff, and any quantity above that number has a higher tariff. Tariff-rate quotas had been floated as a replacement for tariffs in place since the Trump administration. The association believes that a tariff-rate quota is key to rebuilding the US aluminum industry.

Finally, in Chile, worker strikes have had a meaningful impact on copper production. Data released this week by the Chilean Copper Commission indicates that copper-mine production was 461,900 mt in August, down 4.6% from August 2020. Year-over-year production at the two mines largest mines in the world, Escondida and Collahuasi, fell by 14% and 19.7%, respectively. The largest percentage drop occurred at the Andina mine, down 55.2%.Andina endured a month-long worker strike in part of August and September.

| Bottom Line: | |||||

|

Contrary to normal, we are hard-pressed to point to one or two specific catalysts that drove this week’s trade. Perhaps the most interesting news was related to natural gas, rather than metals. Russian President Vladimir Putin stated that the country will be supplying more natural gas to Europe. This is potentially bearish for metals if that newfound natural gas is supplied to metals producers. Much like Asia, some European metals producers have stopped or slowed production due to low natural gas supplies. One issue that several of our customers and industry veterans have noted is material overstocking. Some current demand is being driven up by end users purchasing larger-than-normal orders from metal suppliers. These purchases are not being driven by increased downstream demand, but rather a fear that upstream metals supplies may dry up. However, this extra material may eventually result in bloated corporate inventories and therefore might be bearish for metals prices, especially aluminum. The backwardation of the HRC Steel, aluminum, copper forward curves persists. This gives end users the opportunity to hedge forward purchases at a sizable discount to the cash markets. For metals end users, zero-cost collars (selling put options to offset the cost of call options) could be a logical strategy. We also suggest using limit orders along with reasonable stop-loss targets to add incremental protection if prices trend higher. |

|||||

|

|

|||||

LME Aluminum |

|||||

|

Aluminum prices rose this week. The last trade on the LME 3M Select was $2,959.50/mt, with trade ranging from $2,856/mt to $2,989/mt. Cash-3M last traded at a $17.95/mt contango (where cash is lower than 3M), narrowing from last week’s trade of $20/mt contango. In other words, the nearby forward curve has flattened. Also, volatility has slowed dramatically in the past several weeks. However, the latter half of 2022 and beyond is still quite backwardated. Thus, longer-term consumers can still hedge at discount to the cash and nearby market. |

|||||

|

|||||

|

The CME MWP contract for October ‘21 was 34.7¢/lb at the time of this writing and unchanged for the week. The front three contracts for MWP have traded in a 1¢ to 1-1/2¢/lb range since early September. It seems as if the bullish factors, such as freight costs, counterbalance the perceived slowdown in demand. The MWP forward curve remains relatively flat, compared to LME aluminum. |

|||||

|

|

|||||

|

|||||

|

Last trade for the LME 3M Select was $9,350/mt, and trade ranging from $8,992/mt to $9,390/mt. From a chartists’ perspective, new resistance may be the mid-September high trade of $9,738/mt. Copper had a very tight trading band this week while China was on holiday. A stronger USD Index aided copper prices last week. This week, contrary to normal trade, both the USD Index and copper traded slightly higher. Little news this week provided any new color on the copper supply-demand picture. Copper prices may have firmed due to higher aluminum and nickel prices.

|

|||||

|

|

|||||

|

|||||

|

Nickel was up for the week. Last trade on the LME 3M Select contract was $19,160/mt, with a trade range of $17,750/mt to $19,270/mt for the week. |

|||||

|

|

|||||

|

|

|||||

|

|||||

|

HRC steel futures traded slightly lowerthis week. As of this writing, the CME HRC futures contract for October ‘21 last traded at $1,881/T, down $35/T for the week. Trade range was from $1,878/T to $1,930T. Longer-dated contracts, through the remainder of the year and into 2022, continue to be backwardated. Opportunities remain open for HRC consumers to hedge future prices below the current spot price. For both producers and those carrying inventory, zero or low-cost collars or swaps are currently the best structure to achieve protection against a major market correction. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

10/5/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 09/16/2021: AEGIS Factor Matrices: Most important variables affecting metals prices 09/07/2021: China Exports Are an Economic Spot as Value Hits All-Time High 08/09/2021: China's Copper Imports Slow as Prices Weigh on Demand |

|||||

Notable News |

|||||

|

10/8/2021: China orders immediate jump in coal output to fight power crunch 10/7/2021: China’s ‘golden week’ travel drops as zero Covid-19 approach forces consumers to stay home 10/5/2021:Power outage, manufacturing slump: Key things to know about China’s economy 10/4/2021: Indebted Evergrande set to raise more cash from partial sale of its property services unit 10/4/2021: Hong Kong Stock Benchmark Closes Down 2.2%; Hopson Said Buying Evergrande Unit, Alibaba Drops 10/4/2021: Silicon metal and aluminum industries hit by China power shortages 10/4/2021: Rio Tinto reaches new labour agreement for BC Works (Kitimat) 10/4/2021: Column: China energy crunch may boost overseas metal producers 10/4/2021: Copper production in Chile falls 5% in August - report

|

|||||