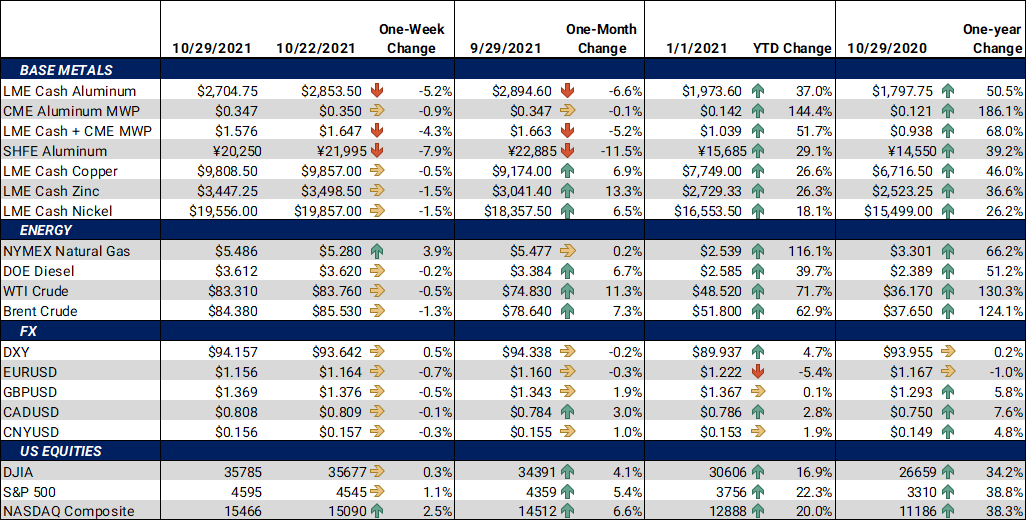

Bottom Line:China’s intervention in the coal markets may decrease energy input costs, thereby incentivizing more metals production and push metals prices lower. On Wednesday, China’s state planner (National Development and Reform Commission (NDRC)) requested that local governments in coal-producing areas investigate illegal storage sites and discourage hoarding. This news led domestic thermal coal futures to hit the 10%-down trading limit Wednesday. Prices for thermal coal are now down 47% since October 19.Since its production requires high amounts of electricity, the news of coal-market interventions led the LME Aluminum 3M contract to close down nearly 5% for the week. LME copper and zinc also finished lower, but aluminum took the news the hardest. |

Notable Metals News

Magnesium, a key metal for aluminum alloy production, is in short supply for Euro zone metals end users. China, which supplies nearly 95% of the metal to the region, has shuttered nearly 70% of its magnesium smelters through 2021 due to electricity crunches. WVM, Germany’s metals producers’ association, estimates that the region’s magnesium inventory will be depleted by the end of November.

In China, new COVID-related lockdowns may slow metals demand and production. Since last week, a spike of over new 100 cases has occurred in provinces in the northern region. This includes areas of Inner Mongolia, a main aluminum production region.

Continuing in China, bond and interest-payment defaults by real-estate firms might weigh on metals demand. For several troubled real-estate firms, any available cash is going to bond interest payments, rather than investment. The most recent example was Modern Land China Co who missed a principal bond and interest payment on a $250 million bond on Monday. China’s state planner, the National Development and Reform Commission, met with several of the largest real-estate firms on Tuesday. A prolonged debt crisis in the real-estate sector could weigh on deferred metals prices if little construction activity occurs.

Finally, at the LME, the dwindling copper stocks could support deferred contracts. On Friday, warehouse inventories were pegged at 140,175 mt, a new low for the year. Copper on warrant (i.e., available to trade) rose to 31,475 mt; however, this is only slightly above the October 15 low of 14,150 mt. If those that are short in the nearby contacts need to roll forward into the future, the increase in copper on warrant is supportive to deferred contracts. The backwardation between the cash and deferred contracts might decrease if this occurs.

|

Hedge Strategy Suggestions: |

|||||

|

Given the drop in recent weeks, metal end users may opt for a staggered hedging strategy. For instance, consumers might begin to layer into call options further out the forward curve. Later, that consumer could sell put options to offset the cost of the call, if or when prices begin to stabilize. This strategy could be used an alternative to a standard no-cost collar. For those who have a lower risk tolerance, buying swaps could be a logical strategy. We also suggest using limit orders along with reasonable stop-loss targets to add incremental protection if prices trend higher. |

|||||

|

|

|||||

LME Aluminum |

|||||

|

The LME Aluminum 3M fell $141.50/mt this week. This week’s selloff did little to change the shape of the forward curve through August ’22. More importantly, this week’s selloff has lowered the entire forward curve, so end users of aluminum can still hedge forward purchases at a sizable discount to the cash markets. |

|||||

|

|||||

|

The CME MWP contract for October ‘21 last settled at 34.933¢/lb at the time of this writing, but it had no trades this week. November, which becomes the prompt month on Monday, also had no trades so far this week. December has traded and is down almost 4¢/lb (over 11%) for the week. Like last week, the prompt month MWP remained firm despite LME Aluminum’s selloff. Demand has slowed as we enter the winter season. The MWP forward curve become more backwardated this week. |

|||||

|

|||||

|

The LME Copper 3M fell $196/mt this week. The recent LME rule changes and China’s intervention in the coal markets have led to lower copper prices. Like LME aluminum, this week’s selloff did little to change the shape of the forward curve. The entire forward curve has moved lower, to the advantage of end users.

|

|||||

|

|||||

|

LME Nickel 3M was down a mere $175 for the week. Relative to HRC Steel, nickel prices have weakened this month. Given that demand seems to be waning, nickel's downtrend may continue. |

|||||

|

|

|||||

|

|

|||||

|

|||||

|

HRC steel futures traded slightly higher this week. As of this writing, the CME HRC futures contract for November ‘21 last traded at $1,798/T, down only $12/T for the week. Trade range was from $1,770/T to $1,820/T. The forward curve for HRC remains severely backwardated throughout calendar year 2022. Thus, end users of HRC still have opportunities to hedge future prices below the current spot price. For those with inventory, zero or low-cost collars, or swaps, are viable structures to achieve protection against a major market correction. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

10/28/2021: AEGIS Factor Matrices: Most important variables affecting metals prices 10/27/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 10/14/2021: Is It Wise to Hedge HRC Steel with Crude Oil? |

|||||

Notable News |

|||||

|

10/29/2021: Coal in Freefall in China as Government Steps Up Price War 10/28/2021: Iron ore price down as Beijing moves to cool coal prices 10/28/2021: Chinese Smelters to Increase Exports as Short Squeeze Pushed LME Copper Prices Higher 10/27/2021: Iron ore price retreats amid Chinese intervention to cool commodity prices 10/27/2021: Shanghai aluminum drops to 2-month low as coal prices tumble 10/26/2021: Record China Defaults in Focus as Modern Land Joins the List 10/26/2021: Another Chinese property developer defaults, shares drop 10/25/2021: Copper prices rebound as stockpiles fall 10/25/2021: Fresh lockdowns in China as local Covid-19 infections spread to 11 provinces 10/25/2021: China locks down thousands, expects new Covid outbreak to worsen in coming days 10/24/2021: Copper chaos is latest in a rich history of wild metal swings 10/22/2021: London Metal Exchange has to restrain disorderly copper 10/22/2021: EU in talks with China to avoid “catastrophic” magnesium crunch 10/22/2021: Nucor profitability continues through Q3

|

|||||