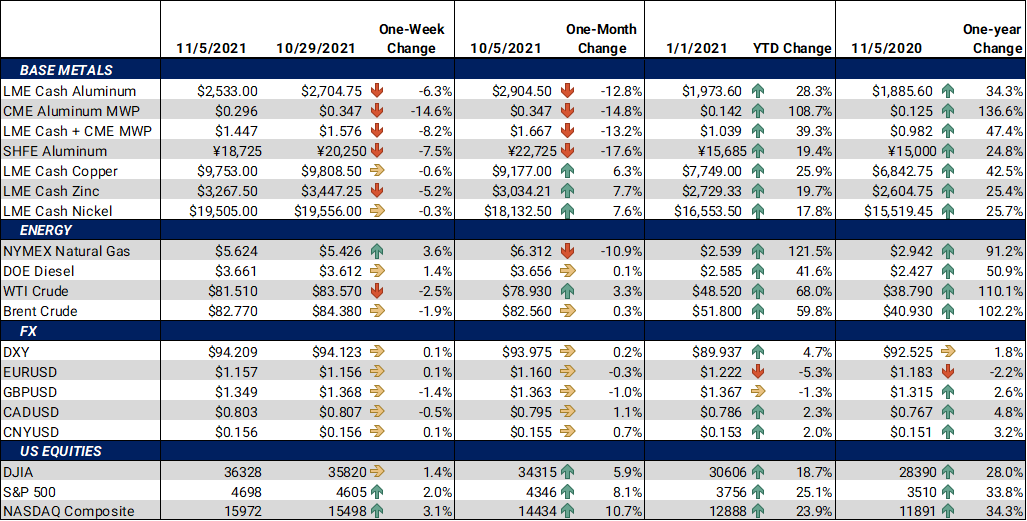

Bottom Line:The CME Aluminum Midwest Premium (MWP) saw the most price action this week; however, on little news. Industry professionals cited by Reuters and others claim that shrinking demand and the end-of-year conclusion of Russian export tariffs as reasons behind the drop in MWP prices.Since aluminum production requires high amounts electricity, thermal coal prices in China continue to have a strong correlation with LME Aluminum. On Wednesday, Chinese thermal coal futures and LME Aluminum futures rallied after China’s state planner again interfered in the coal markets. During a web conference on that morning, China’s state planner stated that coal prices should not drop too far too fast. This statement comes after prior state intervention, meant to boost coal supply and usage, caused Chinese thermal coal prices to drop nearly 50% in the last two weeks. However, this bounce in prices was short lived, as both fell into the weekend. |

Notable Metals News

Due an agreement made at last weekend’s G20 summit, the US might begin importing more aluminum and steel in the coming months. The US has agreed to end the Section 232 tariffs on EU-produced steel and aluminum. These tariffs were 25% on steel and 10% on aluminum. The new system will be based on a tariff quota ratio (TQR), and allow for a small, to-be-determined amount of metal to enter the US duty-free. A tariff-rate quota is a two-tiered tariff mechanism in which a pre-determined quantity of a good is set at one tariff, and any quantity above that number has a higher tariff.

Some American aluminum producers and steel workers applauded the decision to modify the Section 232 tariffs. Mark Duffy, CEO of the American Primary Aluminum Association, stated the “arrangement supports America's primary aluminum industry by setting the quota portion of the TRQ at very low levels that are well below pre-232 volumes.” United Steelworkers (USW) International President Tom Conway similarly stated, “Steel and aluminum are the backbone of our nation's defense and critical infrastructure, but for too long, global overcapacity and targeted predatory practices have undermined domestic production and employment. That's why the USW backed the Section 232 relief measures the Department of Commerce initiated years ago and why our union now supports the interim arrangement between the United States and the European Union.”

Finally, at the LME, the dwindling copper stocks could continue to support the forward curve. On Friday, warehouse inventories were pegged at 122,600 mt, a new low for the year. Inventories have dropped by 17,575 mt since last Friday. Copper on warrant (i.e., available to trade) rose to 40,875 mt; however, this is only slightly above the October 15 low of 14,150 mt. The new rules implemented the LME in mid-October have slowed, but not stopped, the outflow of metal from LME vaults. These new rules may affect copper hedgers who have a physical exposure to the cash market. Please contact AEGIS if you think this applies to you.

|

Hedge Strategy Suggestions: |

|||||

|

This week's price action is similar to last week’s, so we are sticking with the same recommendations. Metal end users are preferring options-based hedges that can be layered in stages. Consider the following staggered hedging strategy. Consumers might begin to layer into call options, for protection against price increases, further out the forward curve. Later, that consumer could sell put options to offset the cost of the calls, if or when prices begin to stabilize. The hedger has effectively made a collar, possibly at several strike prices. This strategy could be used an alternative to a standard no-cost collar. For those who have a lower risk tolerance, buying swaps could be a logical strategy. We also suggest using limit orders along with reasonable stop-loss targets to add incremental protection if prices trend higher. |

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

This week’s sell-off has flattened and lowered the forward curve into calendar year 2022. End users might consider the strategy we detail above for longer term purchases. |

|||||

|

|||||

|

Industry professionals, quoted by Reuters and others, are anticipating a slowing of demand for aluminum as we enter the winter season. Thus, premiums have dropped in recent weeks. The MWP forward curve remains backwardated into early 2022; however, has flattened after spring 2022.

|

|||||

|

|||||

|

A rally on Friday helped copper close nearly unchanged for the week. Copper prices remain influenced by the recent LME rule changes and China’s intervention in the coal markets. This week’s drop in prices did little to change the shape of the forward curve. The entire forward curve has moved lower, to the advantage of end users.

|

|||||

|

|||||

|

LME Nickel 3M was down a mere $200 for the week. The forward curve remains similar to last Friday’s. |

|||||

|

|

|||||

|

|

|||||

|

|||||

|

Prompt month futures for HRC have dropped over $100/T since recent highs. The forward curve for HRC remains severely backwardated throughout calendar year 2022. End users of HRC still have opportunities to hedge future prices below the current spot price. For those with inventory, zero or low-cost collars, or swaps, are viable structures to achieve protection against a major market correction. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

11/1/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 10/28/2021: AEGIS Factor Matrices: Most important variables affecting metals prices 10/14/2021: Is It Wise to Hedge HRC Steel with Crude Oil? |

|||||

Notable News |

|||||

|

11/05/2021: Could Russia’s aluminum export tax be coming to an end next month? 11/05/2021: Aluminium buckles under pressure from higher coal output 11/04/2021: China’s coal miners commit to cut prices after state intervention 11/03/2021: China coal prices claw back after Beijing signals pacing down price drive 11/03/2021: China coking coal futures track spot prices higher, jump over 14% 11/02/2021: Iron Ore Back Below $100 as China’s Steel Curbs Roil Market 11/02/2021: Chinese steel, iron ore prices slump as bear factors weigh on futures, physical markets 11/02/2021: China eases power crunch with boost to coal production 11/02/2021: Aluminium prices to stay high until next year, owing to high energy cost: Global Analysts 10/30/2021: U.S., EU end Trump-era tariff war over steel and aluminum 10/30/2021: APAA Supports the Biden Administration's Tariff-Rate Quota Deal with the European Union 10/30/2021: USW Supports Interim Arrangement with EU on Section 232

|

|||||