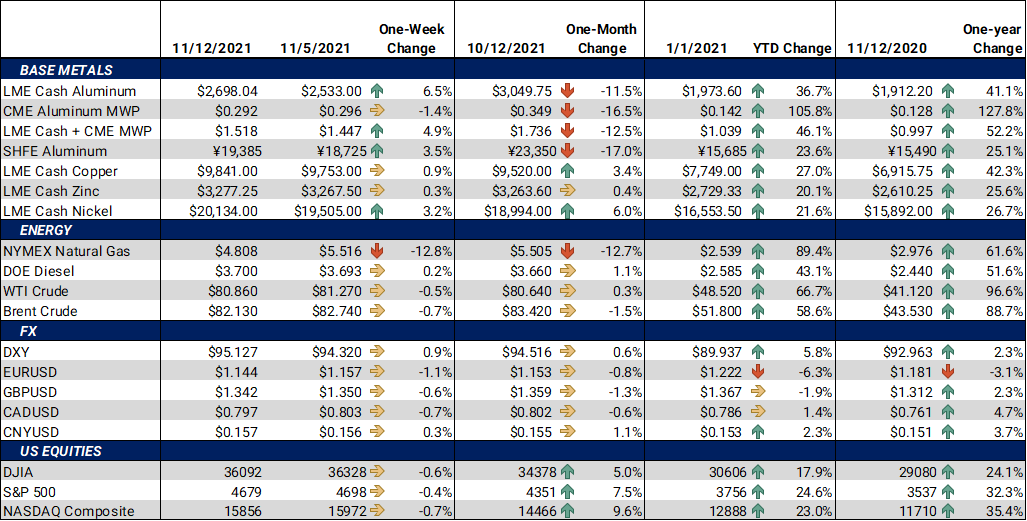

Bottom Line:After three straight weeks of lower prices, LME Copper 3M, Aluminum 3M, and Nickel 3M all finished higher on the week. Both LME Copper 3M and Nickel 3M closed above last week’s high, which is a positive technical charting signal. Even though aluminum closed positive, it only traded within last week’s range;its chart looks neutral.A strengthening dollar could weigh on metals prices. After trading in a very tight range since late September, the US Dollar Index broke out and made new highs for the year. Metals prices normally are negatively correlated to the USD.A flight to the USD could be bearish to metals. |

Notable Metals News

Cash copper prices might stall if end users choose to defer purchases. Earlier this week, Reuters reported that major copper producer Codelco is requiring a $105 premium over LME on some 2022 sales to some Chinese customers. However, some of those customers are foregoing purchases due to extreme market backwardation. Backwardation is market jargon for when near-term prices are more expensive than prices farther in the future. The cash – 3M spread reached over $1000/mt backwardation in mid-October. This spread now sits near $200/mt; however, some end users are hesitant to do short-term purchases due to spread volatility and backwardation.

Prices for copper, aluminum and steel could stall if a semiconductor supply crunch leads to a slowdown in automotive production. Early this week, the CEO of major semiconductor producer Infineon stated they expect chip shortages persist into 2022. Infineon gets approximately 40% of its sales from the automotive industry and is one of the largest suppliers to the sector.

Lower energy costs in China might incentivize more um and steel production. Thermal coal prices in China have dropped by over 50% since mid-October, after government intervention in the coal markets. Coal stockpiles continue to build, and data released earlier this week shows that coal imports last month were nearly double that of October 2020.

|

Hedge Strategy Suggestions: |

|||||

|

Even though prices for copper, aluminum and other base metals did go up this week, it was not enough to change any chart trends. Moreover, there was no major news this week that could significantly change the supply-demand picture. With little impetus for change, we are sticking with our previous recommendations for end users. Metal end users are preferring options-based hedges that can be layered in stages. Consider the following staggered hedging strategy. Consumers might begin to layer into call options, for protection against price increases, further out the forward curve. Later, that consumer could sell put options to offset the cost of the calls, if or when prices begin to stabilize. The hedger has effectively made a collar, possibly at several strike prices. This strategy could be used an alternative to a standard no-cost collar. For those who have a lower risk tolerance, buying swaps could be a logical strategy. Do you have the risk appetite (or, simply prefer) to wait? We suggest using limit orders along with reasonable stop-loss targets to add incremental protection if prices trend higher. We have neglected metals producers in recent weeks, so a refresher on strategies is in order. Costless collars (selling calls and buying puts) is a viable strategy for producers of metals whose markets have trended sideways (such as copper). These costless collars can mitigate a lot of the recent volality that has made put options expensive. Aluminum producers may wish to have a “sell on rallies” mentality given the aggressive price downtrend in recent weeks. |

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

The forward curve into calendar year 2022 has flattened in recent weeks. With this week’s rally, the current forward curve is slightly above last week’s ending forward curve. However, it is approximately $300/mt to $400/mt below where prices were 30 days ago. |

|||||

|

|||||

|

The forward curve for the MWP mimics that of LME aluminum. This week’s MWP forward curve is barely above last week’s and is 5¢/lb to 6¢/lb below the forward curve from 30 days ago.

|

|||||

|

|||||

|

LME Copper 3M closed above last week’s high, which is generally thought of as a bullish signal. We note that copper prices have trended sideways for over three months. Thus, the current forward curve for copper essentially sits on top of where it was both 30 and 90 days ago.

|

|||||

|

|||||

|

LME Nickel 3M was up $500/mt for the week. Due to this rally, the forward curve has also risen. It was a vertical rise in the curve; its shape is similar to last Friday’s. |

|||||

|

|

|||||

|

|

|||||

|

|||||

|

The November ’21 for HRC has traded in roughly a $60/T range since mid-October, with little movement above the $1,800/T level. The forward curve for HRC remains severely backwardated throughout calendar year 2022. End users of HRC still have opportunities to hedge future prices below the current spot price. Zero or low-cost collars are a viable strategies for such end users. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

11/1/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 10/28/2021: AEGIS Factor Matrices: Most important variables affecting metals prices 10/14/2021: Is It Wise to Hedge HRC Steel with Crude Oil? |

|||||

Notable News |

|||||

|

11/11/2021: Codelco’s China clients stall on 2022 deals amid copper backwardation 11/11/2021: Stainless Espresso: Asian coal prices on the rise again 11/10/2021: China Evergrande meets another interest payment deadline. 11/10/2021: Metals Will Be The Oil Of The Future 11/09/2021: Tin Ticks All The Commodity Supercycle Boxes 11/09/2021: Copper price down despite supply scarcity concerns 11/09/2021: Nickel prices seen falling in 2022 due to surplus 11/09/2021: Infineon CEO: chip supply to remain tight in 2022 11/08/2021: China’s daily coal production hits new high of 11.93 mln tons, further ensuring energy supply 11/07/2021: China’s coal imports in October nearly doubled from a year ago 11/06/2021: Honda Motor (HMC) Q2 2022 Earnings Call Transcript 11/05/2021: Honda profit dips 30% as chip crisis hits output, sales

|

|||||