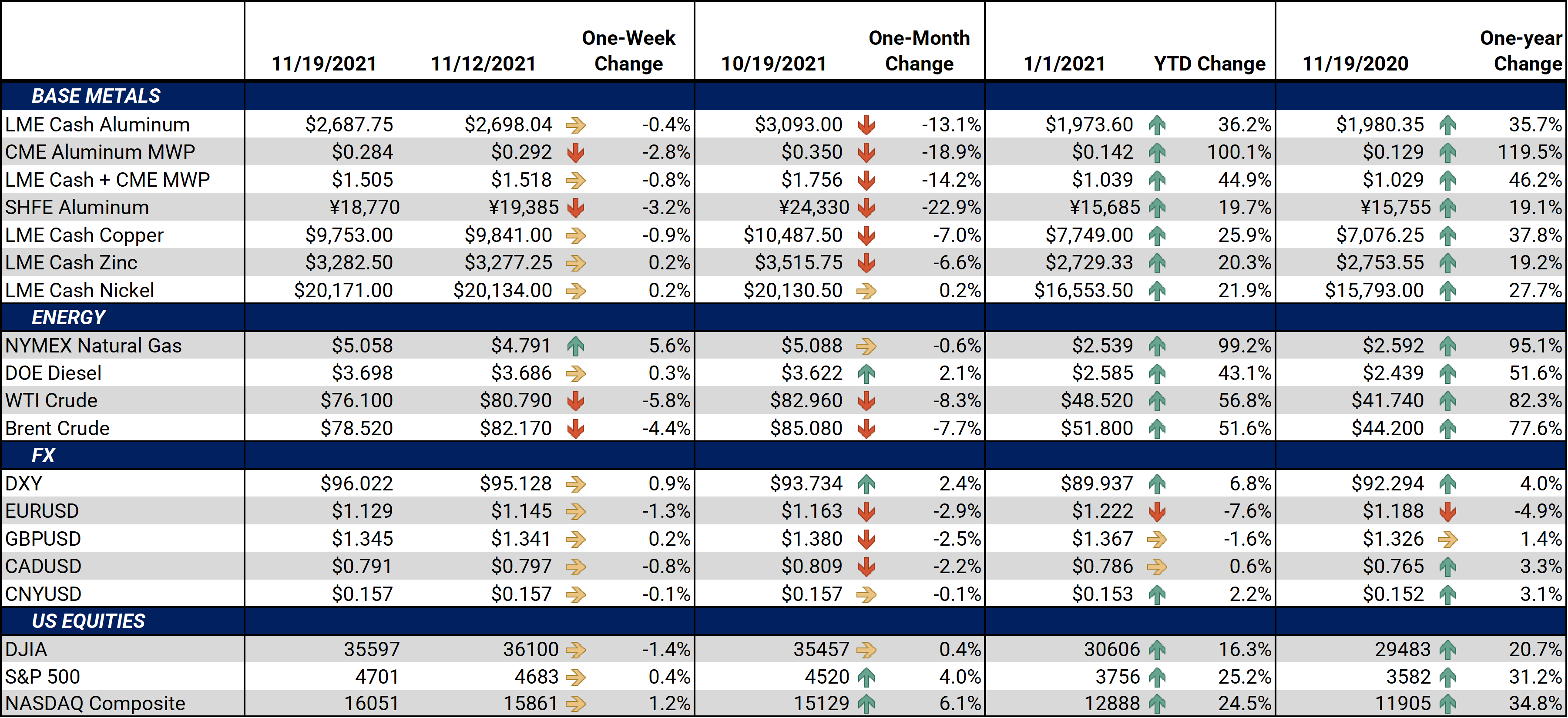

Bottom Line:Prices for most base metals moved lower this week. The Nickel 3M contract eked out a small gain of $80/mt. None of this week’s price action was significant enough to change any price trends.News that may change the supply-demand picture has been sparse in recent weeks. Thus, going forward, outside markets such as the USD Index, may play a more significant role than usual.The continued strength in the US Dollar Index has likely weighed on metals prices. This index has now had four straight weeks of gains since October 25. The USD Index is normally negatively correlated with base metal prices. A strengthening USD would make dollar-denominated goods more expensive to foreign-currency buyers, so the price falls to keep their purchasing power intact.New COVID developments could also influence base metals prices. Cases are on the rise in the Midwestern US and throughout most of Europe. Some European countries are implementing new lockdowns, and others are considering doing so. Lower demand because of new lockdowns could weigh on prices; however, prolonged smelter shutdowns and logistical bottlenecks could keep prices elevated. |

Notable Metals News

President Biden signed the $1-trillion infrastructure bill into law on Monday. Investments which will require significant metals consumption include:

Some of these investments are less than what was initially requested. For example, Biden initially proposed $100 billion for broadband infrastructure.

American end users of HRC Steel are largely uncertain on future price direction. In a recent survey by Steel Market Update, half of the survey participants are predicting continued price gains; the other half predicts price losses. Bullish steel buyers cite demand, outages and the infrastructure bills for potential price gains. Bearish steel buyers cite lower automotive production, higher import volumes and new production capacity for potential price losses.

Moving to international news, earlier this week Japan’s industry minister stated that “Japan and the US have agreed to start discussions to solve the issue over US ‘Section 232’ tariffs on steel and aluminum imports.” However, another ministry official stated, “Japan’s trade minister and US commerce secretary did not discuss any concrete measures to resolve the issue like that of EU-US agreement.”

In China, the state planner, known as the National Development and Reform Commission (NDRC), has laid a plan to curb pollution by energy-intensive industries such as aluminum smelting. This plan will go into effect on January 1, 2022. This includes restricting additional production capacity, improved recycling and implementing renewable energy.

|

Hedge Strategy Suggestions: |

|||||

|

At the risk of sounding like a broken record, there was no major news this week that could significantly change the supply-demand picture. However, the ever-evolving COVID situation could keep a lid on demand; yet, supply chains remain fractured and inventories, tight. Option strategies could provide the most prudent hedging protection as we enter a new era of COVID uncertainty. Metal end users are preferring options-based hedges that can be layered in stages. Consider the following staggered hedging strategy. Consumers might begin to layer into call options, for protection against price increases, further out the forward curve. Later, that consumer could sell put options to offset the cost of the calls, if or when prices begin to stabilize. The hedger has effectively made a collar, possibly at several strike prices. This strategy could be used an alternative to a standard zero-cost collar. Metal producers may also find it advantageous to use costless collars. Their strategy is slightly different from that of the end user, in that a producer would be selling calls and buying puts. These costless collars can mitigate a lot of the recent volatility that has made put options expensive. Copper continues to trend sideways, so producers of the red metal may opt for this strategy. |

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

Aluminum’s forward curve is the same shape as last week’s; however, it has shifted $40/mt to $50/mt lower given this week’s slight selloff. It is less backwardated than 30 days ago, to the advantage of aluminum producers who need make deferred sales. |

|||||

|

|||||

|

The forward curve for the MWP is flatter compared to last week. It remains 5¢/lb to 7¢/lb below the forward curve from 30 days ago. |

|||||

LME Copper |

|||||

|

Copper’s forward curve essentially mirrors that of last Friday’s, albeit $150/mt to $200/mt lower. However, it looks vastly different from the forward curve of 30 days ago, as it has become much less backwardated during that time.

|

|||||

|

|||||

|

The forward curve for nickel sits almost exactly where it did last week, and likewise has a shape that similar to last Friday’s. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

The trading range for the November ’21 HRC futures contract keeps getting tighter. The spread of high to low prices on that contract was only $15/T this week. Likewise, its trend remains sideways. Even as prices continue to run in place, the forward curve remains severely backwardated throughout calendar year 2022. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

11/15/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 11/12/2021: AEGIS Factor Matrices: Most important variables affecting metals prices 10/14/2021: Is It Wise to Hedge HRC Steel with Crude Oil? |

|||||

Notable News |

|||||

|

11/18/2021: Copper falls to one-month low 11/17/2021: Steel prices dominate manufacturing news in 2021 11/16/2021: METALS-Shanghai aluminium hits near six-month low as stockpiles rise 11/15/2021: Falling stocks pose problems for London Metal Exchange 11/15/2021: Here's what's in the bipartisan infrastructure package 11/15/2021: US states and cities are already making big plans for the $1 trillion infrastructure bill 11/15/2021: U.S., Japan to Discuss Lifting Tariffs on Aluminum, Steel as China Ramps up Production 11/15/2021: Japan-US to resolve issue over US “section 232” tariffs on steel and aluminium imports 11/15/2021: METALS-Copper prices ease on firm dollar, weak Chinese property data 11/12/2021: Lithium prices keep rising on the strength of the Chinese market

|

|||||