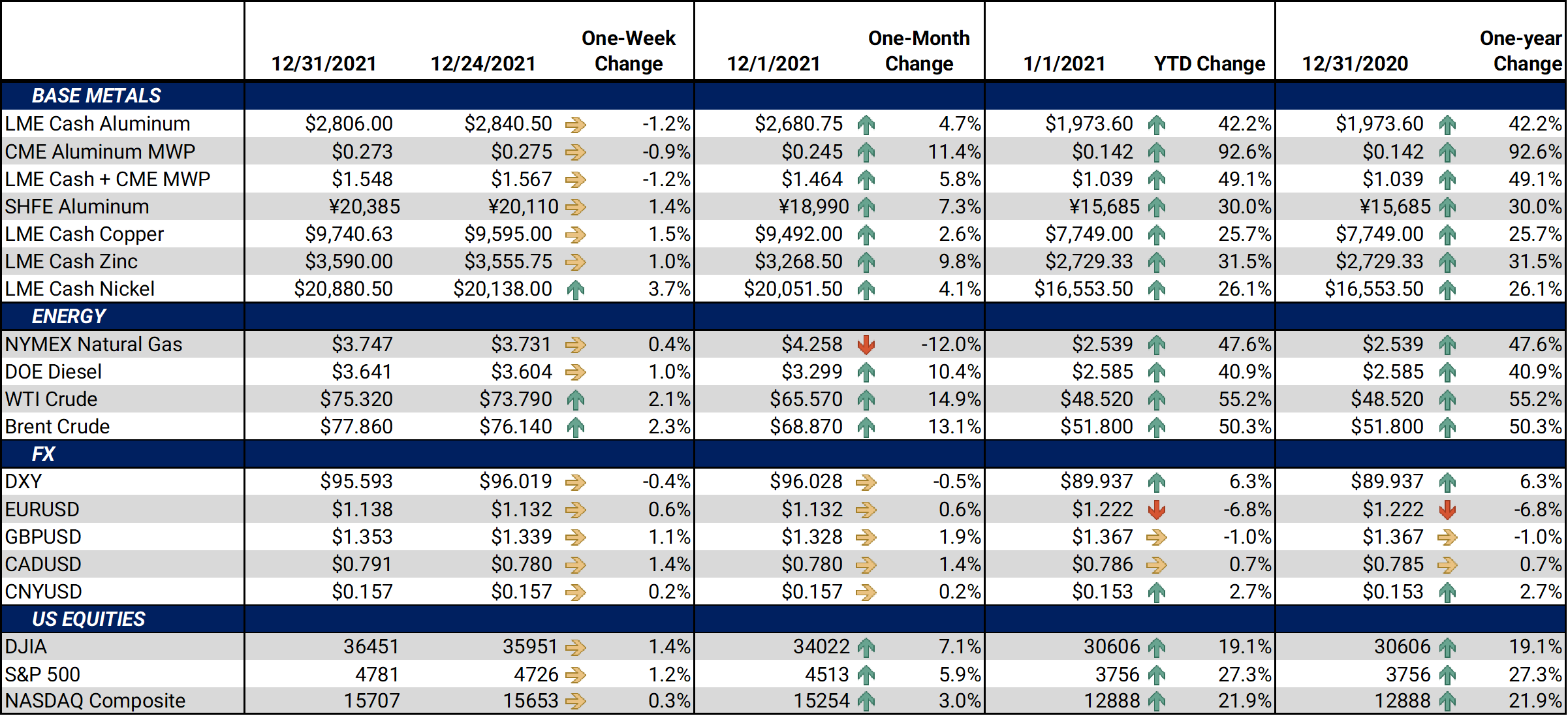

Bottom Line:LME aluminum prices finished nearly unchanged this week. The low volatility is noteworthy in light of some recent news. Aluminum’s supply picture in Europe keeps getting tighter as at least three more smelters have announced production cutbacks. European smelters of aluminum continue to grapple with skyrocketing electricity costs. |

Notable Metals News

High electricity costs continue to plague the European aluminum industry. Alcoa’s 228,000 mt/year San Ciprian, Spain primary aluminum smelter will close in January 2022. Production is set to restart on January 1, 2024. As Alcoa will be making major investments in the plant and guaranteed future pay and employment, most employees voted in favor of the closure. Prior to this investment announcement, Alcoa had been trying to sell the plant since 2020. The plant has been plagued with worker strikes and unprofitability in recent years.

Continuing the theme, Alro, which is Romania’s only primary aluminum smelter, is set reduce primary aluminum by 60% in 2022. In a December 27 press release, the company stated it will resume full production “when energy market conditions return to normal.” It is one of the largest producers in Europe, and the largest in the eastern and central Europe. According to the company’s website, primary aluminum production capacity is 265,000 mt per year.

The AEGIS energy-research team notes that Europe is likely to continue having energy-supply problems in 2022 and into 2023. The continent has only minimal amount of gas available for storage for the remainder of winter. More daily supply may arrive mid-year when Russia’s Nord Stream II pipeline is in service, but the timing is uncertain. A bullish risk to metals exists while Europe’s energy balance leans toward undersupplied. The good news? Those consumers can often hedge the gas exposure.

Finally, in copper news, the blockade at the Peru-based Las Bambas mine has ceased and production will resume soon. The mine had been plagued with road blockades by protestors since mid-November. These protestors were local residents seeking compensation for the mine’s usage. Due to the ongoing protesting and road blockages, the mine had been shut since December 18. Reuters stated it would take up to six days to restart operations. According to the company, in 2021, the mine will produce 290,000 mt, which is down from 311,020 mt produced in 2020. Reuters recently stated the mine can produce 400,000 mt of copper concentrate per year, which is approximately 2% of world production.

|

Hedge Strategy Suggestions: |

|||||

|

End users who need to make forward purchases in the Midwest Premium (MWP) might consider buying swaps in a backwardated market (where longer-term contracts are priced lower than the cash and near-term market). The MWP market is extremely thin, so please contact us for details on hedging opportunities. Producers who have short-term (over the next one to four months) downside inventory price risk in aluminum, may consider selling forward in a contango market (where shorter-term contracts are priced lower than the deferred market). The market reverts to backwardation in the latter half of 2022 and beyond, so end users who have longer term price risk might consider buying calls into this backwardated curve. LME Copper’s forward curve is in backwardation through December 2023. Thus, similar to MWP, end users can make deferred purchases at a deep discount to the cash market. Layering into swaps with tenors throughout the second half of 2022 might be a logical tactic for such end users. Also, copper prices have been rangebound recently, so collars could be considered too. For CME HRC Steel, the backwardation remains significant. Similar to our copper ideas, layering into swaps with tenors throughout the second half of 2022 might be a logical tactic for end users. The HRC Steel market is extremely thin, so contact us for strategies to execute hedges efficiently. |

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum remains within its trading range that began in late October. This week’s forward curve is slightly more backwardated than last week’s. As stated at the outset, let’s keep an eye on the production situation in Europe. The forward curve might see more severe backwardation if production slows while demand remains elevated. Our research team is available to discuss the energy markets and the potential risks they pose for metals prices. |

|||||

|

|||||

|

The forward curve for the MWP remains backwardated. July ’22 and beyond has shifted about 0.5¢ to 1¢ lower compared to last week. |

|||||

LME Copper |

|||||

|

Compared to last week, LME copper’s forward curve has shifted higher by about $150/mt. It remains severely backwardated.

|

|||||

|

|||||

|

Nickel’s continued rally keeps shifting the forward curve higher. Its shape is the same as last week; however, is higher by about $700/mt. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

HRC Steel traded sideways this week. The charts remain in a downtrend and rallies have been met with quick resistance. Even as prices have begun to slide, the forward curve remains severely backwardated throughout calendar year 2022. The forward curve now essentially sits on top of where we were both last week and 30 days ago. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

12/22/2021: AEGIS Factor Matrices: Most important variables affecting metals prices 12/13/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 11/30/2021: Will the Omicron COVID Variant Impact South African Metals Production or Exports? |

|||||

Notable News |

|||||

|

12/30/2021: MMG's Las Bambas mine to restart copper output after Peru deal 12/30/2021: Peru community agrees to lift blockade that disrupted Las Bambas mining -RPP Radio 12/30/2021: Further curtailment of production at Slovalco 12/29/2021: Peru government still far from deal on MMG’s Las Bambas mine restart 12/29/2021: Alcoa to curb aluminum output in Spain after energy costs soar 12/28/2021: Romania’s Alro to cut primary aluminum production due to high energy prices 12/27/2021: China's 2021 primary aluminum output seen below early estimates: Antaike 12/26/2021: World economy now set to surpass $100 trillion in 2022 |

|||||