|

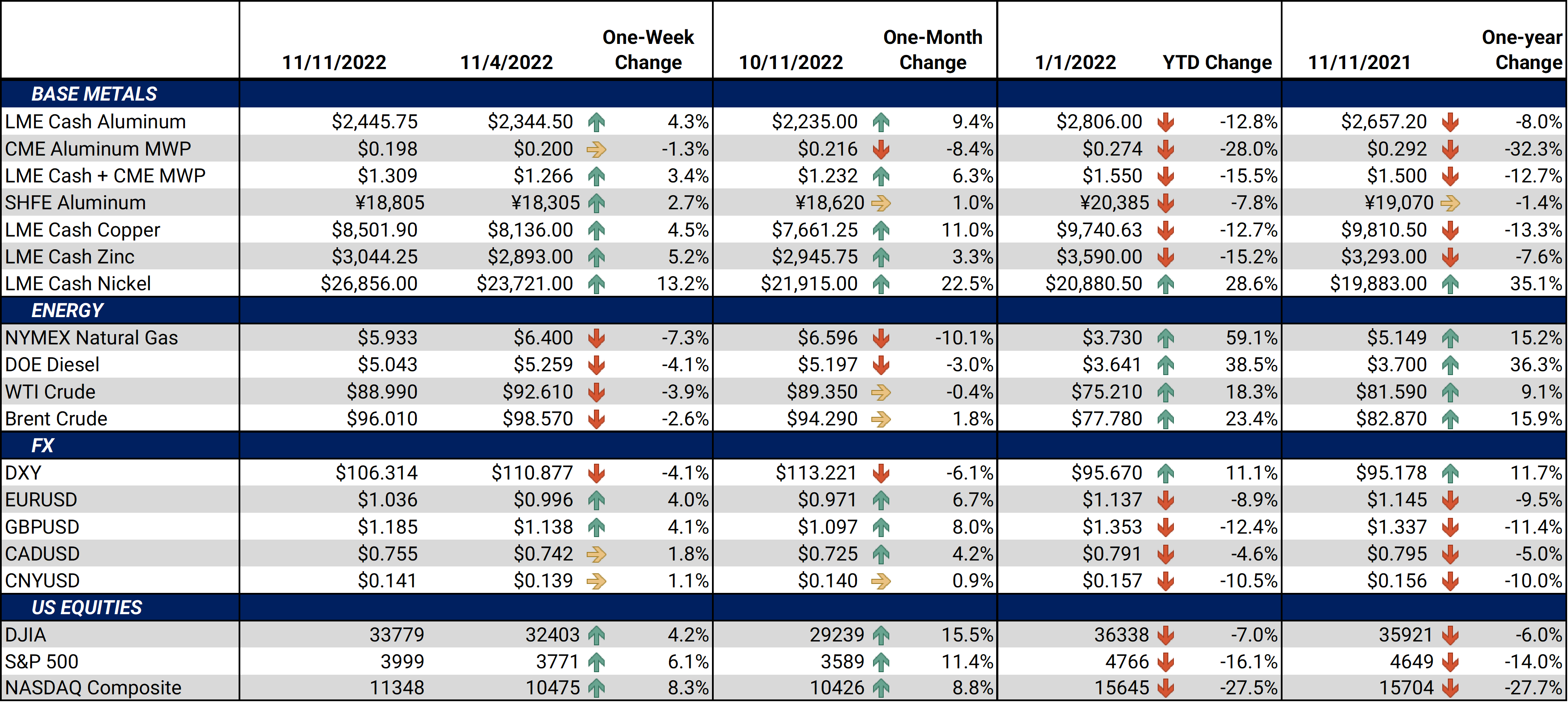

All major LME industrial metals rallied Friday on news that China reduced quarantine times for inbound travelers and for those who have been in close contact with infected people, according to Bloomberg. They have also ended a “circuit breaker” penalty for airlines, whereby airlines were punished for bringing in too many COVID cases, according to Reuters. Wall Street analysts cheered the news, with Daniel Hynes, senior commodity strategist at Australia and New Zealand Banking Group proclaiming, “the bulls have been waiting for such a trigger.” Zinc gained over 5% at one point, while aluminum jumped over 4%. (Sources: Bloomberg, Reuters) |

Copper

Concerns over Peruvian copper supplies have also supported prices recently. Peru's Las Bambas copper mine is reducing production due to ongoing protests, according to company statements from last Thursday. If mine operations stop, it would potentially remove 2% of global supply, according to Reuters. The Las Bambas mine has been subjected to several disruptions this year, including one stoppage that lasted over a month. The residents who are protesting at the mine are demanding compensation for its usage. The Las Bambas mine, which is one of the world’s largest copper mines, produced 300,000 mt in 2021. At 2.2 million mt, Peru was the world’s second-largest copper miner in 2021, according to USGS data. (Sources: Reuters, Bloomberg)

Aluminum

As of this morning, LME aluminum stocks have fallen 29,150 mt from the October 28 peak of 578,425 mt. Most of the recent decline originated from warehouses in Port Klang, Malaysia. AEGIS notes that the aluminum delivered out of Port Klang warehouses was likely there only briefly. As of October 19, LME aluminum stocks in Port Klang totaled 381,425 mt, more than double the level seen on October 10. Most of this recent increase came from Citibank, according to unnamed sources cited by Reuters late last month. According to the sources, increasing borrowing costs had cut the profitability of the bank’s aluminum trading. Banks such as Citibank, often use metals such as aluminum as collateral for financing deals. Such deals normally involve borrowing money to purchase aluminum now to sell forward at a higher price. However, rising interest rates have made such deals less attractive. Thus, as existing financing deals have expired, more aluminum has been delivered to LME warehouses. (Sources: Bloomberg, Reuters)

Aluminum prices have trended sideways since early October, despite the deliveries into LME warehouses. However, some industry professionals have warned that even greater volumes could be delivered to the exchange. Last month, US aluminum producer Alcoa expressed fear that 1,000,000 mt of Russian-origin aluminum could be delivered to the LME every year. Allowing even higher volumes of metal onto the LME could ultimately push prices lower.

Steel

India’s steel demand could grow at a "high single-digit" rate over the next 12 to 15 months, according to comments from Moody's Investors Service yesterday. According to their comments, this expected demand growth could come from infrastructure investments before India’s 2024 national elections. Moreover, they believe that Indian demand is a “bright spot” compared to other regions. AEGIS notes that India’s steel is already on the upswing. Compared to 2021, the country’s finished steel consumption grew by 11.4% between April and October to 65.5 million mt, according to government data. Imports of finished steel also grew during that period, as they imported 3.2 million mt, up 14.5% from the same period in 2021. (Source: Reuters)

Even though India normally imports little steel from the US, higher Indian demand could be bullish to CME HRC prices, if their demand for US finished-steel products increases over the next year. Moreover, other major steel importers could be forced to look elsewhere for steel, especially if their cargoes are diverted to India.

However, a bearish sentiment still hangs over the steel market. Steel industry professionals have lamented that the market is “oversupplied,” and a new contract between the United Steelworkers (USW) and US Steel might add fuel to the fire. A possible strike was averted by the union and US Steel tentatively agreeing to a new four-year contract earlier this week. The new contract includes a wage increase, a $4,000 bonus, and higher pension and 401K contributions. If ratified, the agreement would be similar to the one reached with Cleveland-Cliffs in October, according to an unnamed source interviewed by Bloomberg. Unnamed sources recently told Argus that a potential strike by the USW could be “the only action that could turn around the market, save increased production cuts by steelmakers.” (Sources: Bloomberg, Argus)

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,463.50/mt, up $108.00/mt on the week. Aluminum prices were up this week. Compared to last Friday, the forward curve has shifted vertically higher by about $100/mt; however, its shape remains the same. It remains in contango, meaning that spot prices are lower than futures prices. Those that are carrying aluminum inventory and are concerned about decreasing prices might consider hedges that provide downside protection, such as selling swaps or buying put options. Such positions are standard; however, they can result in opportunity costs or cash costs if metal prices increase. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 19.8¢/lb this week. The CME Midwest Premium market is in contango from the prompt month (November) contract through January 2024. Prices are flat throughout the remainder of 2024. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,492.50/mt, up $393.50/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted higher by about $400/mt. There is a slight backwardation into spring 2023, but prices are relatively flat for the remainder of the curve. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $26,925/mt, up $3,114/mt on the week. As prices rallied this week, nickel’s forward curve has also shifted higher, by about $3,100/mt. It remains in contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last settled at $662/T, down $16/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

11/09/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 11/07/2022: AEGIS Primer on LME Aluminum Price History 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 8/31/2022: Will Chilean Production Issues Drive Copper Prices Higher? |

|||||

Notable News |

|||||

|

11/11/2022: China shortens quarantines as it eases some of its COVID rules 11/10/2022: Recession-shy investors can turn to capital cycle 11/9/2022: US ferrous: Northern markets slide in November 11/7/2022: US steel sentiment remains bearish as uncertainty looms over the demand outlook: survey 11/7/2022: China again holds firm on ‘zero covid,’ despite the worsening toll 11/7/2022: Moody's says India a bright spot in global steel demand 11/4/2022: India's April-October finished steel exports drop 55% y/y - data |

|||||