|

Aluminum The LME will not ban Russian metal from being traded and delivered to exchange warehouses, the exchange stated after last Friday’s close. They will not impose limits on how much Russian metal may be delivered to or stored in exchange warehouses. According to the LME, many end-users have already contracted to buy Russian metal next year. Moreover, no Russian metal producers have been sanctioned, therefore the exchange believes it “should not take or impose any moral judgments on the broader market." The LME later stated that it will “remain responsive to any sanctions or tariffs imposed by governments and will communicate with the market should those arise.” The statements were taken from the exchange’s response to the discussion paper on Russian metals launched in early October. The motivation for the discussion paper stems from Russia’s ongoing conflict with Ukraine. (Source: Reuters, LME) |

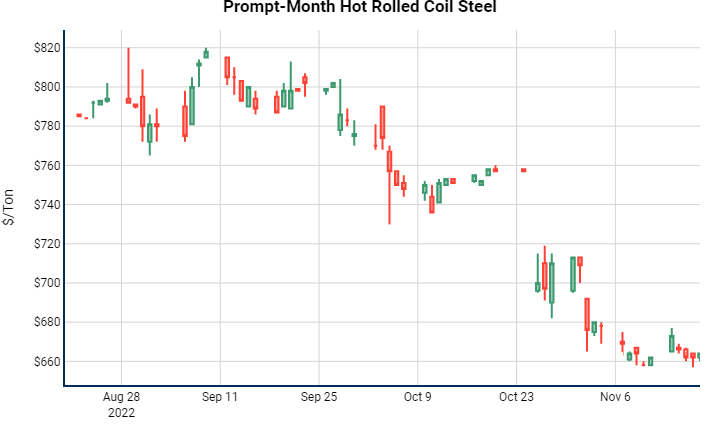

Steel

Some steel producers feel that HRC prices are nearing a bottom, as most are operating at breakeven or even at a loss, according to Argus. Many of these steelmakers are working through “high-priced” pig iron and busheling scrap that was purchased months ago, leading to higher conversion costs and lower profitability. However, these producers report “decent” downstream demand as shipments have been stable in recent months. AEGIS notes a looming rail worker strike in December could be damaging to the US economy and may affect HRC prices, demand, and supply. (Source: Argus)

Nickel

The Goro nickel mine, which is one of the world’s largest deposits, is cutting production in 4Q due to leaks from a tailings dam that holds mining waste, according to Bloomberg. The production cutbacks were requested by local authorities. It is unclear how much production will be cut; however, the operation has an annual production capacity of approximately 60,000 mt. The mine is partially owned by Trafigura and backed by Tesla. The Goro nickel mine is on the island of New Caledonia, a French territory off the coast of Australia. At 160,000 mt, New Caledonia was the world’s fourth-largest nickel producer in 2021, according to USGS data. (Source: Bloomberg)

Zinc

Nyrstar will resume operations at its Budel, Netherlands-based zinc smelter this month, according to company statements from late last week. Due to unprofitability, the smelter was placed on care and maintenance status approximately two months ago. Since the start of the Russia-Ukraine conflict, Russia has decreased natural gas flows to Europe. This drop in natural gas flows has led to soaring natural gas (TTF) and electricity prices across the continent. As zinc smelting is electricity-intensive, soaring electricity costs have forced producers such as Nyrstar to curtail production fully or partially. However, AEGIS notes that both European natural gas and electricity prices have fallen tremendously since the summer highs which is likely why Nyrstar is able to restart operations. Nyrstar’s Budel, Netherlands smelter normally has an annual capacity of 315,000 mt, making it one of Europe’s largest zinc smelters. (Sources: Reuters, Bloomberg)

Commodity Exchanges

The Chicago Mercantile Exchange (CME) has taken aim at the LME’s dominance in industrial metals trading. Open interest in the CME’s aluminum contract has surged over 400% this year. Also, nearly 150 new accounts began trading the CME’s aluminum contract between May and mid-September this year. Total open interest in CME aluminum is currently about 30,000 mt, a fraction of the 14 million mt on the LME. Trading volumes in aluminum increased dramatically after the CME adjusted the daily settlement period to align with the LME close, thereby opening greater arbitrage opportunities between the two contracts.

Similarly, trading in the CME’s cobalt contract is growing. Open interest in the CME’s cobalt contract has increased by over 500% this year. Compared to CME’s cobalt contract, trading of the LME’s cobalt contract has largely ground to a halt. “Liquidity in the cobalt market is almost solely based in the CME” proclaimed Jack Nathan, head of battery metals at Freight Investor Services. (Source: Bloomberg)

|

|

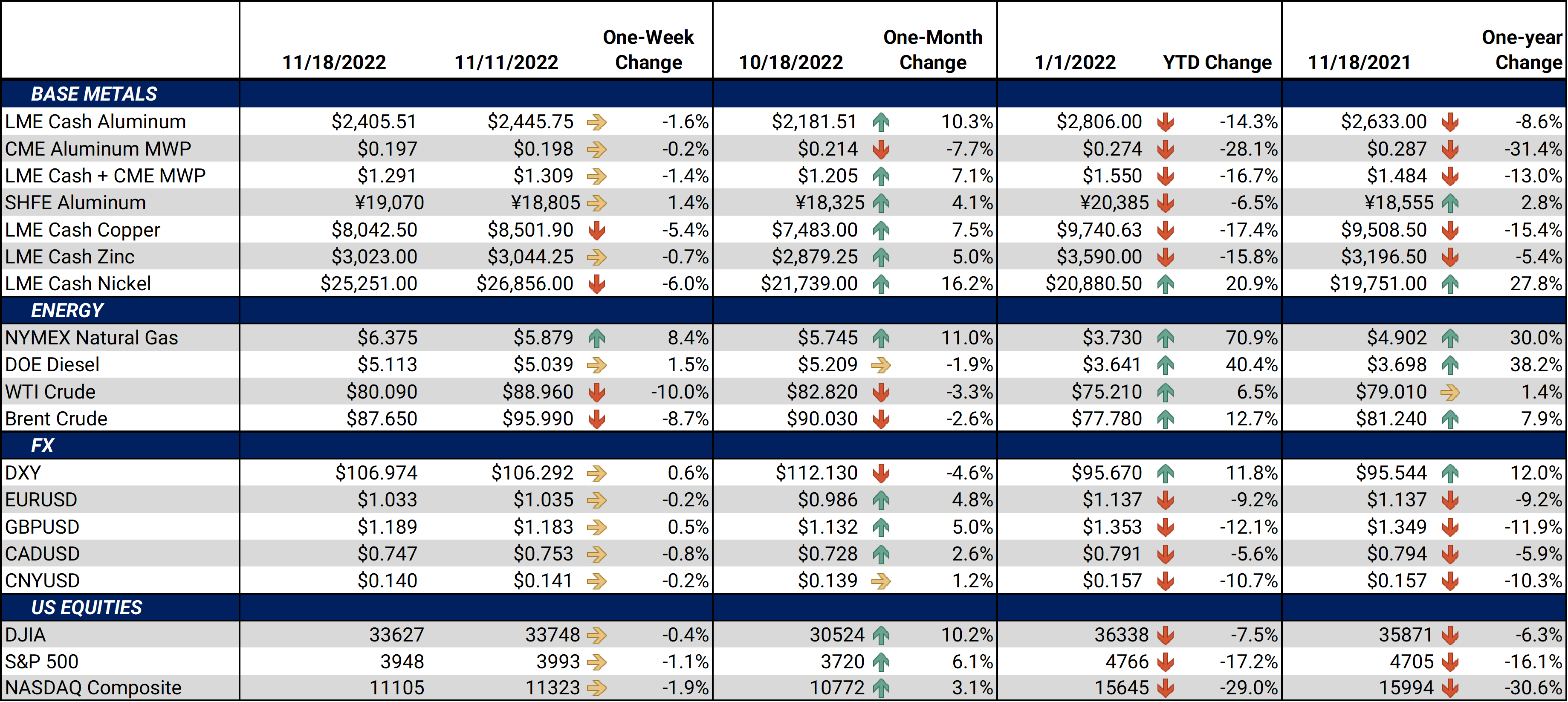

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,430.00/mt, down $33.50/mt on the week. Aluminum prices were down this week. Compared to last Friday, the forward curve has shifted vertically lower by $30/mt; however, its shape remains the same. It remains in contango, meaning that spot prices are lower than futures prices. Aluminum consumers that are concerned about increasing prices might consider hedging future needs by buying swaps or call options. End-users might consider strategies that use only swaps or options or a combination of both, depending on risk tolerance. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 19.7¢/lb this week. The CME Midwest Premium market is in contango from the prompt month contract (November) through January 2024. Prices are flat throughout the remainder of 2024. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,076/mt, down $416.50/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted lower by about $400/mt. Prices are very flat throughout the curve. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $25,385/mt, down $1,540/mt on the week. After much volatility, nickel prices fell about $1,500/mt this week. Nickel’s forward curve also fell, shifting vertically lower by about $1,500/mt. It remains in contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

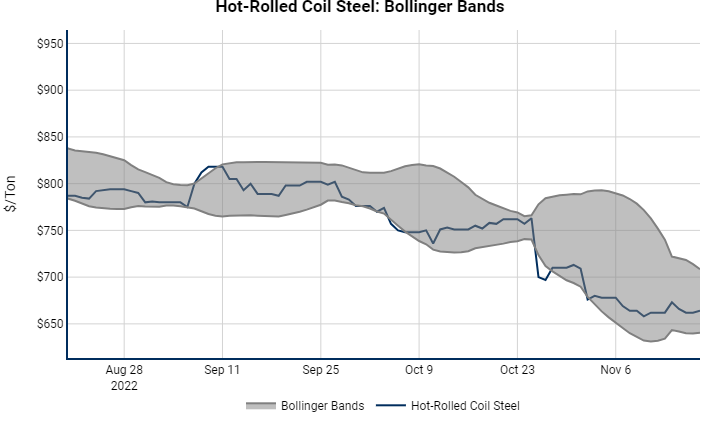

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month CME HRC Steel last settled at $663/T, up $1/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

||||

AEGIS Insights |

|||||

|

11/17/2022: Do Chinese Aluminum Import and Export Flows Affect LME Prices? 11/16/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 11/07/2022: AEGIS Primer on LME Aluminum Price History 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 |

|||||

Notable News |

|||||

|

11/18/2022: Rio to pursue Turquoise bid after ending talks with minority shareholders 11/16/2022: Nickel prices tumble as LME scrutinises volatile trading 11/15/2022: US steel shipments down again in September 11/15/2022: US HRC: Prices fall, market sees the floor 11/15/2022: Column: LME stays Russian metal ban with views starkly split 11/14/2022: Electric vehicle makers burning cash, slammed by sky-high costs 11/14/2022: No surge of Russian metal into LME warehouses-exchange 11/14/2022: Nucor kept December plate prices flat 11/11/2022: LME will not ban Russian metal from its system |

|||||