|

Aluminum Starting in January 2023, the LME will produce monthly reports detailing how much Russian metal is in LME warehouses. However, Rusal and Alcoa requested that the LME reports detail metals of all origins, not just those from Russia. AEGIS notes that this is a rare amount of agreement for the two companies, as Alcoa previously demanded that the LME ban all Rusal and other Russian-produced metals from the exchange. However, earlier this month the LME dismissed such a ban. In September and October, Alcoa sent three letters to the LME requesting that Russian metal be banned from the exchange. At that time, Alcoa stated that allowing large volumes of Russian metal into the LME system could exert undue influence on LME aluminum prices and might upset the global aluminum supply and demand balance. These letters were in response to the discussion paper the LME launched in late September outlining possible actions against Russian metals producers, including an outright ban on their metals. (Source: Reuters) |

Shifting over to China, the country’s aluminum product exports could increase by nearly 40% over the coming years. The country’s largest aluminum producers will study plans to jointly build alumina plants in Guinea and new factories and fabricators in Southeast Asia, according to Bloomberg. The companies involved, which include Aluminum Corp. of China Co. and Shandong Weiqiao Pioneering Group Co., believe that these additions could boost the country’s aluminum product exports to 10 million mt. Researcher Antaike estimates that China’s aluminum product exports will total 6.3 million mt this year, up 16% from 2021. The companies also plan to improve domestic mining to increase bauxite reserves. These company statements were initially published in the China Nonferrous Metals Industry Association’s newsletter mid-last week. (Source: Bloomberg)

Nickel

A proposed OPEC-like organization that would aim to control global nickel production and prices is unlikely to gain traction, according to industry analysts. Indonesia discussed the idea with Canadian officials at the G20 summit last week. However, Canadian government officials stated they are “very unlikely” to join such an organization. One Canadian nickel producer echoed similar comments, as Canada has a different supply chain and customer base than Indonesia. AEGIS notes that most of Indonesia’s production is controlled by Chinese companies, as compared to domestic producers in Canada. Moreover, analysts note that nickel production is managed by privately held companies and not by governments. Thus, the proposed organization is unlikely to yield little pricing power, compared to OPEC’s influence on oil prices. Indonesia and Canada are the world’s largest and 6th largest nickel producers, according to USGS data. (Source: Reuters)

Platinum

Due in part to a recovering global automotive sector, platinum usage will jump 19% year over year to 7.77 million oz in 2023, according to the World Platinum Investment Council (WPIC). This jump in demand, along with supply issues in South Africa, will push the market into a deficit of 303,000 oz next year. This is a large shift in demand, as a surplus of 804,000 ounces is expected this year. Increasing vehicle production and stricter emissions regulations are driving the boost in automotive demand. Also, some manufacturers are substituting palladium with cheaper platinum. Swapping palladium for platinum will account for nearly 500,000 oz of platinum demand next year, according to WPIC figures. (Source: Reuters)

|

|

|||||

LME Aluminum |

|||||

|

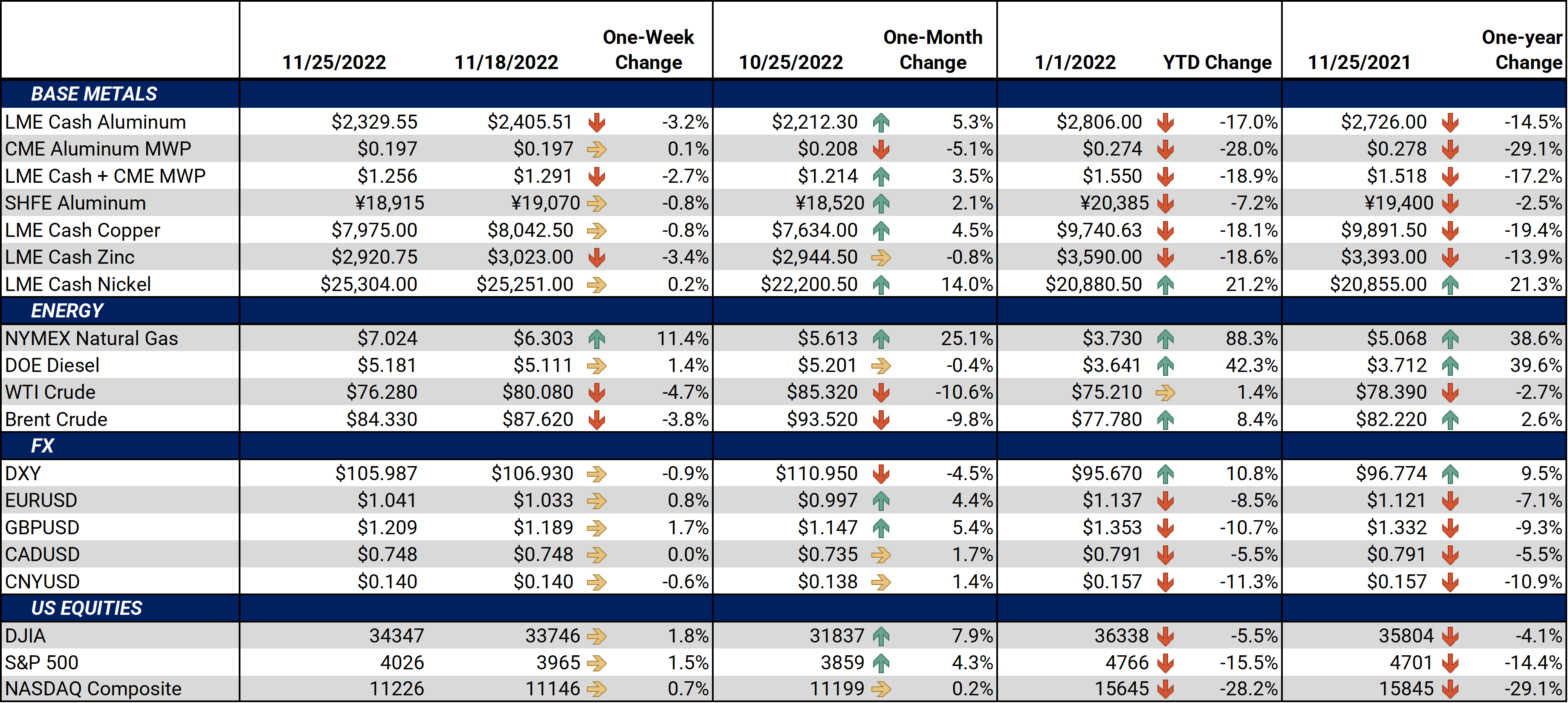

LME Aluminum 3M settled at $2,362.50/mt, down $67.50/mt on the week. Aluminum prices were down this week. Compared to last Friday, the forward curve has shifted vertically lower by $70/mt; however, its shape remains the same. It remains in contango, meaning that nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. End-users might consider strategies that use only swaps or options or a combination of both, depending on risk tolerance. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 19.7¢/lb this week. The CME Midwest Premium market is in contango from the prompt month contract (November) through January 2024. Prices are flat throughout the remainder of 2024. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using strategically placed limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only.* |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,008.00/mt, down $68.00/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted lower by about $70/mt. Prices are very flat throughout the curve. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $25,416/mt, up $31/mt on the week. Nickel prices slightly rallied this week, but the forward curve is little changed. It remains in contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last settled at $656/T, down $7/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

11/17/2022: Do Chinese Aluminum Import and Export Flows Affect LME Prices? 11/16/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 11/07/2022: AEGIS Primer on LME Aluminum Price History 10/05/2022: European Aluminum Smelters Might Have Negative Margins Through 2023 |

|||||

Notable News |

|||||

|

11/25/2022: Truckers' strike cripples shipments in cement, steel industries 11/24/2022: South Korea truckers strike again with auto, battery supply chains at risk 11/24/2022: South Korean truck drivers start indefinite strike 11/21/2022: Alcoa backs Rusal's call for LME to reveal origin of all metal stocks 11/21/2022: Platinum deficit expected in 2023 after bumper surpluses, WPIC says 11/21/2022: North American auto losses deepen 11/21/2022: Large rail union SMART-TD votes to reject labor deal as national strike moves closer 11/18/2022: Rio to pursue Turquoise bid after ending talks with minority shareholders 11/18/2022: Indonesia faces difficult task to create OPEC-like group for nickel 11/17/2022: Canada 'very unlikely' to join OPEC-like group for nickel -gov't source |

|||||