|

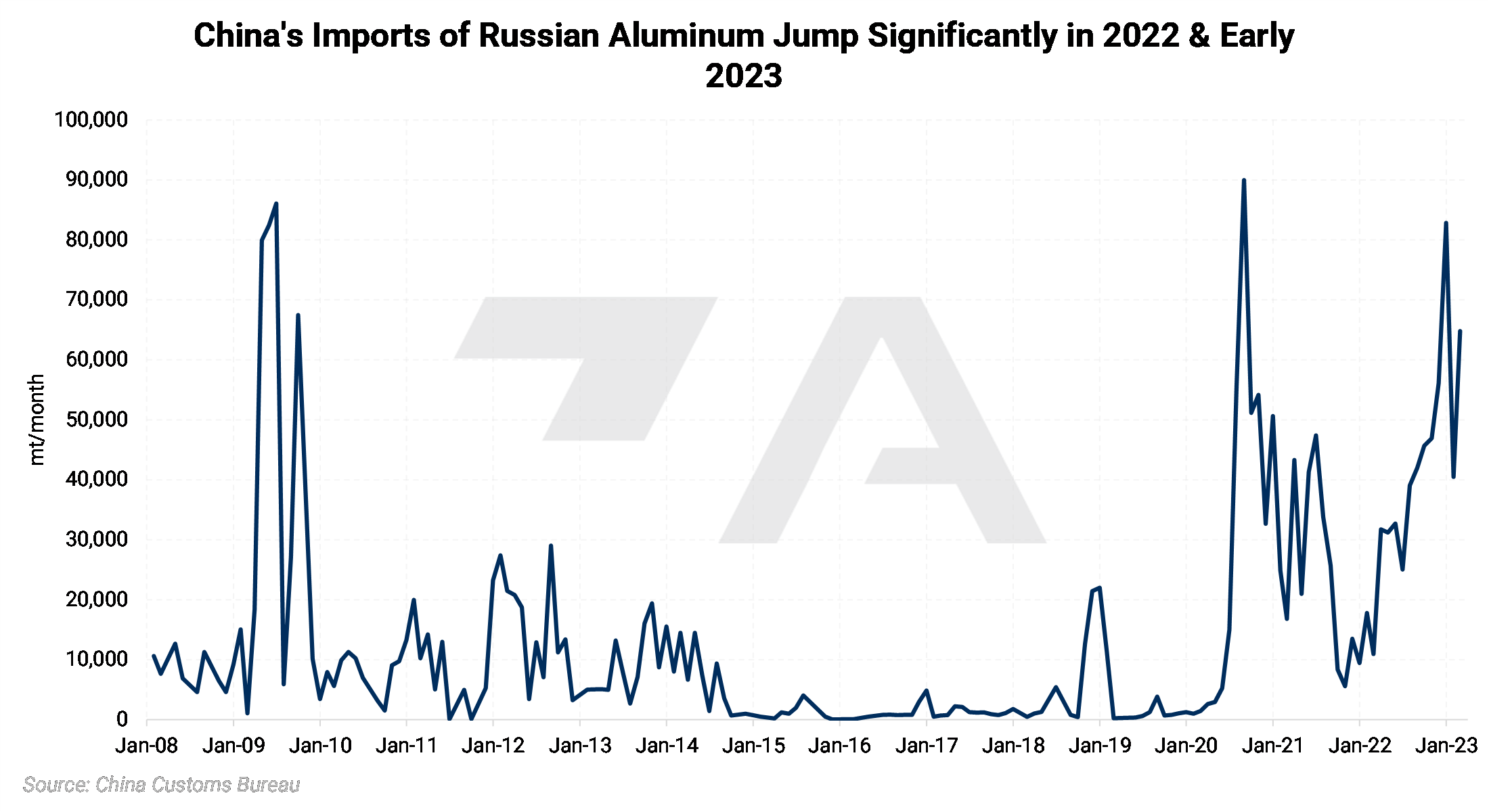

Aluminum China imported 538,000 mt of Russian aluminum between March 2022 and February 2023, up 94% compared to the previous 12 months, according to Chinese customs data. This surge in import volumes could put a “floor” underneath Russian production, according to Capital Economics. Rusal, which is Russia’s top aluminum producer and one of the world’s largest, produced 3.84 million mt in 2022, up about 2% from 2021. AEGIS has been following Russian aluminum export flows in recent months, and we note that some trading houses have broken ties with Rusal, while others are pursuing opportunities. According to Bloomberg, Trafigura is in talks with Rusal to purchase 150,000 mt/yr on a delivered-China basis, while Glencore will end its relationship with Rusal next year. Please contact AEGIS for further discussion on the potential market impact of these evolving relationships and import flows, as well as LME aluminum hedging strategies.

|

|

Copper

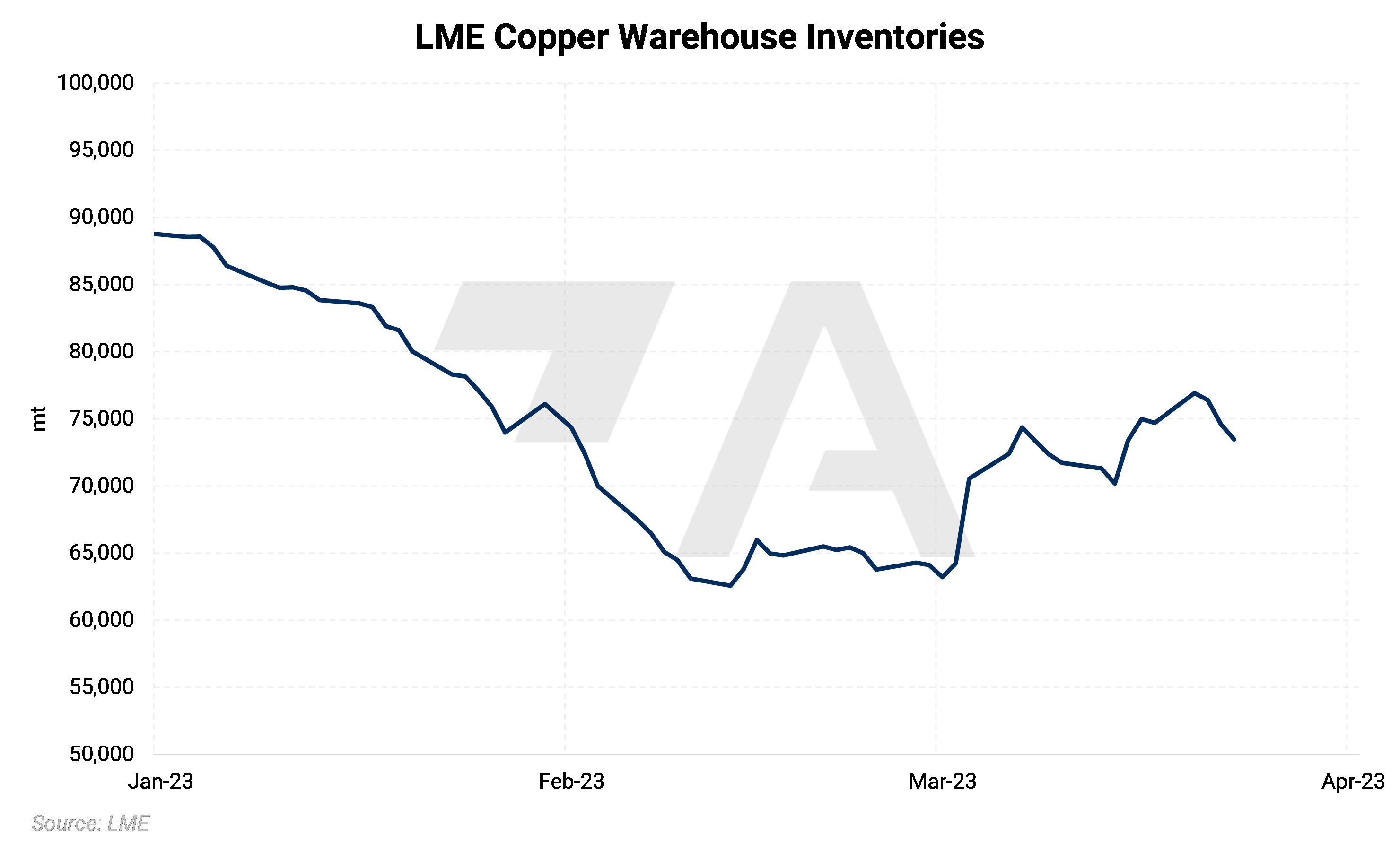

China’s daily refined copper output hit a record 32,966 mt in January and February, according to government data. Total production was 1.945 million mt, up 10.6% compared to the same period in 2022. While reporting these figures, Bloomberg suggested that this jump in copper output comes while Chinese demand appears to have stalled. This is the second time in as many weeks that Bloomberg has suggested that China’s copper demand has slowed due to a weakening economy. Earlier this month, Bloomberg reported that at least four Chinese smelters will deliver 23,000 to 45,000 mt of copper into Asian LME warehouses “in the coming weeks” due to falling domestic demand. AEGIS notes these deliveries likely haven’t occurred yet, as total LME stocks are nearly unchanged since these earlier reports. If you are worried about the potential impact that falling Chinese demand could have on the global copper market, please contact AEGIS for strategies.

|

Will global copper supply outpace demand this year? Bloomberg Intelligence expects a global copper market surplus of 91,000 mt this year, compared with a deficit of 106,000 mt in 2022. The supply surplus could more than quadruple to 369,000 mt in 2024, even if developed market regions avoid a recession. If those regions enter a recession, the supply surplus could reach almost 400,000 mt this year. AEGIS notes in both of Bloomberg’s “best” and “worst” case scenarios, supply will continue to grow and ultimately outpace demand. Under normal market conditions, a copper surplus would likely put downward pressure on futures prices. Please contact us for strategies that involve LME or CME swaps or options.

Steel

Argus’s weekly domestic HRC assessment was unchanged this week at $1,150/st, breaking the streak of six consecutive weekly rises. Mills are reporting sales at $1,150/st, while others such as Cleveland-Cliffs and Nucor are targeting $1,200/st. No sales have been reported at $1,200/st, however. Buyers are now telling Argus that they are cautious about new purchases, fearing that prices could drop in 2H2023. AEGIS notes this cautiousness from buyers could stem from the strength and speed at which the nearly 40% rally in the prompt month (March) CME HRC futures has occurred in the past two months. It appears that buyers are looking for prices to level off or drop before placing more orders with steel mills. We also note that the futures forward curve for 2023 has shifted lower by approximately $50/st compared to last Friday, but remains elevated compared to late February. Please contact AEGIS for prudent hedging strategies on your steel consumption or production.

We also note that this skepticism about HRC prices could also stem from increasing production levels. US Steel said last Thursday it has reopened its 1.5 million st/yr furnace in Gary, IN, due to improved demand. This furnace had been idled since September 2022 due to poor steel prices and high import volumes. The company reopened the 1.4 million/yr furnace at Mon Valley Works in Pennsylvania in February. AEGIS notes that most American steel producers have more than doubled their base price for physical sales to $1,100/st or higher compared to late last fall due to an uptick in demand. This in turn has led to a significant rally in CME HRC futures. Most of the rally in CME HRC has occurred towards the front end of the futures forward curve, leading to a severely backwardated market. We do note that production capacity has been increasing since early January while prices have been rising due to increasing demand. Please contact AEGIS on how steel consumers should hedge in a severely backwardated market.

|

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,337/mt, up $63/mt on the week. Aluminum prices were up this week. This has caused the forward curve to shift vertically higher by approximately $60/mt. It remains in contango, meaning that nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. End-users might consider strategies that use only swaps or options or a combination of both, depending on risk tolerance. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 28.1¢/lb this week. The CME Midwest Premium market is backwardated through April 2023 but then becomes largely flat for the remainder of this year. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,921.50/mt, up $341.50/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted higher by about $340/mt. The forward curve is now relatively flat throughout 2023 but becomes backwardated in 2024 and beyond. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $23,468/mt, up $104/mt on the week. As prices were up this week, nickel’s forward curve has also shifted vertically higher, by about $100/mt. It remains in contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last settled at $1,056/T, up $1/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

03/22/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 03/14/2023: Why Are Steel Prices Increasing? 02/24/2023: European Aluminum Smelters Improve, But Not Enough To Entice More Production 02/07/2023: Will Aluminum's Rally Continue? |

|||||

Notable News |

|||||

|

3/23/23: Chinese lithium price dives in heated auto price war 3/22/2023: Fed hikes key rate, sees tighter credit 3/21/2023: US HRC: Prices flat, buyers grow skeptical 3/21/2023: Goldman Sachs expects commodities supercycle 3/20/2023: Credit Suisse buyout, bank measures aim to stem crisis 3/17/2023: Battery industry cautiously welcomes new EU legislation |

|||||