|

LME Market Structure Changes The LME will soon reduce the daily trading price limits on its copper and aluminum contracts to 12%, down from the current 15%, the exchange stated on Thursday. Price limits are the maximum limit (usually measured as a percentage) that a futures contract can move up or down in a trading session. These price limits were initially a temporary measure due to the extreme price volatility seen in March 2022. The LME has now decided to permanently implement these new price limits on aluminum and copper, along with the current 15% band on all other LME metals, by the end of 2Q2023.

|

To add liquidity to the nickel contract, the LME stated they will help “fast-track” the listing of new LME nickel brands and waive fees for these new brands. These new nickel adaptations come after the LME reinstated nickel trading during Asian hours earlier this month. The LME also stated that they, along with its affiliate Qianhai Mercantile Exchange, will soon develop spot nickel sulphate and matte markets in China. AEGIS notes that new trading bands for copper and aluminum should not materially impact how end-users hedge on a daily or monthly basis. If you have any questions on these new LME changes or need a copy of the press release, please reach out to AEGIS.

Steel

Global steel demand is at an all-time high, according to Swedish steel producer SSAB. This stellar demand mainly comes from the defense and infrastructure industries. Steel supply has become strained in the last 12 months, mainly because Russia and Ukraine have been shut out of the world market. Steelmaking capacity has stagnated, and gone down in some regions, SSAB also stated. Some analysts are also revamping their outlooks on steel demand and specific companies. Earlier this week, UBS stated that ArcelorMittal might have the “wind in its sails as steel-market conditions improve.” Elaborating further, UBS also stated, “We expect positive earnings momentum in 1Q, 2Q driven by improving prices, volumes, and lower energy costs.”

Many analysts had predicted that elevated energy costs, high interest rates, and China’s COVID policy would weigh on steel demand; however, steel prices in the US and Europe have soared in recent months as buyers have replenished inventories. All the factors that both SSAB and UBS outlined are generally bullish for steel prices. If you are a steel end-user who is concerned about rising prices, please contact AEGIS for strategies on CME HRC Steel.

Metals & Energy Transition

Declining ore grades in both copper and lithium, as well as a lack of investment, could slow the energy transition and lead to higher metals prices, analysts stated at an industry conference last week. Ore grades in existing copper and lithium mines have decreased significantly in recent years, and new mines are also yielding less than expected. Ore grade is defined as the concentration of an element (such as copper) in a potentially mineable ore deposit. A myriad of recent geopolitical and economic issues, including the pandemic, the Russia-Ukraine conflict, inflation, the US-China trade war, and a poor Chinese real-estate market have made investors leery about investing new capital into mining and other projects. Recycling can partially fix the looming gap between supply and demand; however, it likely won’t occur on a large enough scale until after peak battery consumption, which could be 10 to 20 years away, the analysts stated. These comments were made at the First Critical Metals and Minerals Conference in London last week. AEGIS is very adept at developing hedging strategies in all “mature” metals markets such as copper that will be required in the energy transition. As for newer markets such as cobalt and lithium, AEGIS can also help you with developing and implementing, but we do warn that these newer markets can be illiquid. Please contact us for further details and hedging ideas.

Aluminum

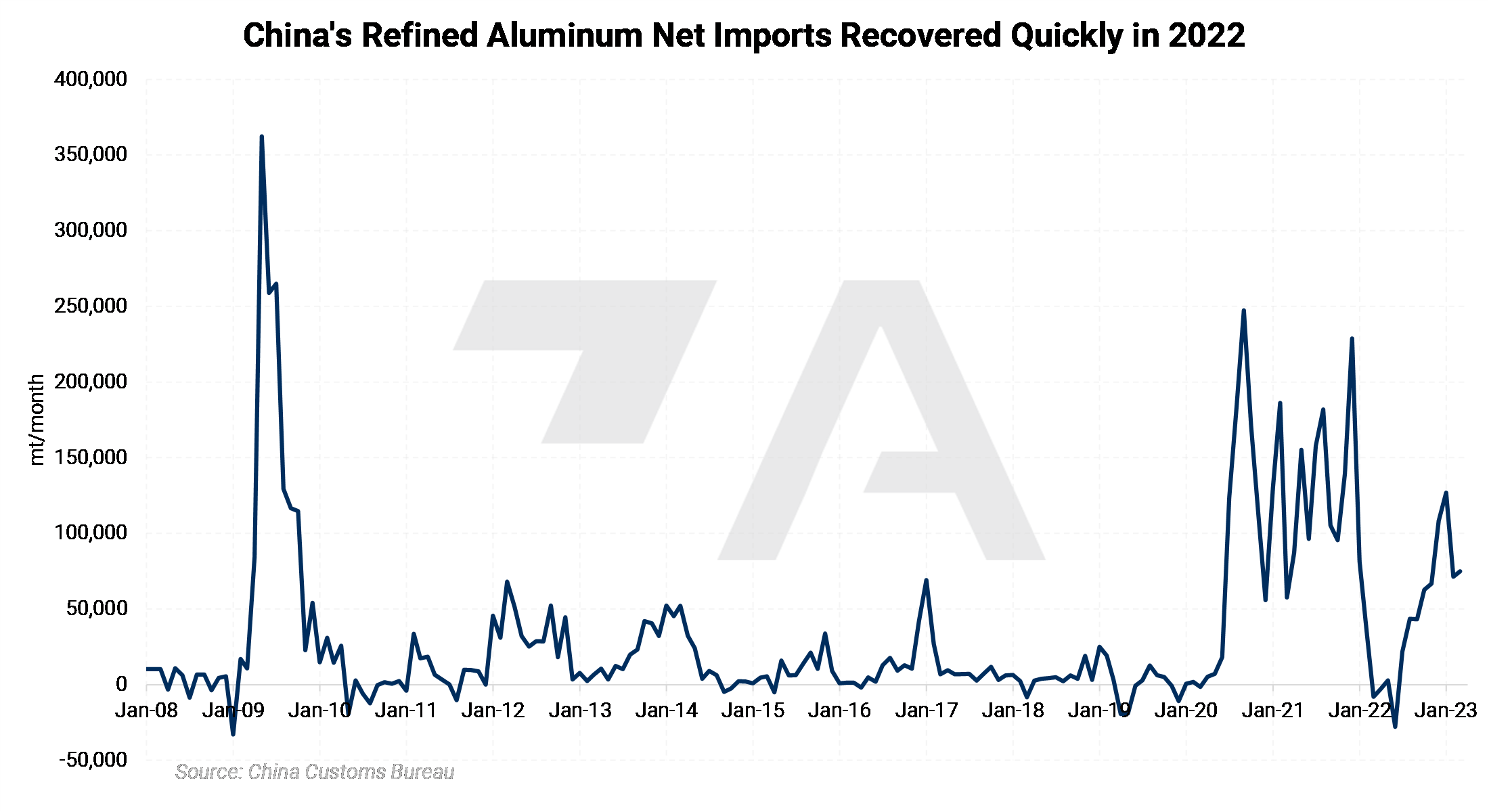

China imported a net 146,299 mt of primary aluminum in January & February, up nearly 120,000 mt, compared to the same period last year. SMM believes that China will import approximately 50,000 to 60,000 mt of Russian primary aluminum this year. So far this year, 105,300 mt, or 52,650 mt on average per month, of Russian primary aluminum has flowed into China. China’s annual aluminum smelter capacity has recovered to 40.2 million mt, up over 300,000 compared to March 1, according to SMM. This is mainly due to previously curtailed production in Guizhou and Sichuan provinces being brought back online. LME Aluminum prices are nearly flat for the year. AEGIS notes that China’s dependence on imports could be supportive of global prices. Please contact us for further thoughts on China’s production and imports, as well as hedging implications.

|

|

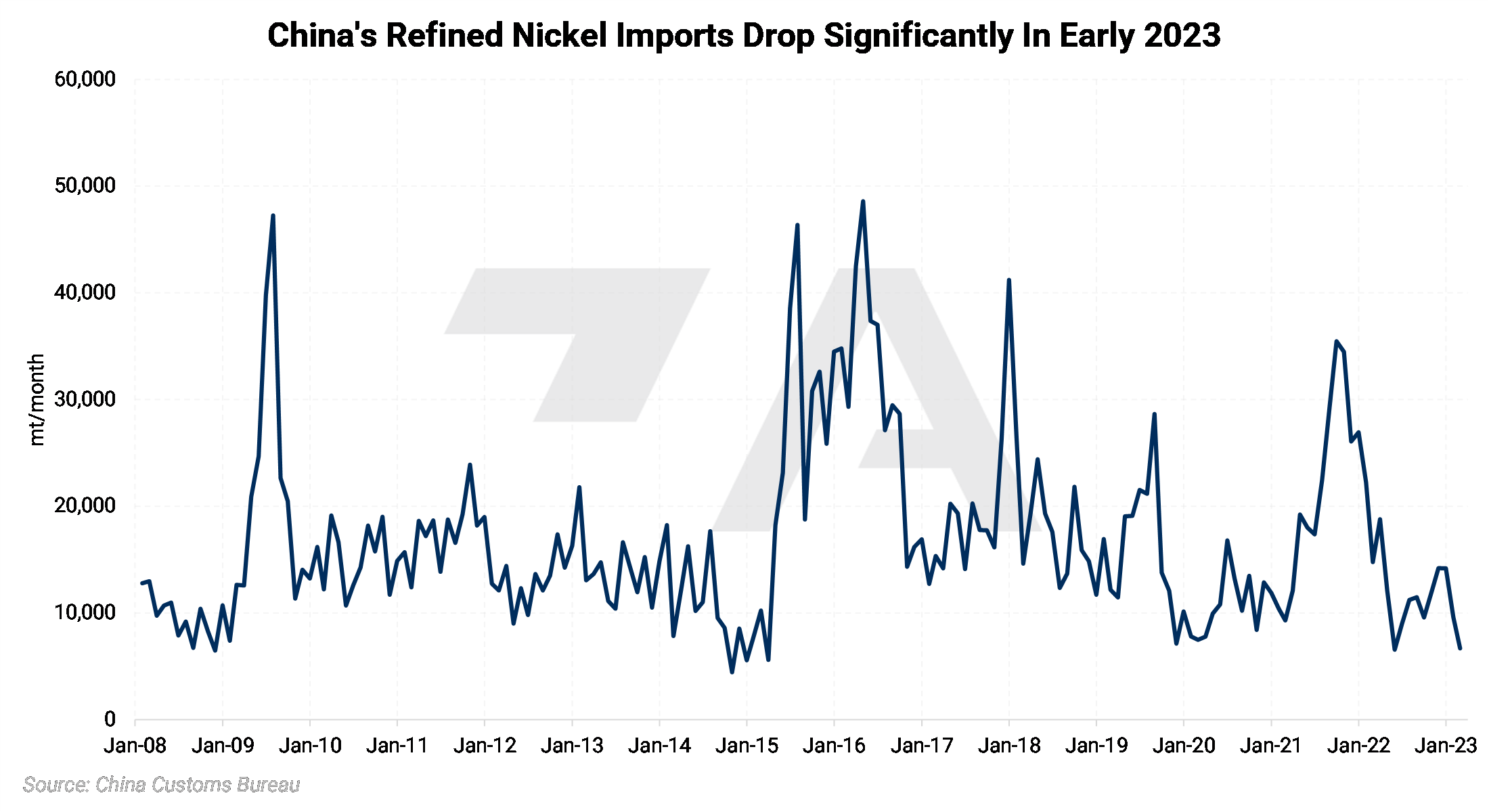

Nickel According to researcher Mysteel, China’s refined nickel production could hit 245,900 mt this year, up 39% compared to 2022. This is due in part to a large increase in raw materials from Indonesia. At 174,100 mt, China was responsible for approximately 64% of global refined nickel output last year, based on SMM & Mysteel data. China imported a mere 6,679 mt of refined nickel in February, the lowest amount since May 2022, according to customs data. Nickel has been one of the worst-performing LME metals in 2023, with prices down about 21% on the year. AEGIS notes that nickel trading volumes have shrunk significantly in the past year. Nickel prices have also been extremely volatile in the past 12 months, due in part to this decline in trading activity. If you are a nickel end-user (such as a stainless-steel producer), please contact AEGIS on how to hedge and navigate the volatile nickel market. |

|

|

|

|

|

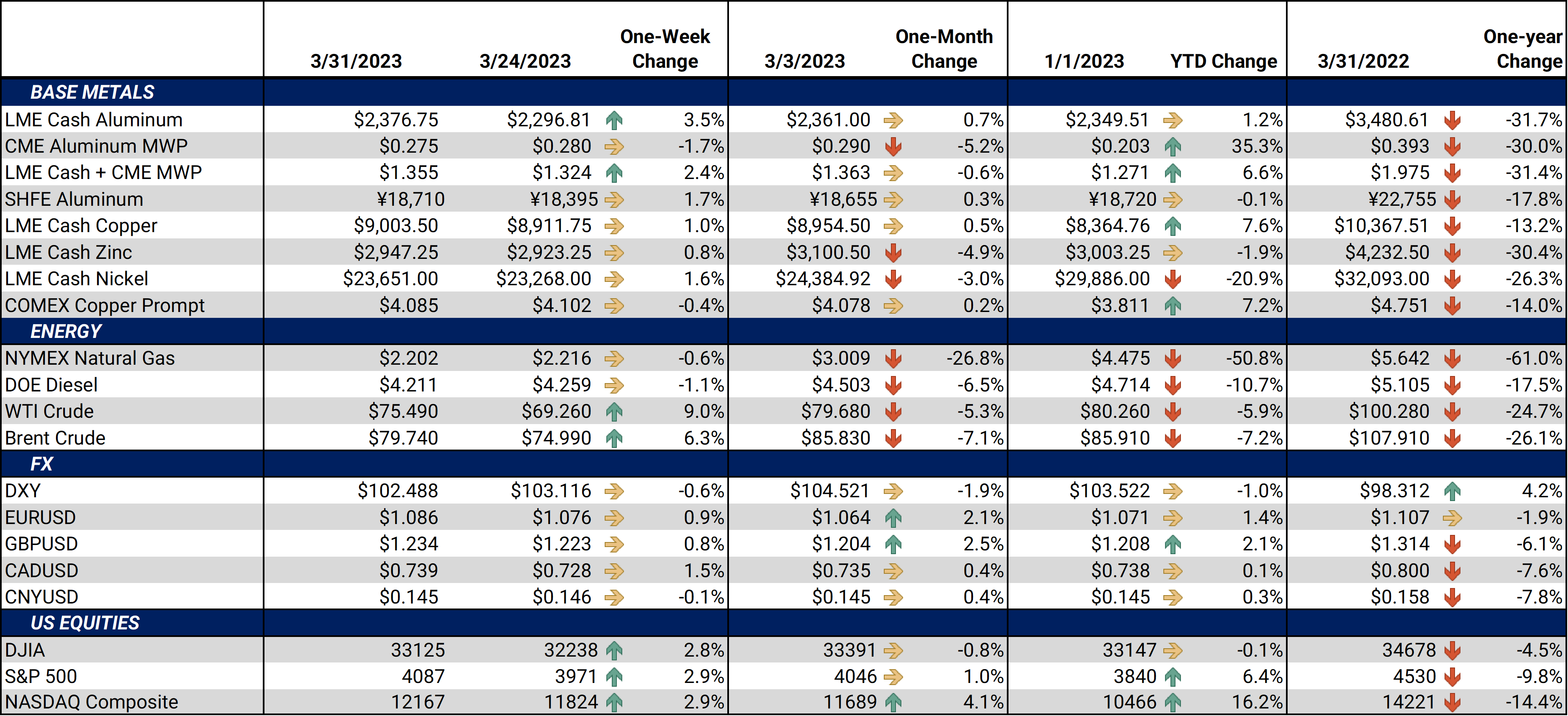

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,413/mt, up $76/mt on the week. Aluminum prices were up this week. This has caused the forward curve to shift vertically higher by approximately $80/mt. It remains in contango, meaning that nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. End-users might consider strategies that use only swaps or options or a combination of both, depending on risk tolerance. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 27.5¢/lb this week. The CME Midwest Premium market is backwardated through April 2023 but then becomes largely flat for the remainder of this year. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,993/mt, up $71.50/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted higher by about $70/mt. The forward curve is now relatively flat throughout 2023 but becomes backwardated in 2024 and beyond. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $23,838/mt, up $370/mt on the week. As prices were up this week, nickel’s forward curve has also shifted vertically higher, by about $350/mt. It remains in contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last settled at $1,153/T, down $44/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

03/29/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 03/14/2023: Why Are Steel Prices Increasing? 02/24/2023: European Aluminum Smelters Improve, But Not Enough To Entice More Production 02/07/2023: Will Aluminum's Rally Continue? |

|||||

Notable News |

|||||

|

3/30/2023: Mercedes-Benz is "able and willing" to invest capital in mining - CEO 3/30/2023: LME's nickel crisis: major developments since chaotic trading halt 3/30/2023: LME Group announces plan to strengthen its markets 3/30/2023: LME launches sweeping plan to revive nickel contract 3/29/2023: Column: Tin's bull flames doused by weak electronic goods demand 3/27/2023: SMM Analysis of Short-Term Aluminium Market Fundamentals 3/27/2023: U.S. Supreme Court turns away challenge to Trump's tariffs on steel imports |

|||||