|

*Please note that the LME will be closed on Monday, April 10. However, the trading desk will provide CME coverage, and current clients can contact metals@aegis-hedging.com for indications. * Automakers and Metals Investments To solidify its nickel supply chain for EV production, Ford is investing in the Pomalaa Block HPAL nickel production plant in Indonesia, the company announced on Wednesday. The plant is set to open in 2026 and aims to produce 120,000 mt of nickel mixed hydroxide precipitate (MHP) per year. This investment is part of a larger push that Ford is making into EV production over the next several years. The company plans to produce more than 2 million EVs by the end of 2026, up from the 600,000 they expect to produce this year. By 2030, Ford hopes to have EVs represent 50% of its global sales.

|

AEGIS notes this investment will likely not have a material impact on LME nickel prices. We do point out that this is part of a growing trend of automakers investing in mining or other metal supply projects. However, as Goldman Sachs recently proclaimed about these and similar investments, “car companies will be better off sticking to their core competencies and reducing their exposure to commodity price swings through hedging.” If you are a major end-user of EV-related metals such as nickel, copper, cobalt, and aluminum, please contact AEGIS to discuss hedging strategies.

OPEC and Metals Prices/Demand

OPEC’s recent oil production cuts have renewed fears that inflation could begin to rise again. One widely watched inflation measure, the US Consumer Price Index (CPI), has been falling since last summer. Rising inflation could force central banks, including the US Federal Reserve, to further hike interest rates, several analysts interviewed by Reuters stated earlier this week. Higher interest rates could lead to a rising US dollar, which is generally bearish to commodities. Rising oil prices could make it harder to avoid a slowdown that would hamper demand for industrial commodities, as Bloomberg suggested yesterday.

If OPEC’s recently announced oil production cuts do hold down aluminum demand, aluminum prices could stay “rangebound,” according to Shanghai Metals Market. AEGIS notes that LME aluminum initially had a bearish reaction to the OPEC news and its potential economic impact, as aluminum prices fell on both Monday and Tuesday. We do note, however, that if oil prices continue to rise, this could put upward pressure on metals prices, due to higher production and transportation costs. For further discussion on how to hedge your metals production and fuel costs, please reach out to AEGIS.

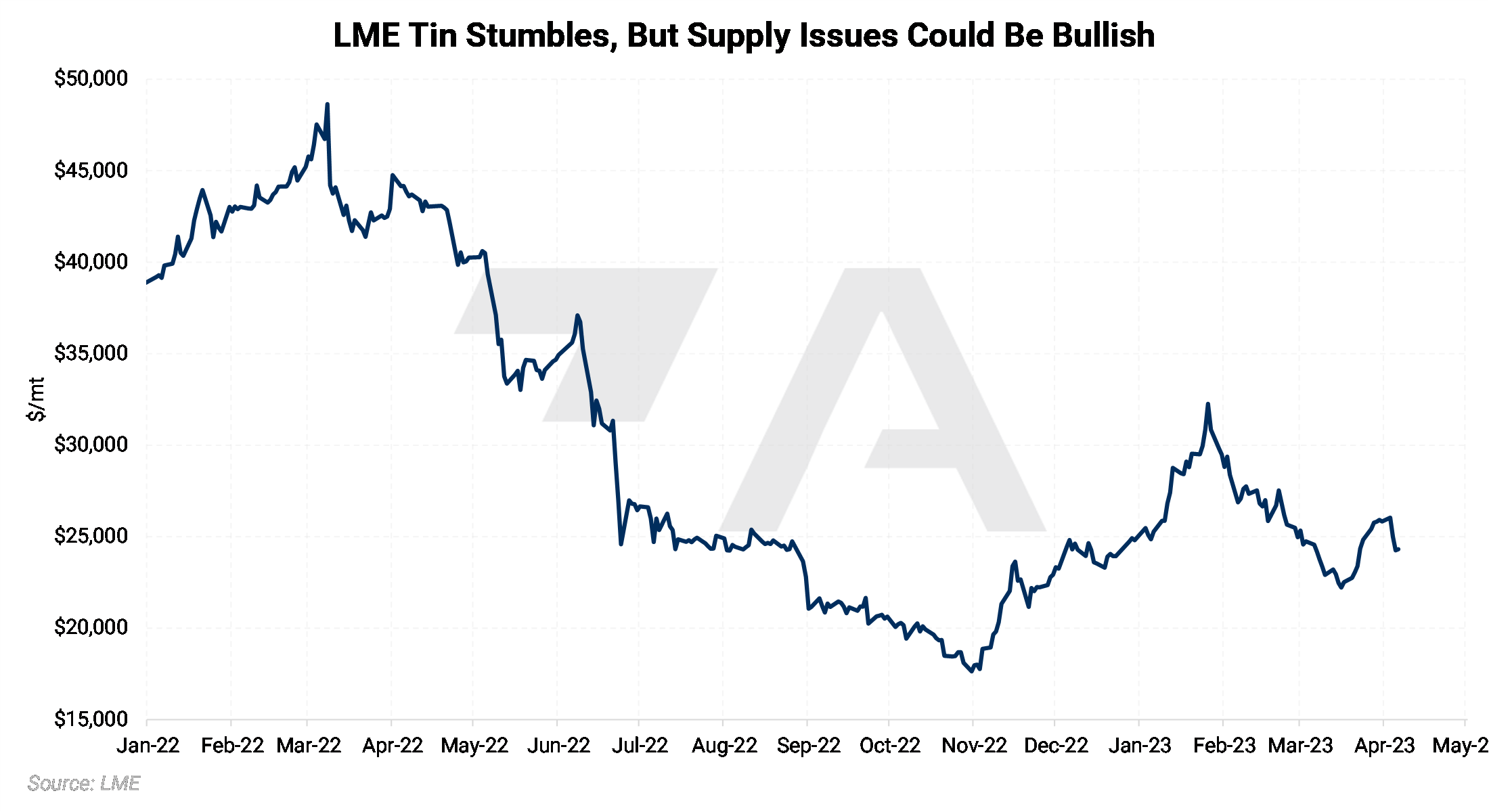

Tin

Tin’s importance as a “technology” metal has been understated for many years, leading to little investment in new mines, according to the International Tin Association (ITA). Based on the ITA’s estimates, the world will need at least 50,000 mt more tin per year due to the “technology surge” that will occur by 2030. This is mainly due to an expected ramp-up in demand from the EV and solar technology sectors. This expected ramp-up in demand will require over $1 billion in investment in new mines and mining-related technology. In the past 20 years, only a “handful” of new tin mines have been brought online. Due to higher tin prices and improving technologies over recent years, existing and abandoned mines will be likely reassessed for further development. Soaring demand and prices for certain tin mining byproducts (such as lithium) could also make some existing or abandoned mines more economically feasible. AEGIS notes that aside from during the pandemic global tin production has grown steadily over the past 10 years, as 230,000 mt was mined in 2013, compared with 310,000 mt in 2022, according to the USGS. However, this development pace is nearly 5x behind the ITA’s expected ramp-up in demand over the coming years.

|

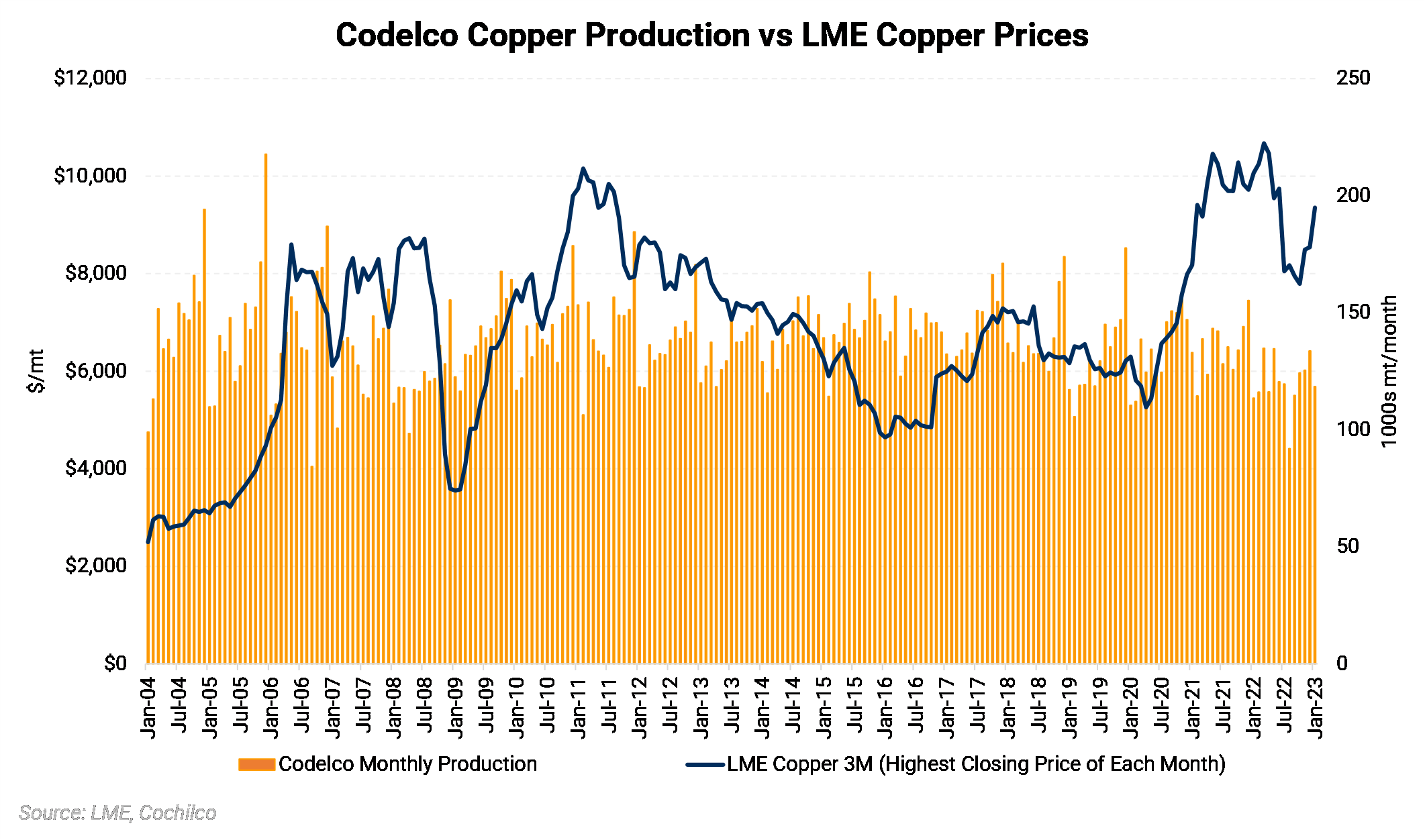

Copper

Codelco, which is Chile’s state-owned copper miner and the world’s largest supplier, estimates that it will produce 1.35 to 1.42 million mt this year, down from 1.45 million mt in 2022. The company blames declining ore grades and operational setbacks for the subpar projections. (Ore grade is defined as the concentration of an element (such as copper) in a potentially mineable ore deposit.) This expected decline follows an 11% drop in production in 2022 due to project delays, equipment problems, a rockfall, and a dam freeze. Despite the expected drop in production, Codelco predicts that copper will trade between $3.50/lb to $4.40/lb, compared to $4.08 currently. AEGIS notes that declining ore grades have become a serious issue in recent years. Chile’s average ore grade was 0.63% in 2021 (the most recent data available), down nearly 32% from the 0.93% average ore grade in 2005. We also note this could be supportive of LME Copper prices in the coming years, especially during the “energy transition.” Please contact AEGIS for hedging strategies and further discussion on LME copper.

|

|

|

|

|

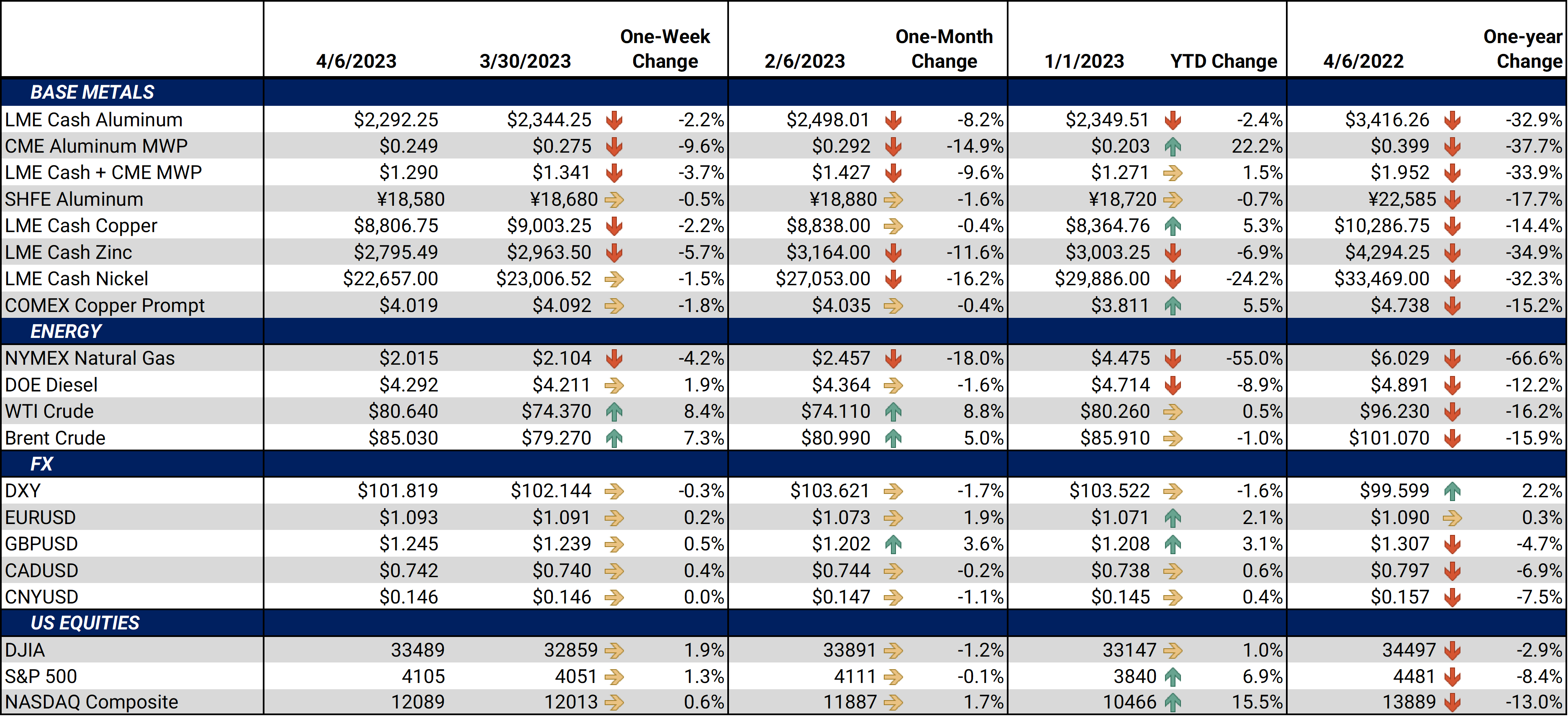

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,333.50/mt, down $46.50/mt on the week. Aluminum prices were down this week. This has caused the forward curve to shift vertically lower by approximately $50/mt. It remains in contango, meaning that nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. End-users might consider strategies that use only swaps or options or a combination of both, depending on risk tolerance. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 24.9¢/lb this week. The CME Midwest Premium market is backwardated through May 2023 but then becomes largely flat for the remainder of this year. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,800/mt, down $202.5/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted lower by about $200/mt. The forward curve is now relatively flat throughout 2023 but becomes backwardated in 2024 and beyond. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $22,800/mt, down $943.50/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower, by about $950/mt. It remains in contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last settled at $1,166/T, up $2/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

04/04/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 03/14/2023: Why Are Steel Prices Increasing? 02/24/2023: European Aluminum Smelters Improve, But Not Enough To Entice More Production 02/07/2023: Will Aluminum's Rally Continue? |

|||||

Notable News |

|||||

|

4/3/2023: Why did OPEC cut oil production? Key reasons explained 4/3/2023: Simmering Macro Uncertainty to Keep Aluminium Prices Rangebound 4/3/2023: Cliffs raises HRC to $1,300/st 4/3/2023: Factbox: Automakers accelerate drive to secure battery raw materials 4/3/2023: Germany's Speira more than doubles aluminium recycling capacity |

|||||