|

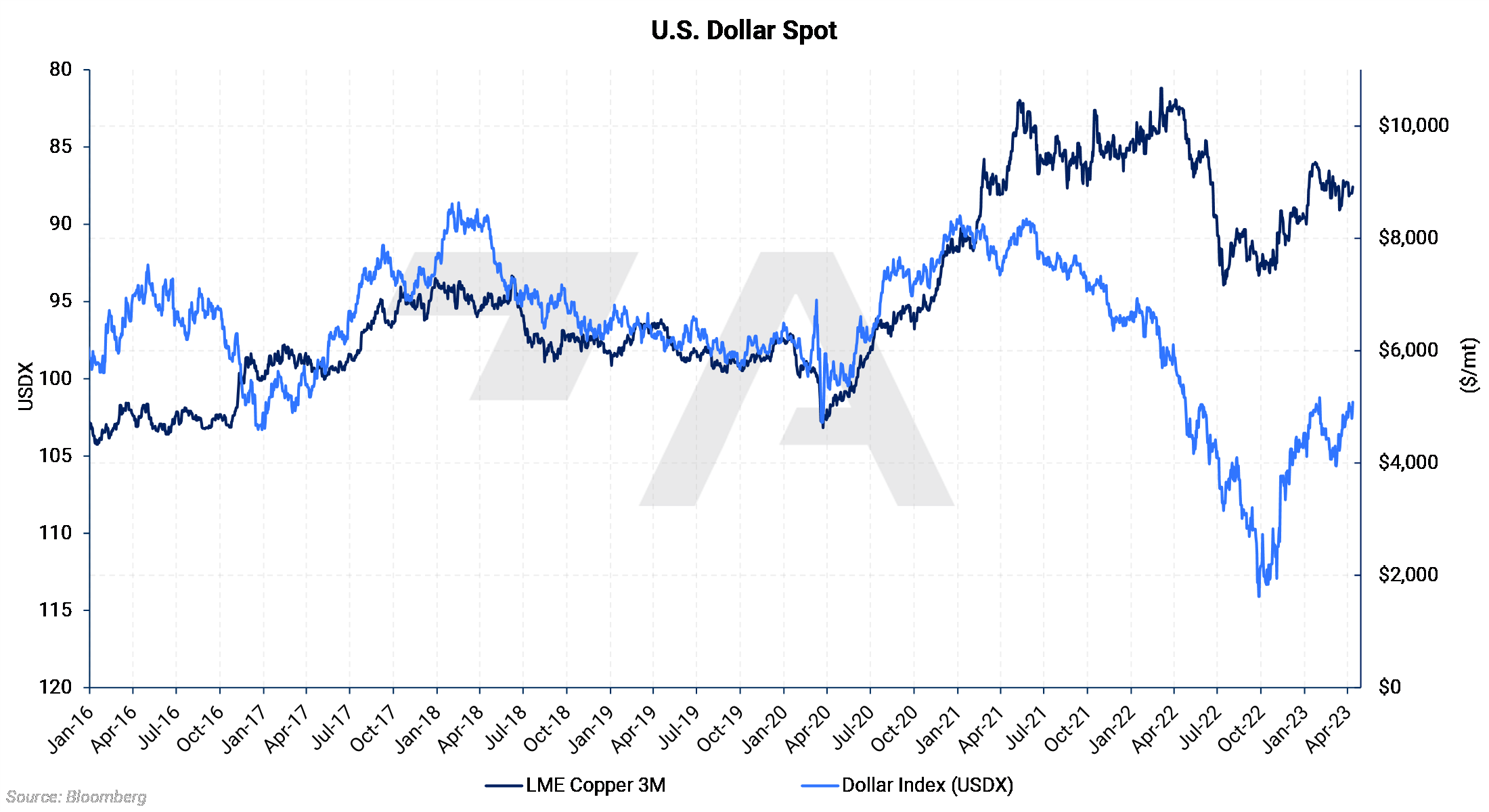

Copper Prices for commodities such as copper usually rise if the US Dollar (USD) falls. This is because dollar-denominated commodities such as copper become cheaper for foreign buyers if the USD falls. This relationship has held true this year, with the USD dipping about 2.2% and LME Copper 3M price rallying approximately 7.7%. One Bloomberg analyst suggests that the USD could rally this year if the Federal Reserve continues to hike interest rates. This could ultimately weigh on copper prices. A rising USD could weigh on prices for other LME metals such as aluminum, zinc, and nickel. If you think that falling commodity prices could adversely affect your bottom line, please contact AEGIS for hedging strategies.

|

|

China’s refined copper production hit 951,400 mt in March, up 4.8% compared to February, according to a Shanghai Metal Market survey. Shanghai Metal Market predicts that output could reach 953,900 mt in April but could fall in May due to scheduled maintenance. Chinese copper production has climbed steadily this year. Late last month Bloomberg suggested China’s rising production comes while Chinese demand remains subpar.

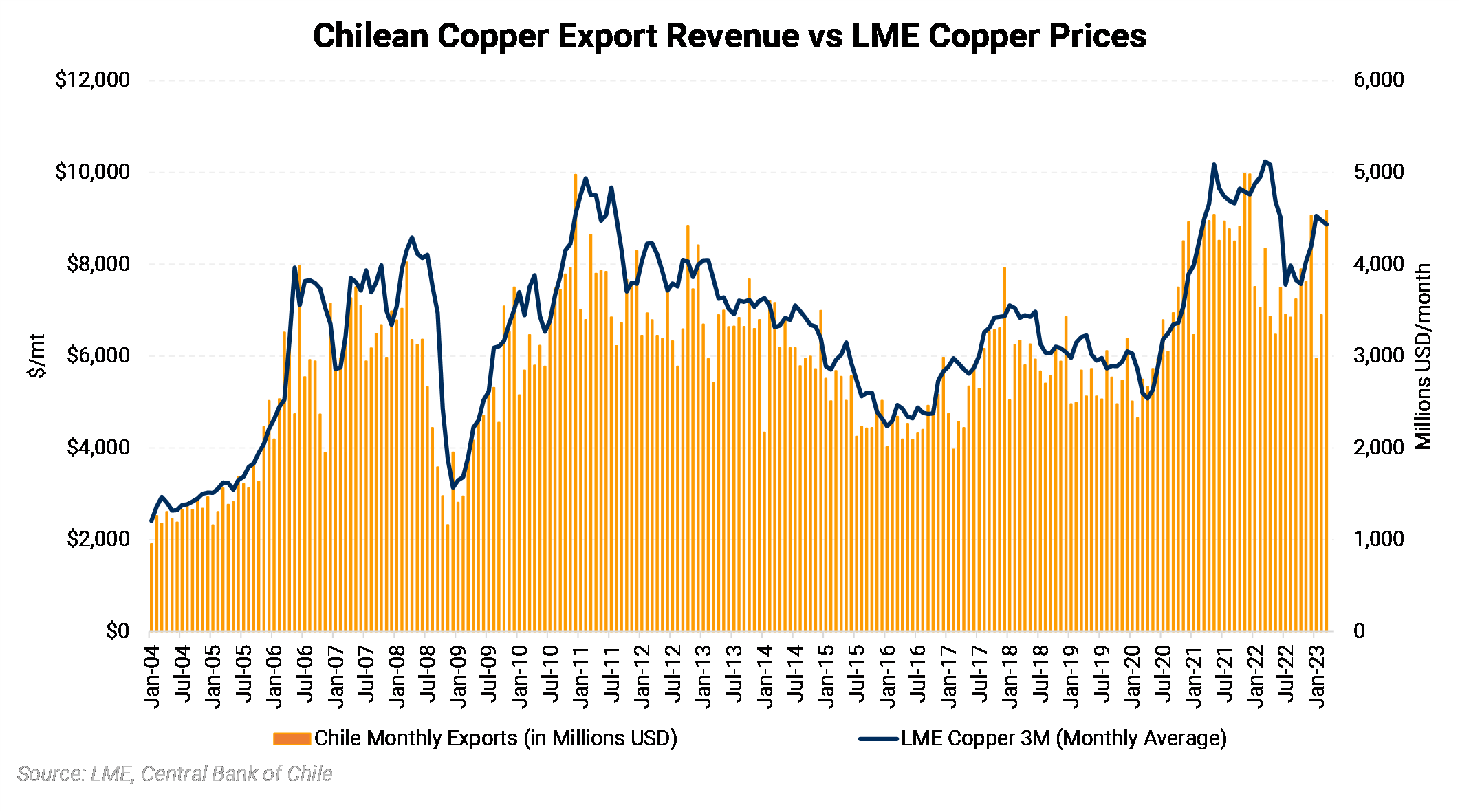

The world’s largest copper producer saw stellar sales last month, despite relatively flat prices. Chile’s copper export revenue hit $4.585 billion in March, the highest revenue figure since December 2021, according to the Chilean Central Bank. Revenue slumped in January and February due to production issues, according to Bloomberg. AEGIS notes that Chilean copper miners continue to be plagued with numerous production issues, including operational setbacks, project delays, and drought-related water restrictions.

LME Copper prices are up about 7.7% so far this year, due in part to the Chilean production issues. If they continue, these production issues could remain bullish for the LME copper market. The average LME 3M Copper price last month was $8,868/mt, up over 17% from the lows of last July. The LME copper forward curve is relatively flat throughout 2023 but becomes quite backwardated in 2024 and beyond. The shape of the forward curve has been persistent throughout 2023, and it could lead to lower production or investment this year or in the coming years. If you are concerned about rising copper prices, please contact AEGIS to discuss and implement specific hedging strategies.

Aluminum

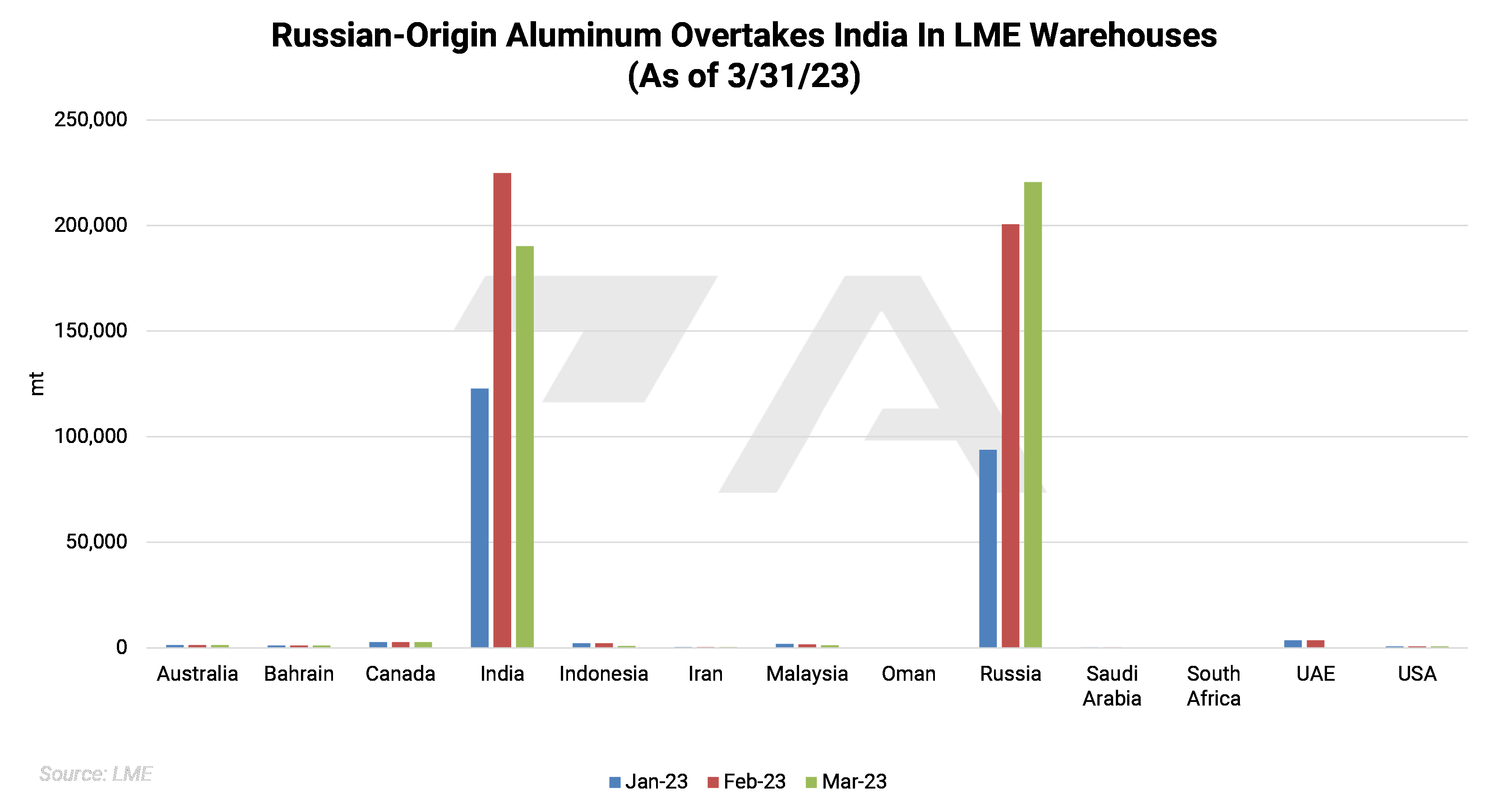

Total LME aluminum stocks fell by 19,950 mt to 419,800 mt in March, according to LME warehouse data released yesterday. AEGIS notes most of this drawdown stems from the 34,625 mt drop in Indian-origin stocks, which now total 190,275 mt. Russian-origin aluminum increased significantly to 220,575 mt, up from 200,600 mt at the end of February. Nearly 98% of LME stocks are of Indian and Russian origin.

The LME aluminum market is in a steep contango, meaning that futures prices are higher compared to nearby prices. The shape of the LME aluminum futures forward curve has been a consistent contango since early January. This encourages traders to "cash and carry" physical inventories, as they can be sold forward at a premium to the spot market. The forward curve has shifted vertically lower by approximately $200/mt since early January as LME 3-month prices have fallen.

|

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,385.50/mt, up $52/mt on the week. Aluminum prices were up this week. This has caused the forward curve to shift vertically higher by approximately $50/mt. It remains in a steep contango, meaning that nearby prices are lower than forward prices. Aluminum consumers that are concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last settled at 25.2¢/lb this week. The CME Midwest Premium market is backwardated through June 2023 but then largely becomes flat for the August through December ’23 contracts. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $9,023.50/mt, up $223.50/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted higher by about $200/mt. The forward curve is now relatively flat throughout 2023 but becomes backwardated in 2024 and beyond. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $24,132/mt, up $1,332/mt on the week. As prices were up this week, nickel’s forward curve has also shifted vertically higher, by about $1,300/mt. It remains in a steep contango, meaning that spot prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last settled at $1,178/T, up $12/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

04/13/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 03/14/2023: Why Are Steel Prices Increasing? 02/24/2023: European Aluminum Smelters Improve, But Not Enough To Entice More Production 02/07/2023: Will Aluminum's Rally Continue? |

|||||

Notable News |

|||||

|

4/13/2023: TRADE REVIEW: Cobalt market eyes subdued Q2 on hydroxide oversupply, dim EV prospects 4/13/2023: Japan's Mitsubishi Corp looks to invest in nickel, lithium projects 4/13/2023: China March copper imports at 408,174 tonnes - customs 4/12/2023: Glencore adds Russian aluminium to LME system, source says 4/11/2023: More than half of aluminium in LME warehouses produced in Russia 4/10/2023: NorthAm auto build outlook rises to 15.6mn 4/10/2023: US steel imports set to extend drop in March 4/10/2023: SMM Analysis of Aluminium Market from Macro and Fundamentals Perspective 4/6/2023: Germany's Stolberg lead smelter reopens after sale to Trafigura |

|||||