|

Aluminum *Our offices will be closed on Monday, June 19 due to the Juneteenth holiday. We will not produce the Metals First Look that morning. The CME is also closed that day; however, our trading desk will provide LME coverage, and current clients can contact metals@aegis-hedging.com for indications. * |

Aluminum

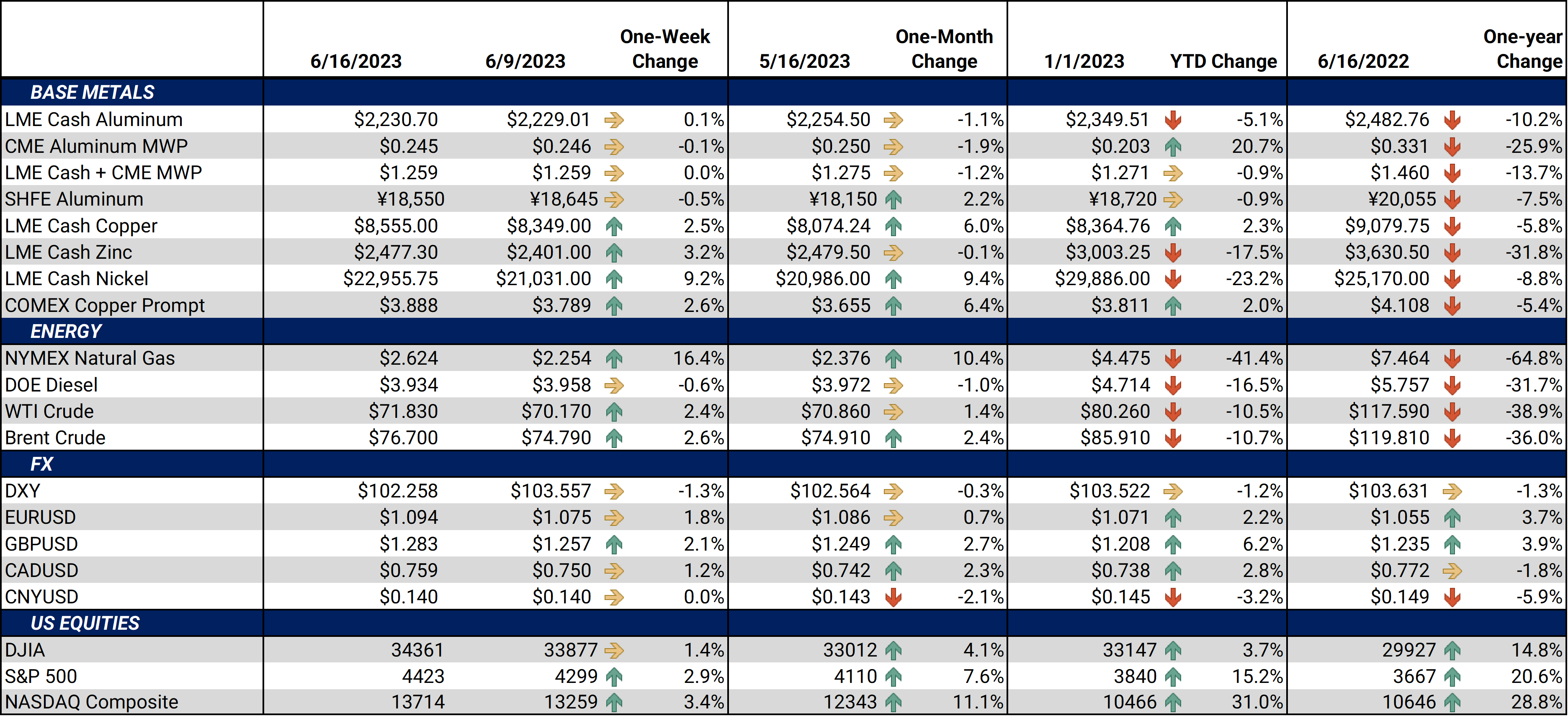

The global aluminum market will remain in surplus due to “tepid” demand, Goldman Sachs stated in a note earlier this week. Russian aluminum is largely barred from Western markets but has been diverted to eager buyers in China, and rest of world demand is “flat” leading to lower import premiums. They also stated that global demand is at the lowest level since the start of the pandemic. (Source: Wall Street Journal)

An ongoing and worsening drought has stymied aluminum production in China’s Yunnan province, and could impact production for the remainder of 2023, BMO stated in a note late last week. During the second half of May, the region received the lowest rainfall amount in over 60 years. Yunnan province is China’s largest primary aluminum smelting region and largely relies upon hydropower for production. (Source: Bloomberg)

Some production is coming back online, however. On Tuesday, government officials in China’s Yunnan province stated that previously curtailed aluminum smelters can restart production later this month, according to Bloomberg and Shanghai Metal Market (SMM). This confirmation follows Shanghai Metal Market’s previously reported rumors from late last week that authorities would soon grant 2 million KW of power to restart curtailed production, but no specific target was given at that time. Of the 2 million mt that has been temporarily shuttered, approximately 1.1 million mt will be restarted, according to SMM. (Sources: Bloomberg, Shanghai Metal Market)

|

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,271/mt, up $3/mt on the week. Aluminum prices were up this week. However, the shape and position of the forward curve is essentially unchanged. It remains in a steep contango, meaning that nearby prices are lower than forward prices. Aluminum consumers that are concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last traded/settled at 24.5¢/lb this week. The CME Midwest Premium market is now quite flat for the August '23 through December ’23 contracts. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,566.5/mt, up $195/mt on the week. Compared to last Friday, LME Copper's forward curve has risen vertically by approximately $200/mt and is now very flat for the remainder of 2023 and throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $23,034/mt, up $1,864/mt on the week. As prices were up this week, nickel’s forward curve has also shifted vertically higher, by about $1,860/mt. It is in a steep contango after the July 2023 contract, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $923/T, down $5/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

06/14/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 05/17/2023: Cobalt End-Users Should Hedge While Market Is Oversupplied 05/3/2023: Copper Producers Can benefit From Hedging Both Inputs and Production |

|||||

Notable News |

|||||

|

6/15/2023: Russia's Rusal to build new alumina plant for $4.8 billion on the Baltic Sea 6/13/2023: US HRC: Prices fall to lowest since mid-Feb 6/13/2023: US HDG/CRC: Mills drop prices for orders 6/13/2023: China's Yunnan set to boost power to aluminium smelters, sources say 6/12/2023: Rio Tinto to invest $1.1 billion to expand aluminum smelter in Canada 6/12/2023: Russian aluminium stocks at LME grow, boosting demand for Indian alternative 6/12/2023: Glencore, automakers to back $1 bln nickel, copper SPAC deal in Brazil |

|||||