|

Aluminum China’s appetite for aluminum imports remains steady as cargoes continue to arrive. Due to poor end-user demand, however, social, or non-exchange inventories of aluminum products keep growing, according to Shanghai Metal Market’s weekly inventory estimates. Meanwhile, China’s domestic production continues to grow, and could also add to inventories. This could weigh on both China’s domestic aluminum and global prices. (Source: Shanghai Metal Market) |

Aluminum smelters in China’s Yunnan Province have restarted previously shuttered output, however, Shanghai Metal Market (SMM) cautions that this uptick could be short-lived. In a note earlier this week, SMM stated “considering the short period of rainy season, the power supply outlook is still full of uncertainty.” Nearly 2 million mt of the province’s aluminum smelting capacity had previously gone offline due to hydropower issues. Of the 2 million mt, about half is scheduled to restart in June, according to previous reports from SMM. (Source: Shanghai Metal Market)

Traders could be pulling Russian aluminum from LME warehouses in South Asia. As of Friday, June 30, the volume of canceled warrants for aluminum, meaning the metal that is set for delivery, from the LME’s South Korean warehouses soared to 60,700 mt, nearly doubling compared to last Friday. This is nearly the highest volume in almost two years, and up from near zero a month ago. The LME’s South Korean warehouses are a known repository for Russian aluminum, according to Bloomberg and Reuters. (Source: Bloomberg, Reuters)

|

|

|

|

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

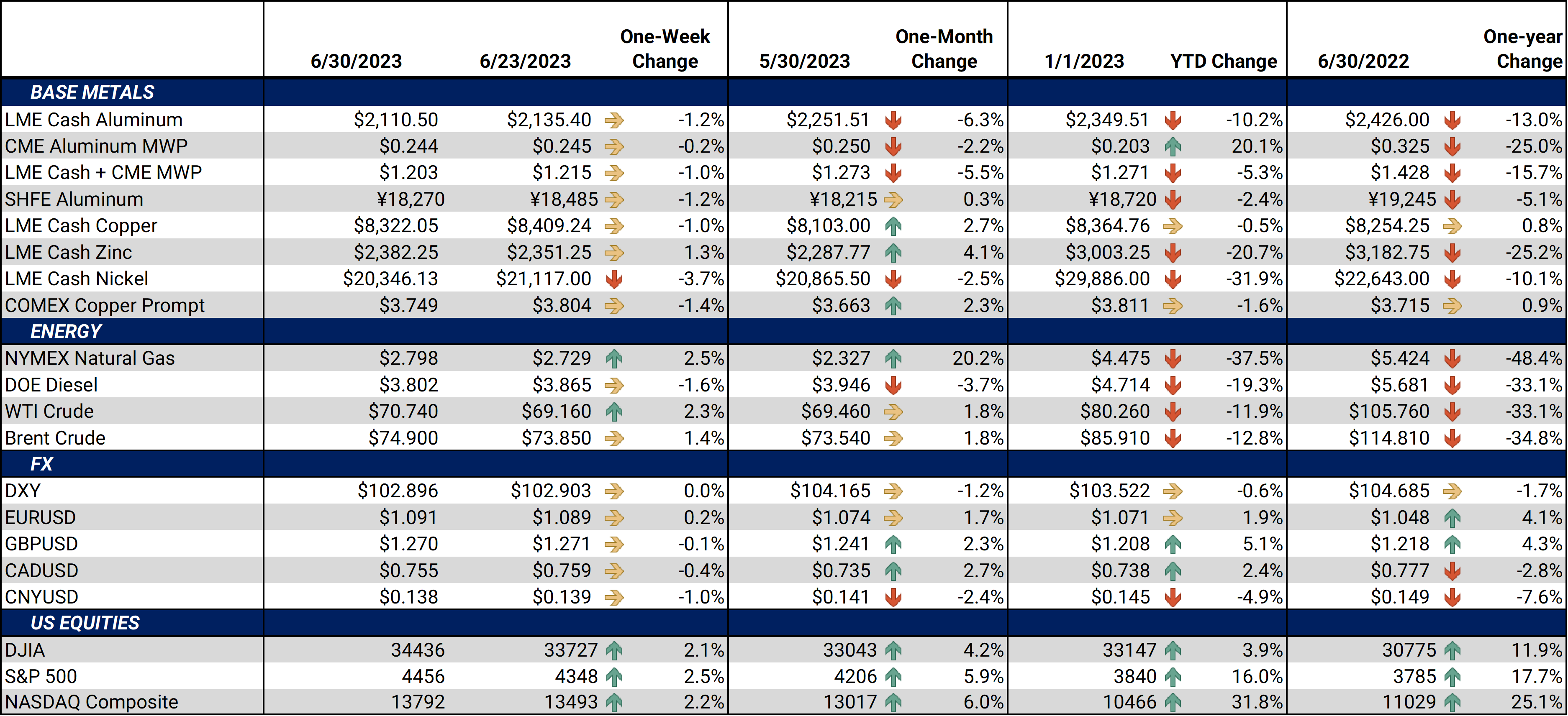

LME Aluminum 3M settled at $2,151.5/mt, down $23/mt on the week. Aluminum prices were down this week. This has caused the futures forward curve to shift vertically lower by approximately $20/mt. It remains in a steep contango, meaning that nearby prices are lower than forward prices. Aluminum consumers that are concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last traded/settled at 24.4¢/lb this week. The CME Midwest Premium market is now flat for the July through December ’23 contracts. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,315.5/mt, down $75/mt on the week. Compared to last Friday, LME Copper's forward curve has fallen vertically by approximately $75/mt and is now very flat for the remainder of 2023 and throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $20,516/mt, down $795/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower, by about $800/mt. It is in a steep contango after the July 2023 contract, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $873/T, down $28/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

06/28/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 06/22/2023: Chinese Metals Imports Could Be the Canary in the Coal Mine for Demand 05/17/2023: Cobalt End-Users Should Hedge While Market Is Oversupplied 05/3/2023: Copper Producers Can benefit From Hedging Both Inputs and Production |

|||||

Notable News |

|||||

|

6/30/2023: Chile copper output falls 14% in May 6/29/2023: SMM Weekly Updates On China Aluminium Ingot And Billet Social Inventories As Of June 29 6/27/2023: US HRC: Prices fall as mill hikes falter 6/27/2023: Column: Global exchange copper stocks sink to 15-year lows 6/27/2023: Canadian wildfire emissions hit record high as smoke reaches Europe 6/26/2023: US prime scrap likely to be tight: Cliffs 6/26/2023: OEMs urged to get more involved in RE supply chain 6/24/2023: India steel gets more US trade access under Section 232 |

|||||