|

Aluminum Beginning July 24, the daily price limit on LME aluminum and copper will be +/-12% of the prior day’s closing price on the 3M contract, down from the current +/-15% range. All other LME metals will remain at +/-15%. These daily price limits were implemented earlier this year in response to the nickel crisis in March 2022. (Source: LME, Bloomberg) |

Analysts continue to fine-tune Chinese aluminum production estimates as drought issues in top-producing Yunnan Province begin to ease. In a report released on Tuesday, Bloomberg Intelligence stated that in its base case scenario about 800,000 mt of the previously 1.9 million mt could be restarted this quarter. This is largely due to heavy rains throughout the region that have refilled hydro reservoirs. Approximately 80% of Yunnan province’s aluminum smelters are powered via hydropower. This increase in production could also push the Chinese aluminum market into a surplus of 658,000 mt, with total production up 3% to 41.2 million mt, they also stated. (Source: Bloomberg)

|

|

|

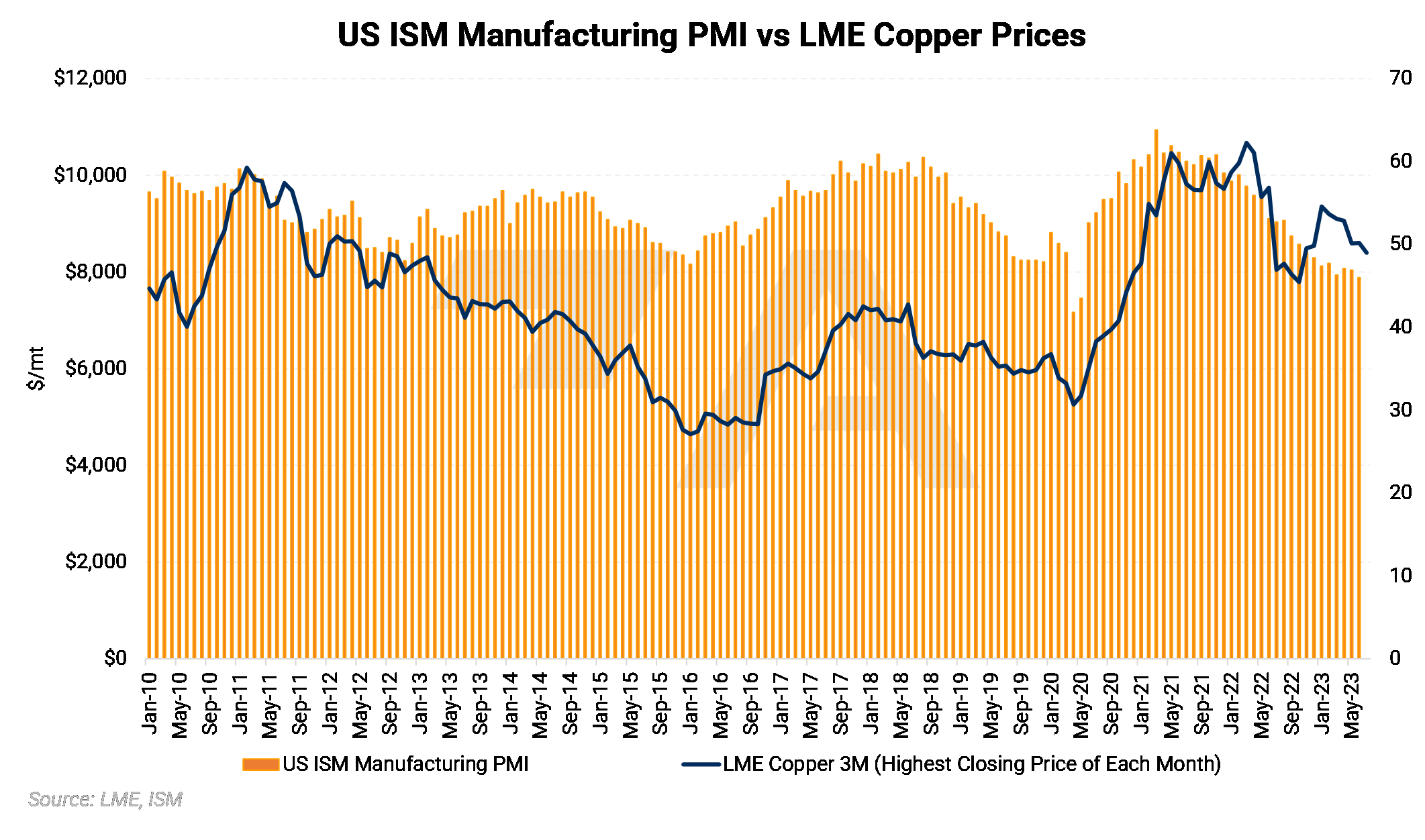

Copper A downturn in US manufacturing activity could be contributing to the recent slump in copper prices. The Institute for Supply Management’s Manufacturing Purchasing Managers' Index (PMI), a key gauge of manufacturing activity, fell to 46.0 last month, the eighth straight month of declines and the lowest since May 2020. A reading below 50.0 signals that the sector is contracting. (Source: Bloomberg) |

|

|

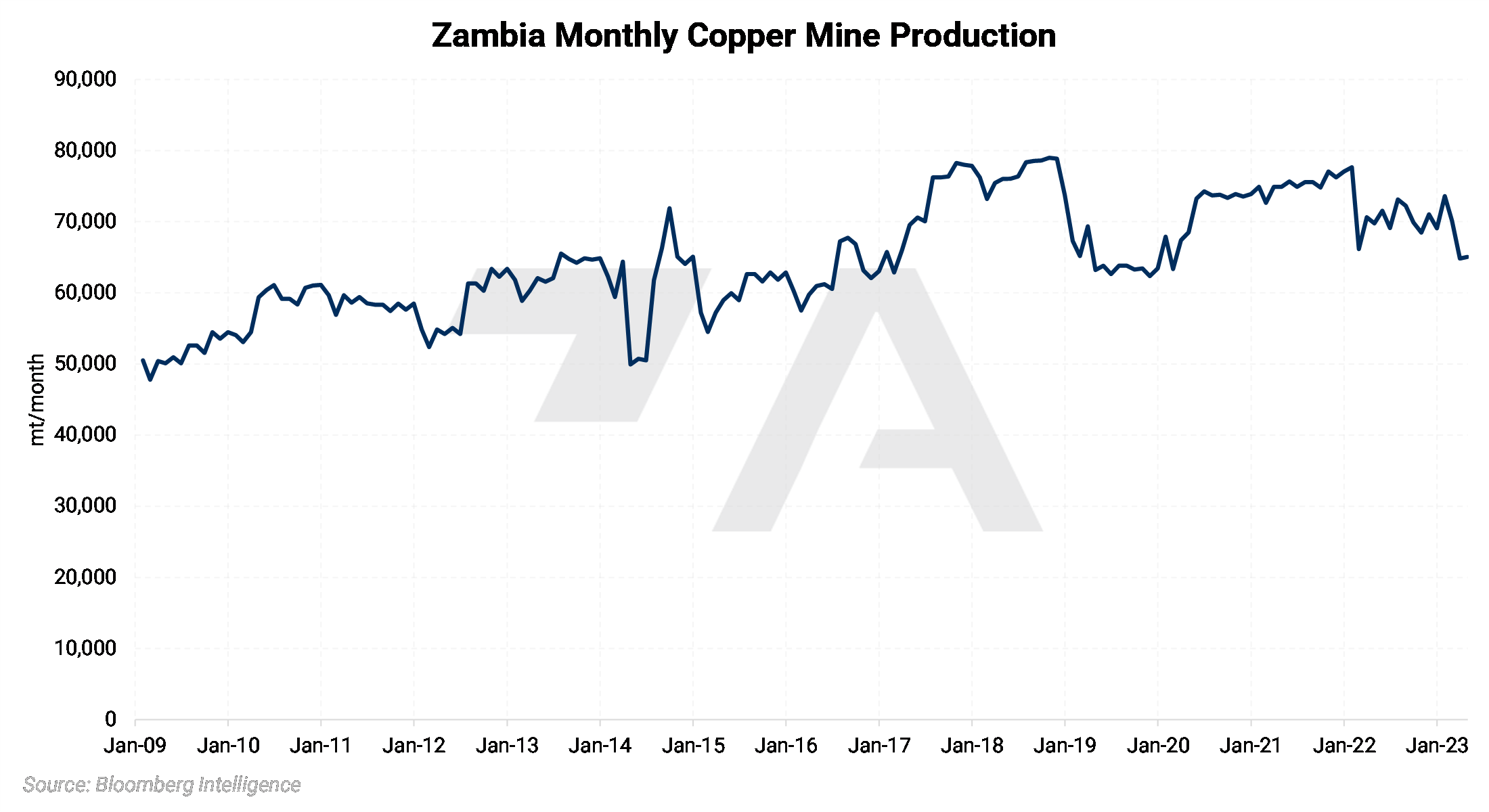

One of southern Africa’s largest and most promising copper projects is in peril while its stakeholders seek new capital. Zambia’s Mopani Copper Mines (ZCCM), saw its production decline to 72,694 mt last year from 87,618 mt in 2021, largely due to a 45-day smelter maintenance shutdown. The mine also lost nearly $298 million last year, up from $74.2 million in 2021. These growing financial losses have forced the company to seek out new investors, a process that should take about two months, the company stated. Zambia is one of the world’s copper-producing countries, responsible for about 3.5% of global copper mine output in 2022. (Sources: Reuters, ZCCM, USGS) |

|||||

|

|||||

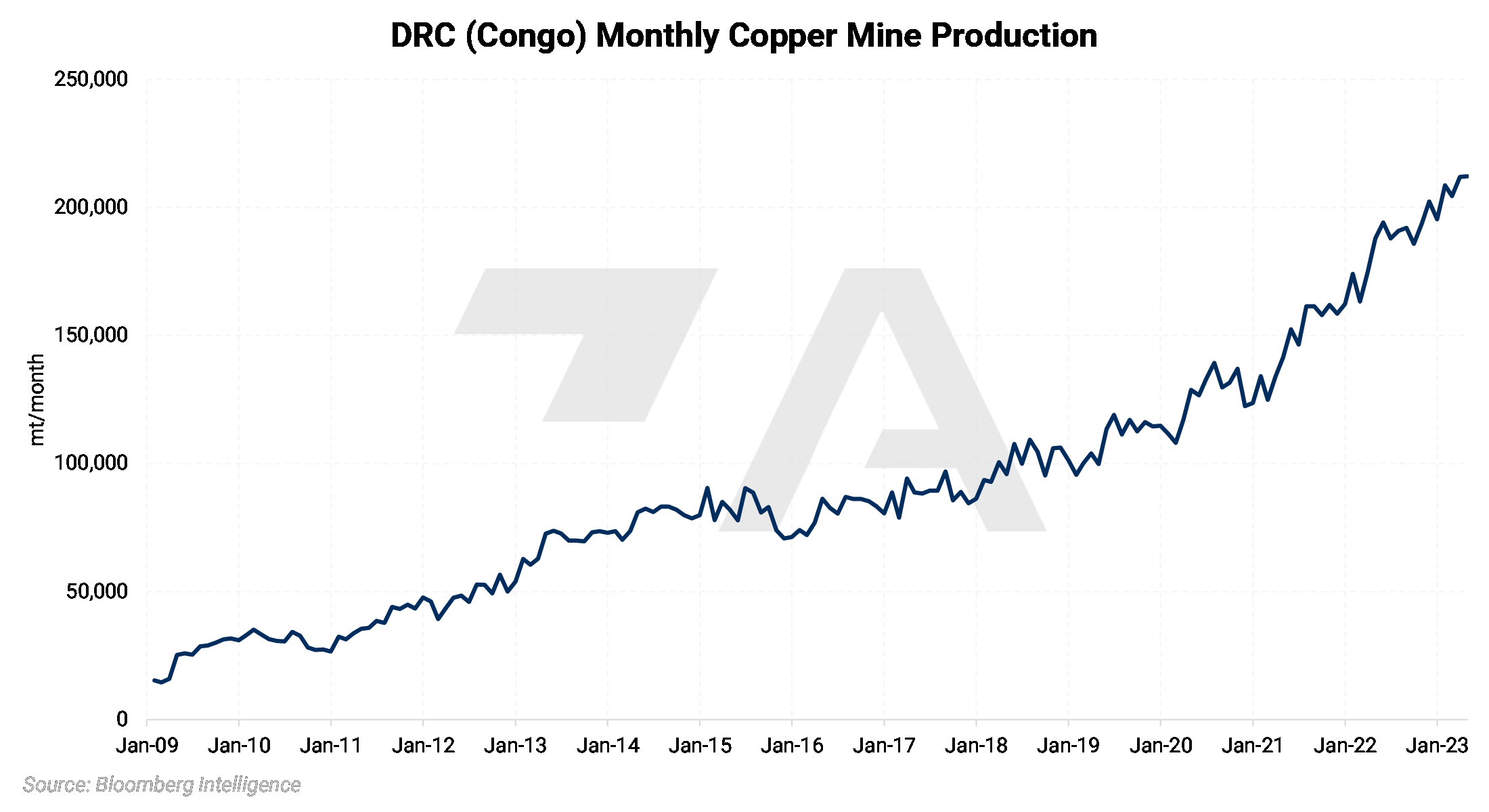

| The Kamoa-Kakula Copper Complex, which was responsible for about 1.5% of the world’s copper mine output last year, is breaking its own production records. Last quarter, the Congo-based mine produced 103,786 mt of copper concentrate, up 11% from 1Q2023. Its concentrators milled 2.2 million mt of ore with an average grade of 5.2%. The mine’s owner/operator, Ivanhoe Mines, believes the mine will produce 390,000 to 430,000 mt of copper concentrate, up from 333,497 mt last year. (Source: Ivanhoe Mines) | |||||

|

|||||

|

Steel At $840/st, Argus’s weekly domestic HRC assessment ticked up by $20/st this week, largely due to slow activity and slightly higher mill prices, according to Argus. While reporting this assessment update, Argus also stated “Some service centers reported pulling back their contract buying as companies continue to manage their inventories down along with seasonal summer slowdowns. One large Midwestern buyer reported cutting contract purchases close to their minimum for the third quarter.” (Source: Argus) Despite an HRC market that has dropped in recent weeks, prices for some finished products remain elevated. According to a statement from late last week, Nucor has kept its plate price at $1,570/st, for a second consecutive month. While reporting on this announcement, Argus stated “Some in the market had hoped Nucor would lower prices as plate remains at elevated spreads to hot rolled coil (HRC).” (Source: Argus) Last month, India exported 502,000 mt of finished steel products, to the lowest level since December 2022 as global steel demand contracts. For the April-June quarter, the country exported 2.05 million mt, down 6.4% compared to last year. According to Argus, “Exports hit a 13-month high in April, but have since tapered off on slowing demand from Europe and increased competition from other Asian origins.” (Source: Argus) |

|||||

|

|

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,145.5/mt, down $6/mt on the week. Aluminum prices were down this week. This has caused the futures forward curve to shift vertically lower by approximately $5/mt. It remains in a steep contango, meaning that nearby prices are lower than forward prices. Aluminum consumers that are concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|||||

|

Prompt month CME MWP last traded/settled at 23.7¢/lb this week. The CME Midwest Premium market is now flat for the July through December ’23 contracts. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,370.5/mt, up $55/mt on the week. Compared to last Friday, LME Copper's forward curve has risen vertically by approximately $55/mt and is now in a slight contango for the remainder of 2023 and throughout 2024. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $20,804/mt, up $288/mt on the week. As prices were up this week, nickel’s forward curve has also shifted vertically higher, by about $290/mt. It is in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $905/T, up $24/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

07/05/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 06/22/2023: Chinese Metals Imports Could Be the Canary in the Coal Mine for Demand 05/17/2023: Cobalt End-Users Should Hedge While Market Is Oversupplied 05/3/2023: Copper Producers Can benefit From Hedging Both Inputs and Production |

|||||

Notable News |

|||||

|

7/6/2023: US light vehicle sales rose to 15.7mn pace in June 7/6/2023: Column: Europe adds aluminium to its critical raw materials list 7/5/2023: US HRC: Prices edge up on offers 7/5/2023: India’s steel exports drop to six-month low in June 7/5/2023: Zambia says deal with India's Vedanta over disputed copper assets imminent 7/5/2023: India's April-May finished steel imports from China at six-year high 6/30/2023: Zambia's Mopani Copper Mines losses deepen amid search for new investor |

|||||