|

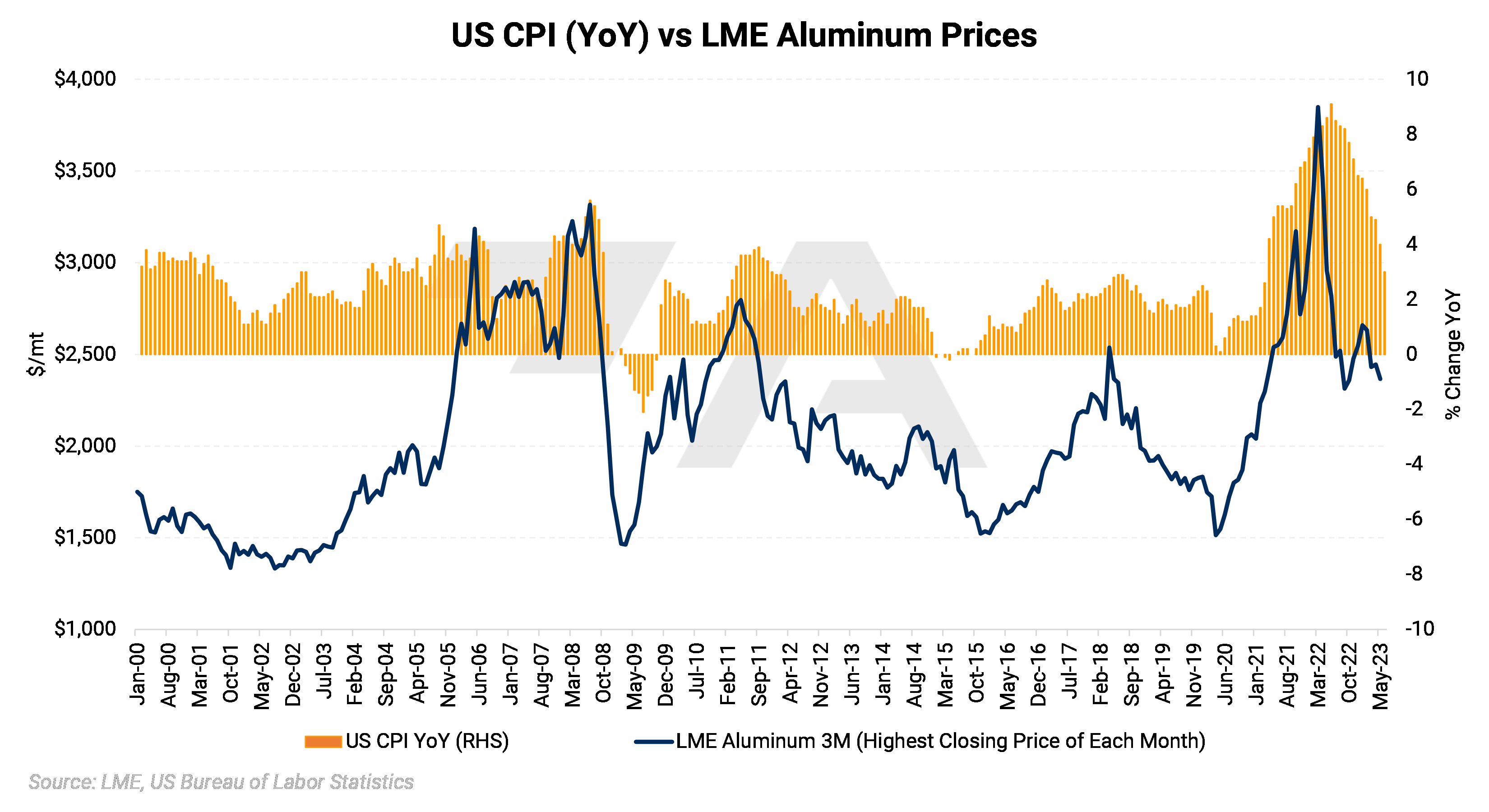

Aluminum LME Aluminum prices rallied on Thursday after government data showed that inflation in the US slowed in June. Slowing inflation could signal that the US Federal Reserve might stop hiking interest rates in the short term, analysts interviewed by Bloomberg stated. According to Peak Trading Research, stopping interest rate hikes could lead to "a bullish macro environment." (Source: Bloomberg) |

|

Due to lackluster demand, Japanese aluminum import premiums could be nearly unchanged compared to last quarter. One major aluminum importer has agreed to a $127.5/mt premium over the LME, according to Reuters. This is down slightly from the $130/mt premium that the country’s importers paid last quarter, but far lower than the $165 to $180/mt offerings by global producers. As Japan is Asia’s largest aluminum importer, its import premium is considered a key gauge of Asian demand. (Source: Reuters)

|

|

|

|

Even though stocks of Russian-origin aluminum in LME warehouses fell by 35,100 mt to 218,025 mt last month, the country now represents approximately 80% of the exchange’s on-warrant (meaning the metal is available to trade) aluminum inventories, according to the LME’s most recent Country of Origin report. Traders have been shunning Russian metal while seeking out other suppliers, according to Bloomberg reports. This is certainly true for Indian-origin aluminum, as LME on-warrant stocks from the country have fallen from 228,800 in April to 49,375 mt in June. (Sources: Bloomberg, LME)

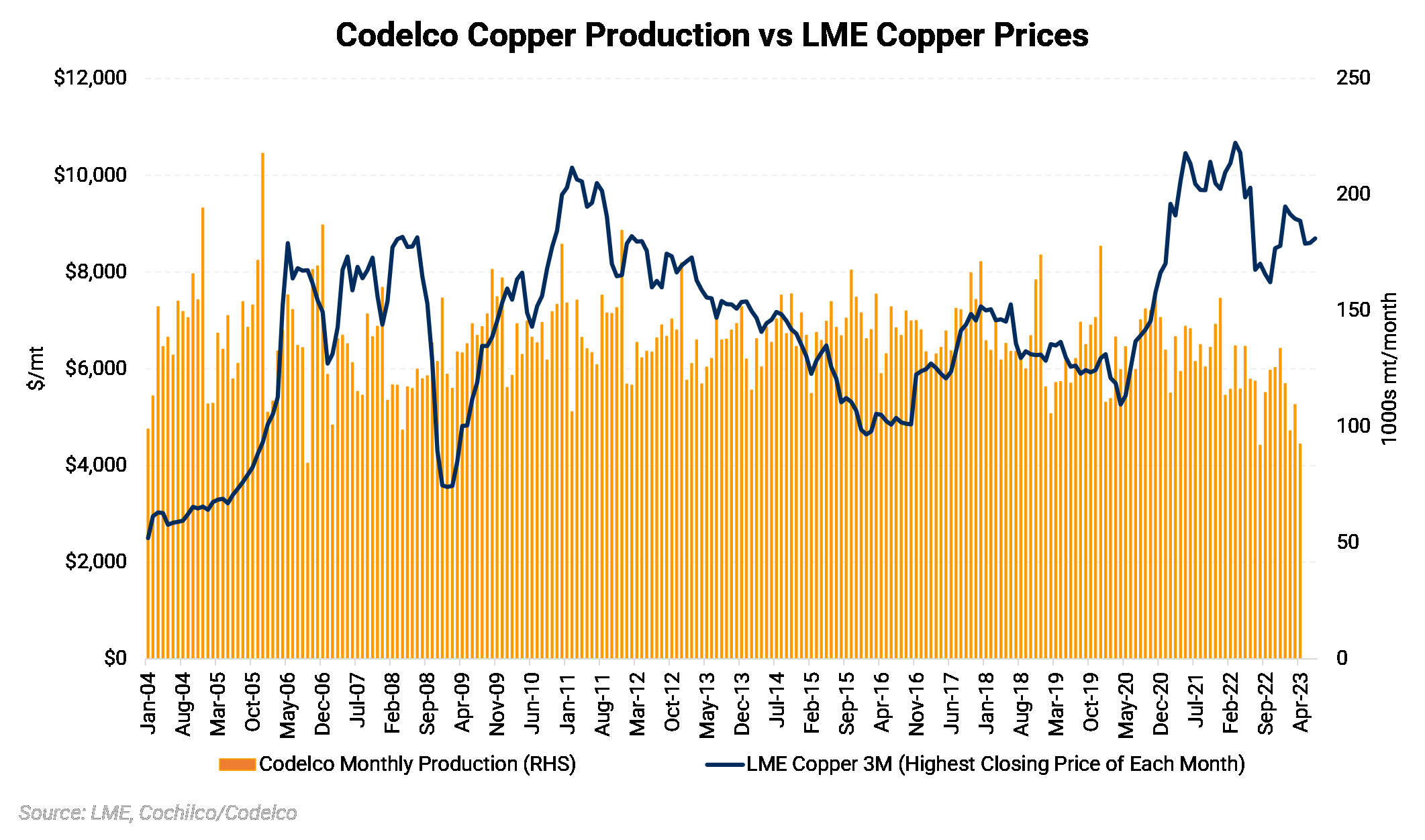

To help ensure the continent’s aluminum production, late last week the EU added aluminum to its list of critical minerals and metals as outlined in Critical Raw Materials Act. According to Reuters, this “Act is the centerpiece of the EU's strategy for ensuring it has the necessary inputs to compete with the United States and China in the global race to decarbonize.” Reuters later added, “Getting aluminum onto Europe's critical raw materials list is an important win for the region's aluminum sector.” As this Act aims to reduce dependence on foreign imports, the EU’s aluminum could rise in the coming decade. Between 2016 and 2020, the EU relied upon imports for 56% of the continent’s demand. As outlined in the Act, this will be achieved by subsidies and tax incentives. (Source: Reuters, EU) Copper Copper output from the world’s largest producer, Chilean state-owner miner Codelco, will rise next year as new projects get underway, according to statements from chairman Maximo Pacheco earlier this week. Pacheco did not give a production estimate for 2023 but did state that they will revise this year’s guidance at a meeting later this month. Codelco has suffered from numerous production setbacks in recent years, including falling ore grades and project delays. (Source: Bloomberg) |

|

|

|

The calls for more Chinese economic stimulus continue to grow louder. Last Thursday, Premier Li Qiang proclaimed that Chinese authorities will “spare no time” in implementing new stimulus measures. Market participants remain skeptical, mainly because authorities have made similar statements in recent weeks while being vague on details. (Source: Bloomberg) There was some headway this week, however. According to Bloomberg, the country’s financial regulators have asked banks to ease loan terms for real estate-related companies, and “state-run newspapers also ran reports suggesting more measures to support property were coming.” As Ian Roper of Astris Advisory Japan, recently proclaimed “While this latest measure will help developers at the margins, it still falls short of market hopes for a stronger support package to raise confidence in the structural health of the property market.” (Source: Bloomberg) There was also some positive economic data from China that helped push copper prices higher. According to government data, Chinese lenders have increased loans to households. Household lending is generally considered a proxy for mortgages, according to Bloomberg. Longer term, this could be met with skepticism, as “Banks usually rush to extend loans at the end of each quarter to meet their lending targets, resulting in a spike in credit in certain months including June,” Bloomberg also stated. (Source: Bloomberg) Miner Rio Tinto remains bullish on the long-term prospects for copper but highlights that China’s tepid real estate market continues to be a short-term problem. Chinese consumers have also pulled back on spending, which is also weighing on the economy. Despite the short-term demand issues, Rio stated “there are enough of the fundamentals to feel good about the prospects as they move forward,” later adding “We are so short of copper as humans it’s not funny.” (Source: Bloomberg) |

|||||

|

Steel Argus’s weekly domestic HRC assessment jumped again this week as spot prices have firmed coming out of the July 4 holiday. The assessment now stands at $870/st, up $30/mt from last week. It’s unclear if the two-to-four-week outage at Steel Dynamics’s (SDI) Sinton, TX mill will have a meaningful short-term market impact, Argus also stated. According to SDI, the outage should be resolved by the end of July. (Source: Argus) The US automotive industry’s steel demand shows no signs of slowing. Last month, sales of light trucks and cars rose to a seasonally adjusted annual average of 15.7 million units, up from the 15.1-million-unit pace in May. Meanwhile, automotive production in May was 154,000 units, up from 143,700 units in May 2022. (Source: Argus) |

|||||

|

|

|||||

|

Citigroup is mixed regarding regional steel demand in 2H2023. European demand for cars, home appliances, and other consumer staples is expected to slump, but American steel demand will be “resilient”. They are therefore “cautious” about 3rd quarter earnings for SSAB, ArcelorMittal, Acerinox, and others. (Source: Bloomberg) |

|||||

|

|

|||||

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,276.5/mt, up $131/mt on the week. Aluminum prices were up this week. This has caused the futures forward curve to shift vertically higher by approximately $130/mt. It remains in a steep contango, meaning that nearby prices are lower than forward prices. Aluminum consumers that are concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please contact AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 22.8¢/lb this week. The CME Midwest Premium market is now flat for the August through December ’23 contracts. The CME Midwest Premium swap market is thinly traded, and there is no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please contact AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,673.5/mt, up $303/mt on the week. Compared to last Friday, LME Copper's forward curve has risen vertically by approximately $300/mt and is now in a slight contango for the remainder of 2023 and throughout 2024. The copper market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon their risk tolerance. Please contact AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $21,630/mt, up $826/mt on the week. As prices were up this week, nickel’s forward curve has also shifted vertically higher, by about $825/mt. It is in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Consumers might consider strategies that use only swaps or options or a combination of both, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $897/T, down $8/T on the week. For CME HRC Steel, liquidity is low for swaps, but hedging can still be done with limit orders. The same is true for options. Similar to other metals, a combination of both swaps and options might work in certain cases, depending upon your risk tolerance. Please contact AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

07/12/2023: AEGIS Factor Matrices: Most important variables affecting metals prices 07/11/2023: Copper Prices Could Remain Subdued While African Production Grows 06/22/2023: Chinese Metals Imports Could Be the Canary in the Coal Mine for Demand 05/17/2023: Cobalt End-Users Should Hedge While Market Is Oversupplied |

|||||

Notable News |

|||||

|

7/14/2023: Trade body flags possible EU ban on Russian aluminium, but not Rusal 7/12/2023: US dollar stumbles, drops to more than one-year low as inflation eases in June 7/11/2023: UPDATE 1-Japanese buyer agrees to pay Q3 aluminium premium of $127.5/T -source 7/11/2023: World's biggest gallium buyer says clients stockpiling 7/11/2023: China gallium curbs raise chip questions for future EV models 7/7/2023: US Trade Representative asks Mexico to address increased steel, aluminum imports |

|||||