|

*Please note that our offices will be closed on Monday, January 15, due to the Martin Luther King Day holiday. We will not produce a Metals First Look that morning. However, the trading desk will provide LME coverage, and current clients can contact metals@aegis-hedging.com for indications. * |

|

|

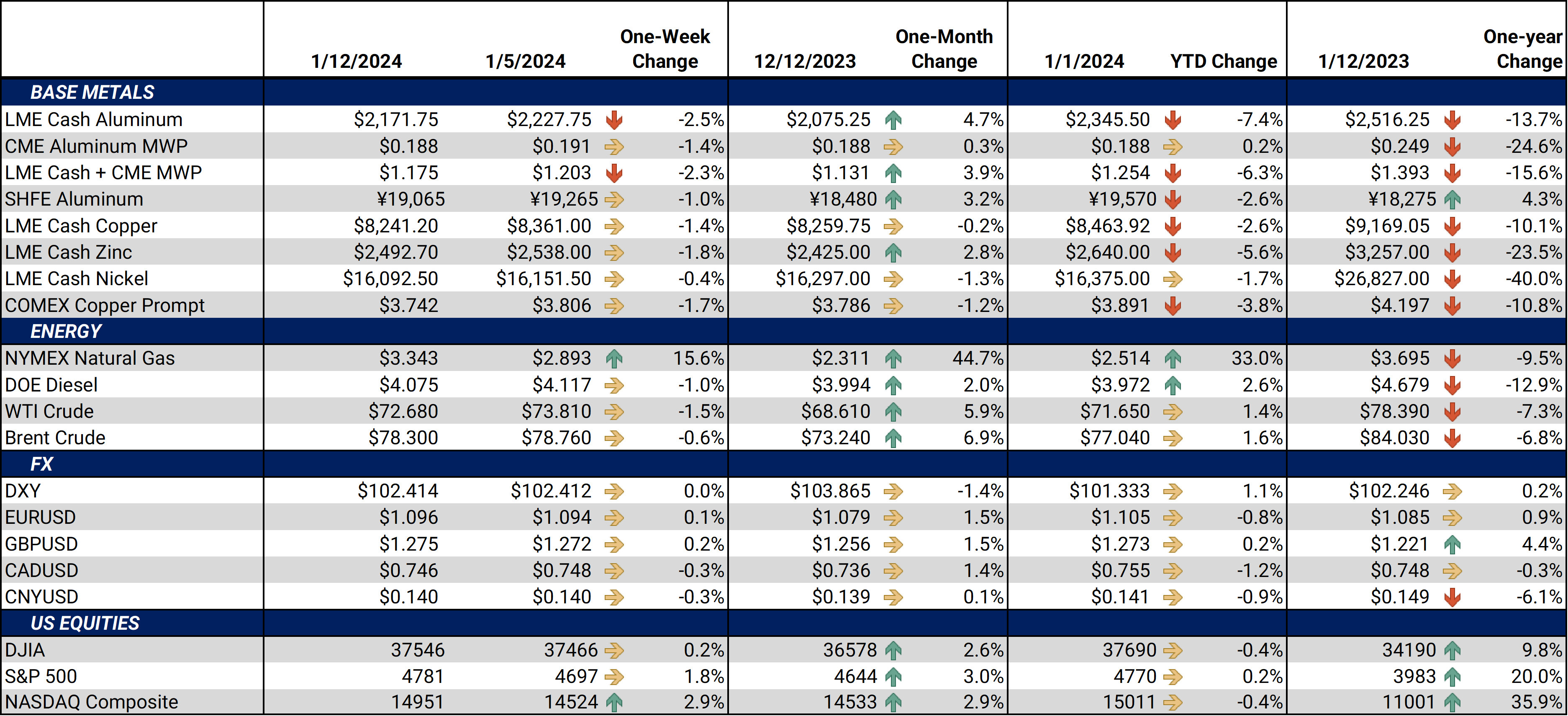

Aluminum Traders could be pulling Russian-origin aluminum from LME warehouses. As of this morning, canceled warrants, meaning metal set for delivery, in South Korean warehouses total 37,450 mt, up from a mere 5,750 mt on Friday morning. This was the largest such increase since late September. The LME’s South Korean warehouses are a known repository of Russian-origin aluminum. (Source: LME) Russian-origin aluminum now represents a whopping 90% of the aluminum in LME warehouses, according to the LME’s Country of Origin report released earlier this week. As of the end of December, 375,250 mt of aluminum was in the LME system, of which 338,375 mt was of Russian origin. LME aluminum inventories surged last month after the UK banned its citizens and companies from trading Russian-origin metals. The amount of Russian aluminum in the LME system has been a controversial subject since the start of the Russia-Ukraine conflict nearly two years ago. (Source: LME) As for raw materials, Alcoa announced on Monday that it will close the Kwinana alumina refinery in Western Australia by the end of 3Q2024. The company stated that the closure was “based on a variety of factors, including its age, scale, operating costs, and current bauxite grades, in addition to current market conditions.” The nearly 60-year-old refinery, which has a nameplate capacity of 2.2 million mt/year, has been operating at 80% capacity since January 2023. (Source: Alcoa) China’s aluminum processing industry contracted in December, according to Shanghai Metal Market (SMM) survey results released last week. SMM cited poor seasonal demand amid restrained production for the contraction. They also stated that the country’s construction aluminum extrusion industry remains in a slump due to a continually poor real estate sector and falling foreign demand. Until demand improves, the country’s faltering real estate sector could remain a burden for global aluminum prices. (Source: Shanghai Metal Market) |

|

Copper The LME Copper Cash to 3M spread, a key gauge of spot demand, has sunk to the widest contango in nearly 30 years. As of this writing, cash is trading at an approximate $94/mt discount to the benchmark 3M contract. This is up slightly from the $108/mt discount at Monday’s close. This steep contango is mainly due to poor spot demand amid ample supply. LME warehouse stocks have surged in recent months while demand has sputtered. (Source: LME, Reuters) Some analysts are tamping down their bullish expectations on copper. In a note earlier this week, Citigroup stated, “We expect cyclical copper demand to weaken further in 2024 as debt-service burdens rise across mature markets, outweighing China policy upside.” They also believe that copper will trade near $8,500/mt this month before moving lower. Just last month, Citigroup proclaimed that copper could rally to $15,000/mt within the next two years due to increasing demand from the energy transition. (Source: Bloomberg) Similarly, some analysts believe that interest rates will greatly influence copper prices this year. In a note late last week, ING proclaimed “Metals are under pressure on increasing signs that the Fed won’t start cutting rates as soon as expected after US jobs data released this week. If US rates stay higher for longer, this would lead to a stronger US dollar and weaker investor sentiment, which in turn would translate to weaker metals prices.” (Source: Mining.com) Beleaguered copper miner First Quantum Minerals is reportedly in talks to sell its Zambian copper mines to China’s Jiangxi Copper, according to Reuters and Bloomberg. The move would help First Quantum generate much-needed cash, as the company has approximately $1.05 billion of debt maturing in early 2025. According to the National Bank of Canada, the sale could generate between $1.5 to $2.0 billion. (Source: Reuters) In addition to selling its Zambian assets, First Quantum Minerals is also reportedly looking to sell its Spanish copper mine as well. The Las Cruces mine, based in southern Spain, is one of First Quantum’s smallest operations and valued at less than $1 billion. Annual refined copper production is approximately 72,000 mt. Late last year, First Quantum’s flagship mine was closed by the Panamanian government, dealing the company a severe financial blow. (Source: Bloomberg) |

|

Steel Nippon Steel is confident it can complete its deal to buy US Steel, Nippon’s CEO proclaimed late last week. At a Japanese steel conference last week, President Eiji Hashimoto stated, "The deal poses no harm to America... as we will make investment in line with the economic security strategies of the United States and other Western nations." Regarding the union and its members, Hashimoto declared “Taking good care of our employees and labour union is our speciality." Mere days after the deal was announced, the Biden administration affirmed that the deal will face extensive scrutiny. (Source: Reuters) US Steel has denied claims by the United Steelworkers (USW) union that the company didn’t disclose information to the union while Nippon Steel, a Japanese steelmaker, was pursuing the company. US Steel blames the USW, as the union did not sign a nondisclosure agreement during the sales process. Although the union cannot block the sale to Nippon Steel, the union does hold enormous political influence. This political influence could impact the Biden administration’s review and scrutiny of the sale. (Source: Bloomberg) After rallying to an 18-month high, iron ore prices in China have slumped in early January, as newly released government data shows that the country’s manufacturing sector remains in a downtrend. China’s Manufacturing PMI, a key gauge of manufacturing activity, continued to contract last month, and is now at the lowest level since June 2023. The country’s manufacturing sector spent most of 2023 in contraction mode. This could remain a burden for global demand. (Source: Bloomberg, China Federation of Logistics and Purchasing) Indonesia’s share of global nickel supply will soon jump from 50% to 70% due to increased production, according to analysts interviewed by Bloomberg. Most of this nickel will be exported to China in the form of refined nickel or stainless steel. After Indonesia recently banned nickel ore exports, several large Chinese companies have invested heavily in Indonesian nickel and stainless steel production. (Source: Bloomberg) Finally, prices for zinc, a key raw material for hot-dipped galvanized steel production, have fallen in early January. As of this writing, the benchmark LME 3M contract traded at $2,507/mt, down nearly 6% on the year. This is mainly due to investment funds slightly reducing their net long position. At the close of 2023, investment funds, which are purely speculators in LME metals markets, had a net long position of approximately 14,400 contracts but have since reduced that position to 11,270 contracts. (Source: LME) |

|

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,219.5/mt, down $54/mt on the week. Aluminum prices were down this week. This has caused the futures forward curve to shift vertically lower by approximately $55/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 18.8¢/lb this week. The CME Midwest Premium market is now in a contango from the January ‘24 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,339/mt, down $124/mt on the week. Compared to last Friday, LME Copper's forward curve has fallen vertically by approximately $125/mt and remains in contango throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Depending on their risk tolerance, consumers might consider strategies that use only swaps, options, or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $16,343/mt, down $29/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower by about $30/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $1,083/T, down $7/T on the week. Steel mill profit margins improved dramatically throughout 3Q and 4Q2023 and are also starting 2024 on a good note. The CME HRC Steel – CME MW Busheling Fe Scrap spread, which is generally used as a gauge for steel mill profitability, is now approximately $635/st, up from about $320/st on September 1. This is mainly due to prompt month CME HRC steel futures rallying alongside prices in the physical market. Since steel prices have increased significantly recently, mills should consider hedging production and raw material usage for 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

1/11/2024: Important US Economic Data (AEGIS Reference) 1/10/2024: AEGIS Factor Matrices: Most important variables affecting metals prices 1/4/2024: Year-End Review of LME Aluminum, Copper, CME HRC Steel and Hedging Implications for 2024 12/8/2023: Aluminum and Copper Markets Diverge but Hedging Opportunities Persist for End-Users 11/17/2023: Aluminum and Copper End-Users Should Hedge As Inflation Eases |

|||||

Notable News |

|||||

|

1/10/2024: Share of Russian aluminium in LME warehouses rises to 90% after UK curbs 1/8/2024: LME copper cash to three month discount hits highest since 1992 1/8/2024: Alumina price panic a sign of future aluminium volatility 1/5/2024: UPDATE 1-Russia's Udokan Copper assesses damage after fire 1/5/2024: Copper prices fall on stronger US dollar - MINING.COM |

|||||