|

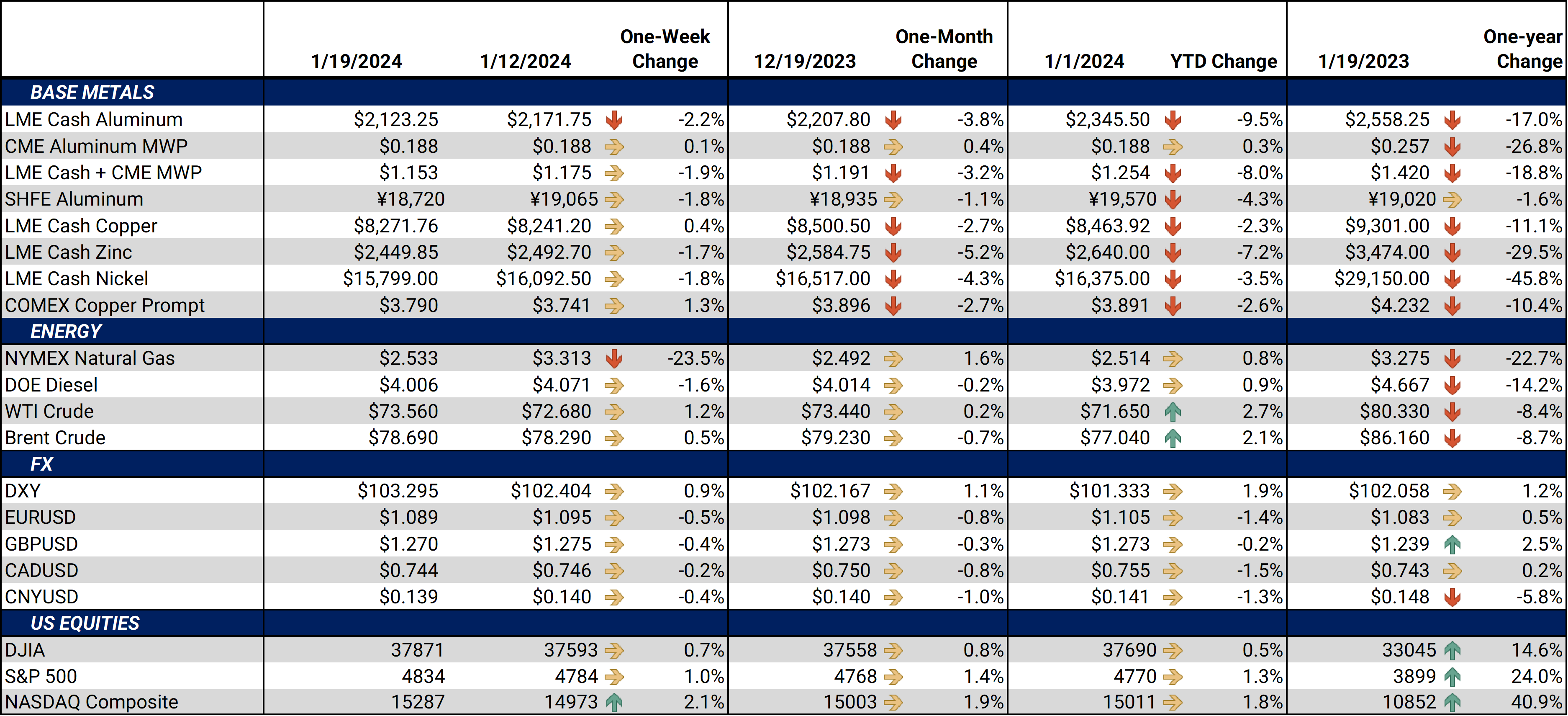

Aluminum Aluminum prices have tumbled nearly 9% over the past three weeks. This is mainly because China’s raw material issues have subsided while demand remains subpar. Also, China’s lack of new stimulus measures failed to impress the market. Most recent economic data shows that China’s economy has weakened and pushed commodity prices lower, hence the need for more stimulus. China’s central bank has an inflation target of 3%, but actual inflation has failed to reach that level for nearly four years. In recent months, the country’s CPI, a key inflation gauge, shows that China’s economy is experiencing deflation. Earlier this week, though, Chinese authorities essentially stated that the government will not implement any stimulus measures. This could remain a burden to aluminum prices and demand. |

|

|

The net long position investment funds held in LME aluminum lasted a mere two weeks. As of last Friday, investment funds, which are purely speculators in metals markets, are net short approximately 940 contracts of LME aluminum, according to the LME’s most recent COT report, released yesterday. In the final report of 2023, these funds were net long, roughly 9,800 contracts. Given that aluminum prices are highly susceptible to investment fund positioning, this could be why prices are down nearly 8% in January. (Source: LME) Chinese primary aluminum production hit a record 41.59 million mt last year and could hit a record 42.7 million mt in 2024, according to Aladdiny, a China-based consultancy. Last year, output grew by 3.7%, its third consecutive year of declining growth. Production in 2023 was hampered by power rationing and China’s self-imposed 45 million mt/yr production cap. Growth this year will come from new projects that are expected to start in the third quarter. (Source: China National Bureau of Statistics, Reuters) Alcoa might shutter its Spain-based San Ciprian alumina smelter later this year due to mounting losses; the company announced earlier this week. The facility’s alumina smelter has been running at 50% capacity, even though the aluminum smelter has been closed since December 2021. The aluminum smelter was scheduled to restart this year but will now remain closed. “If the situation does not change significantly in the months ahead, we anticipate that available funding will be exhausted in the second half of 2024. If that happens, we will have no choice but to make hard decisions that will adversely and potentially irrevocably impact employment and the economy,” Alcoa CEO William Oplinger stated. (Source: Bloomberg) |

|

Copper Like aluminum, copper prices have stumbled recently while China’s weakening property sector remains a burden. In December, property starts were down 10% compared to December 2022, while home sales fell 13% compared to a year prior. The drop in home sales was the largest since 2015. Going forward, some analysts remain pessimistic about China’s housing sector. Earlier this week, Wang Yingying of Galaxy Futures, a China-based commodity brokerage, told Bloomberg, “We are still relatively bearish on the property sector. Housing sales are expected to continue dropping this year. That’s going to drag base metals demand.” (Source: Bloomberg) To save time and money, copper miners buy existing operations rather than developing new ones, Goldman Sachs stated in a note late last week. “We believe miners are becoming increasingly reluctant to chase capital-heavy greenfield development growth, and indeed, we do not believe investors are willing to pay for it, given the broad range of risks facing the industry,” the bank stated. They also suggested that scaling existing mines can be cheaper and provide better returns for investors. (Source: Bloomberg) Antofagasta, one of the world’s largest copper miners, experienced higher than expected costs in 4Q2023 but was offset by higher than forecasted production. The company produced 191,500 mt last quarter and 660,600 mt for the year. Total production in 2023 was up 2.2% compared to 2023. As for 2024, Antofagasta expects to produce 670,000 to 710,000 mt of copper. (Source: Bloomberg) China’s copper smelters produced a record volume last year, but that output might fall this year due to dwindling supply and lower profit margins. Treatment charges, the fees miners pay to have their raw copper processed into refined metal, have fallen to the lowest level in over two years. This drop in fees has dramatically reduced profit margins for many smelters while others are essentially breaking even. Unless the mined copper supply increases, these smelters could run at reduced output and profitability for some time. (Source: Bloomberg) |

|

Steel The US government’s review of Nippon Steel’s potential purchase of US Steel could take until 2025, according to sources interviewed by Bloomberg late last week. The sources proclaimed that this is mainly due to the size of the deal, as well as the prospect of potential delays and “legal wrangling.” This is far longer than either Nippon or US Steel anticipated. In its earnings call in mid-December, US Steel stated, “We anticipate the deal will close in the second or third quarter of 2024.” Nippon also made similar comments in December. (Source: Bloomberg) Rio Tinto, one of the world’s largest iron ore producers and a key supplier to China, expects its new ventures in Africa as opposed to its older operations in Western Australia. Rio’s iron ore facility in Guinea will start next year and is expected to achieve full capacity by 2028. This venture, known as Simfer, will add 27 million mt/year of iron ore sales to the company’s portfolio once it reaches full capacity. Meanwhile, sales from Western Australia have only grown from 319 million mt in 2015 to 332 million mt last year. (Source: Bloomberg, Reuters) Prices and demand for nickel, a key raw material for stainless steel production, will remain subdued this year, according to Sucden Financial. "We expect the supply momentum to carry on into 2024, with rising output from Indonesia flooding the market. Indonesian mining output is set to grow to above 2.3mn t in 2024, with the trend continuing until 2026 when supply for the coming decade will peak." As for demand, Sucden believes "Automakers are unlikely to stockpile nickel as they have done in the past. "We expect that the EV trend is more likely to support prices rather than urge them higher this year." (Source: Argus) First Quantum Minerals will also reduce operations at its Australian nickel mine, the company announced earlier this week. This mine has been hit with a double whammy in recent years, as global nickel prices have fallen dramatically while operating costs have remained high. It will cease mining operations for the next two years and only sell from its current stockpile. Reducing the current inventories will take about 18 to 24 months, after which the company will resume mining operations. The operation processed 5,490 mt of nickel in 3Q2023. (Source: Bloomberg, Reuters) |

|

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,166/mt, down $53.5/mt on the week. Aluminum prices were down this week. This has caused the futures forward curve to shift vertically lower by approximately $55/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 18.8¢/lb this week. The CME Midwest Premium market is now in a contango from the January ‘24 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,351/mt, up $12/mt on the week. Compared to last Friday, LME Copper's forward curve has risen vertically by approximately $10/mt and remains in contango throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Depending on their risk tolerance, consumers might consider strategies that use only swaps, options, or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $16,036/mt, down $307/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower by about $300/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $1,070/T, down $6/T on the week. Steel mill profit margins improved dramatically throughout 3Q and 4Q2023 and are also starting 2024 on a good note. The CME HRC Steel – CME MW Busheling Fe Scrap spread, which is generally used as a gauge for steel mill profitability, is now approximately $640/st, up from about $320/st on September 1. This is mainly due to prompt month CME HRC steel futures rallying alongside prices in the physical market. Since steel prices have increased significantly recently, mills should consider hedging production and raw material usage for 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

1/17/2024: AEGIS Factor Matrices: Most important variables affecting metals prices 1/11/2024: Important US Economic Data (AEGIS Reference) 1/4/2024: Year-End Review of LME Aluminum, Copper, CME HRC Steel and Hedging Implications for 2024 12/8/2023: Aluminum and Copper Markets Diverge but Hedging Opportunities Persist for End-Users |

|||||

Notable News |

|||||

|

1/18/2024: Glencore, Trafigura target spot prices for mined copper sales, sources say | Reuters 1/18/2024: LME CEO aims to have first contracts with Shanghai futures exchange in 2024 1/16/2024: Ni prices unlikely to rebound in near term 1/16/2024: China 2023 aluminium output hits record high but growth rate slows 1/16/2024: Africa not W Australia to grow Rio Tinto iron ore 1/16/2024: Most cobalt producers loss-making after 2023 price slump - ERG 1/15/2024: London Metal Exchange's growing Russian aluminium problem 1/15/2024: LME to suspend 10% of listed metals brands until they submit responsible sourcing audit 1/15/2024: First Quantum to cut Australian nickel mine output, slash workforce |

|||||