|

*Please note that our offices will be closed on Friday, March 29, due to the Good Friday holiday. The LME and CME will be closed that day, and the LME will also be closed on Monday, April 1. We will not produce the Metals First Look either morning. However, on Monday, our trading desk will provide CME coverage, and current clients can contact metals@aegis-hedging.com for indications. * |

|

|

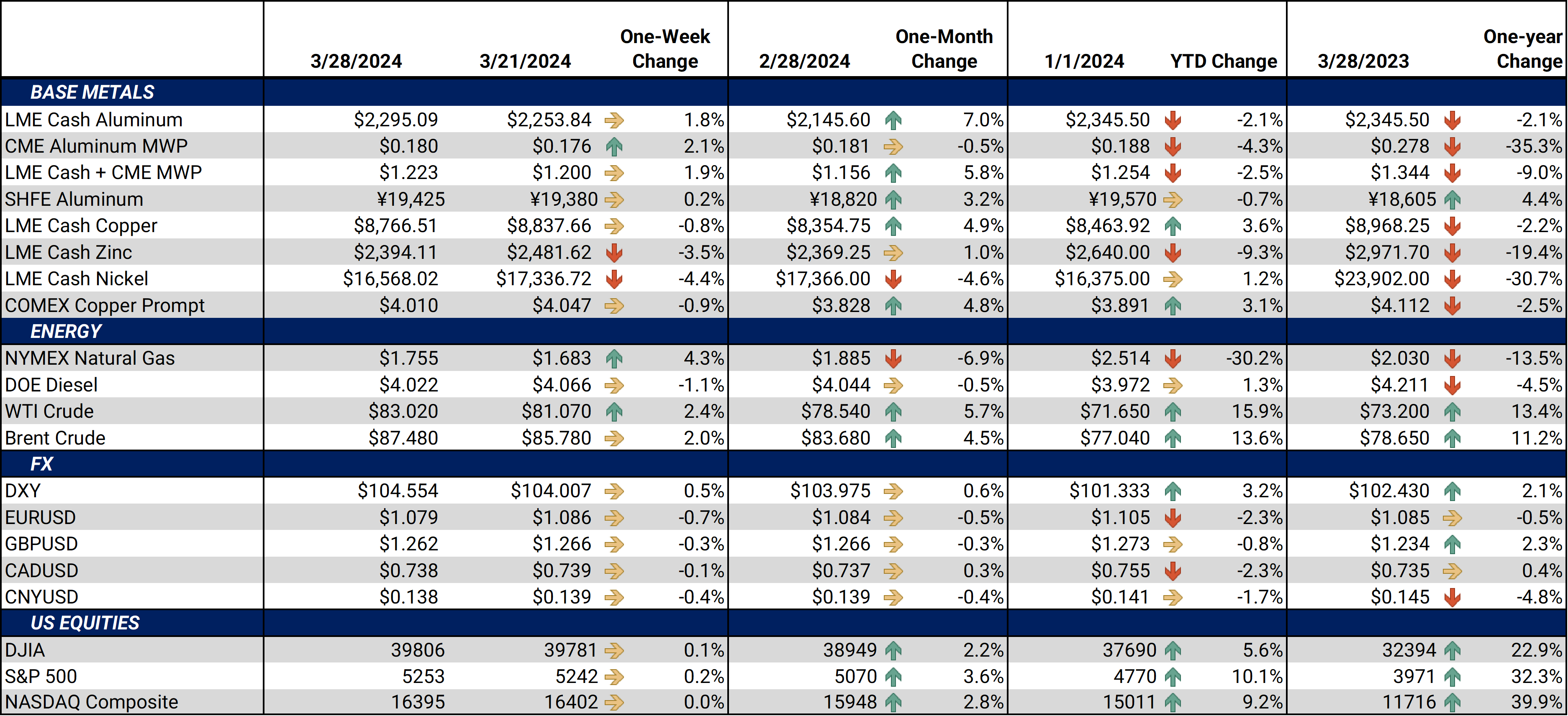

Aluminum Century Aluminum, one of the last aluminum producers in the US, will soon build the country's first new smelter in 45 years. Funding, which is yet to be finalized, could total up to $500 million and will come from the Biden administration’s Inflation Reduction Act. According to Bloomberg, the project could double the amount of primary aluminum smelter capacity in the US. With the closure of the New Madrid smelter earlier this year, the US currently has four operating primary smelters with a total capacity of approximately 1.1 million mt. (Sources: Bloomberg, USGS) Vista Metals, a US-based aluminum products manufacturer, will soon build a specialty aluminum products factory in Bowling Green, KY. According to Vista’s press release dated March 19, “the new site will primarily support downstream processing and value-added products serving the aerospace extrusion, forging and rolling markets. In addition to supporting commercial aviation, the new location will also support defense, automotive and general industrial applications. Initial site preparation is now underway, and Vista Metals will commence a phased build-out to support the growth in its core markets.” (Source: Vista Metals) Primary aluminum smelters in China’s Yunnan province, the country’s top production region, have been slow to bring back previously curtailed production, according to a report from Beijing Capital Futures. Rainfall in April and May is expected to be low, suggesting that the hydropower supply could be short and lead to lower electricity production. This ultimately means the recent ramp-up in aluminum production could be short-lived. (Source: Bloomberg) After peaking in mid-February, the spread between LME Aluminum Cash and the 3M contract, generally used as a gauge for spot demand, has slumped to the lowest since early January. As of this writing, the LME Aluminum cash contract trades at an approximate $41.80 discount to the 3M contract, significantly wider from the $19.4/mt discount on February 16. This suggests spot demand has fallen, even though prices have been rallying. On Wednesday, Hong Kong-based brokerage Jinrui Futures Co. stated as much, proclaiming, “Buyers have been deterred by recent price gains, spot aluminum |

|

Copper Investment funds, generally speculators in metals markets, have started to slow their buying of LME copper while prices hit the highest level in nearly a year. As of last Friday, these investment funds are net long 37,350 contracts, having sold about 500 contracts during the week. Before the recent downtick, investment funds had been steady buyers of LME copper in recent weeks, likely due to production issues. After briefly eclipsing $9,000/mt for the first time since April 2023, copper prices have cooled since mid-March. As of this writing, copper prices are essentially flat on the week, suggesting that funds have done little to no buying. (Source: LME) Chinese copper demand is “finely balanced,” according to commodity brokerage Sucden Financial. The brokerage cites rising inventories despite lower production for the perceived market balance. SHFE warehouse inventories have surged from 30,905 mt on December 31 to 285,090 mt as of last Friday. Meanwhile, copper refiners are having issues sourcing raw materials, hurting refined copper production. (Source: Reuters) Barrick Gold, a Canadian copper miner, says it has partnered with the government of the Democratic Republic of the Congo (DRC) to boost copper and gold production in the country. Currently, Barrick has a gold mine in the northwest region of the DRC but does not have any copper operations in the country. Barrick has a significant copper mine in neighboring Zambia, which produced 260 million lbs last year. The DRC is the largest copper-producing country in Africa, followed by Zambia. (Sources: Reuters, Barrick Gold, USGS) The Democratic Republic of the Congo (DRC) has overtaken Peru as the world’s 2nd largest copper producer. Last year, the DRC produced 2.84 million mt, while Peru’s output was 2.76 million mt. Peru slightly edged out the DRC on exports, with Peruvian producers shipping out 2.95 million mt last year. Peruvian exports were slightly higher than production because miners sold off large stockpiles. Peru's minister of energy and mines recently stated they will produce 3 million mt this year. (Source: Reuters) |

|

Other Important LME and CME Metals

|

|

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,337/mt, up $28/mt on the week. Aluminum prices were up this week. Compared to last week, the futures forward curve has shifted vertically higher by approximately $30/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 18.0¢/lb this week. The CME Midwest Premium market is now in a contango from the March ‘24 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $8,867/mt, up $0.5/mt on the week. Compared to last Friday, LME Copper's forward curve is essentially unchanged and remains in contango throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Depending on their risk tolerance, consumers might consider strategies that use only swaps, options, or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $16,749/mt, down $493/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower by about $500/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $860/T, down $29/T on the week. Steel mill profit margins improved dramatically throughout 3Q and 4Q2023 and are also starting 2024 on a good note. The CME HRC Steel – CME MW Busheling Fe Scrap spread, which is generally used as a gauge for steel mill profitability, is now approximately $460/st, up from about $320/st on September 1. This is mainly due to decreasing scrap prices. Thus, steel mills should consider hedging production and raw material usage for 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

3/27/2024: AEGIS Factor Matrices: Most important variables affecting metals prices 3/14/2024: Important US Economic Data (AEGIS Reference) 2/27/2024: Aluminum Consumers Should Still Implement Hedges, Even Though Russia Sanctions Mean Little 2/2/2024: China's Real Estate Woes Provide Opportunity for Copper Consumers 1/25/2024: Aluminum Starts 2024 On a Down Note, But Potential Supply Shocks Give Consumers a Reason to Hedge |

|||||

Notable News

|

|||||

|

3/27/2024: Chile opens lithium salt flats for investment, saves two for state control 3/25/2024: America's lithium laws fail to keep pace with rapid development 3/24/2024: Copper registers strongest seasonal Shanghai stocks build 3/22/2024: Congo overtakes Peru on copper output, still behind on exports |

|||||