|

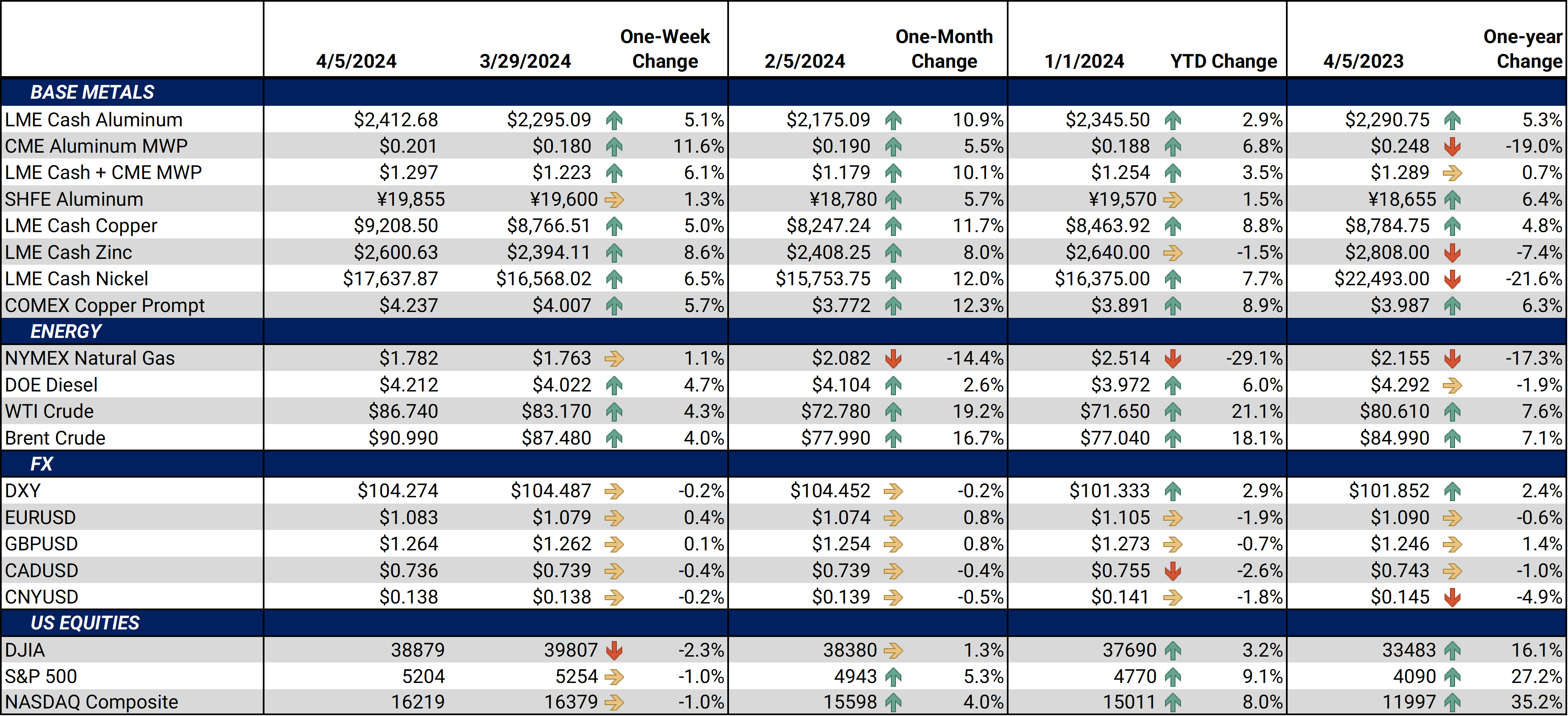

Aluminum This week, LME Aluminum prices spiked to the highest level of 2024 after economic data showed that parts of the US economy are starting to recover. The ISM Manufacturing PMI, a gauge of US manufacturing activity, showed the sector expanded in March. This was the first expansion in US manufacturing since September 2022. Meanwhile, recently released government data showed that China’s manufacturing sector expanded for the first time since September 2023. (Source: ISM, China govt.) |

|

|

Investment funds, generally speculators in metals markets, significantly added to their net long position in LME Aluminum last week. As of last Friday, these investment funds are net long approximately 18,200 contracts, having purchased about 3,300 (net) contracts last week. This position is the largest these funds have had since last November. These investment funds can significantly influence price movement, so they have likely added to their long position this week, given the nearly 5% rally (as of this writing). AEGIS does caution that aluminum prices are nearing the upper end of the recent trading range, which could give these investment funds pause to add more to their long position at these higher prices. (Source: LME) China’s primary aluminum smelters continue at a brisk pace despite some lingering hydropower and electricity issues in the top-producing Yunnan province. Last month, primary aluminum production was 3.56 million mt, up 4% compared to March 2023, according to Shanghai Metal Market (SMM) estimates. Approximately 500,000 mt of previously curtailed production will be brought back online by the end of April. Some remaining capacity will be kept offline due to continued hydropower issues. With overall demand still subdued, this increasing production could be a burden to global (LME) aluminum prices. (Source: SMM) Finally, Vedanta Aluminum, one of India’s largest primary aluminum producers, produced 598,000 mt last quarter, up from 574,000 mt a year prior. Similarly, alumina production was 484,000 mt last quarter, up 18% year-over-year. For fiscal year 2024, aluminum production was up 3% to 2.37 million mt, while alumina production increased 1% to 1.81 million mt. (Source: Vedanta Limited) |

|

Copper To help build relationships with the world’s top emerging copper and cobalt miners, the US State Department is talking with producers such as the Democratic Republic of the Congo’s (DRC) state-owned copper miner Gecamines, the agency stated late last week. These conversations center around supply deals and building new mines and usually occur every four to six weeks. The department did not comment on whether it will seek to buy out First Quantum’s copper operation in neighboring Zambia. The department stated, “Washington's goal is not to offset China's influence in Africa's critical mineral sector but to diversify its own supply chains and encourage African partners to boost their mining standards.” Several of China’s largest metals producers have taken debt or equity stakes in Africa’s most promising copper and cobalt operations. (Source: Reuters) The volume of on-warrant copper, meaning the metal is available to trade, in LME warehouses currently hovers near the lowest level since late summer 2023. As of this morning, on-warrant inventories are 101,800 mt, down from approximately 175,000 mt in mid-November. This usually suggests that spot demand is improving. However, the LME Cash to 3M spread, another gauge of spot demand, has widened to record levels, suggesting that spot copper demand is weakening. (Source: LME) Unlike aluminum, investment funds have been selling copper, which has pressured prices. As of last Friday, investment funds are net long 35,145 contracts, down from 37,860 contracts on March 15. In that time, the benchmark LME Copper 3M fell by just over 2%. Given the rally so far this week, it’s likely that investment funds have done some buying, despite a mixed supply-demand picture. As Chinese brokerage GF Futures stated earlier this week, “The macro front is still focusing on a potential rate cut in June while China economics data improved with exports picking up,” GF Futures wrote in a note. There’s also supply-side support for copper in the form of potential output reductions in China.” (Source: LME) Ivanhoe Mines’ massive Kamoa-Kakula project in the DRC produced 86,203 mt of copper concentrate in 1Q2024; the company announced earlier this week. This is down about 6.5% compared to 4Q2023. The company cited excessive rainfall, which has impacted the DRC’s hydropower and electricity production, for the lower copper output. Ivanhoe expects to produce 440,000 to 490,000 mt of copper concentrate this year. In recent years, the Kamoa-Kakula complex has become an important emerging copper mine, with ore grades that far exceed that of any copper mine in Chile or Peru. (Source: Ivanhoe Mines) |

|

Other Important LME and CME Metals

|

|

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,450.5/mt, up $113.5/mt on the week. Aluminum prices were up this week. Compared to last week, the futures forward curve has shifted vertically higher by approximately $110/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 20.1¢/lb this week. The CME Midwest Premium market is now in a contango from the April ‘24 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $9,329.5/mt, up $462.5/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted vertically higher by approximately $460/mt and remains in contango throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Depending on their risk tolerance, consumers might consider strategies that use only swaps, options, or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $17,804/mt, up $1,055/mt on the week. As prices were up this week, nickel’s forward curve has also shifted vertically higher by about $1,000/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $860/T, down $29/T on the week. Steel mill profit margins improved dramatically throughout 3Q and 4Q2023 and are also starting 2024 on a good note. The CME HRC Steel – CME MW Busheling Fe Scrap spread, which is generally used as a gauge for steel mill profitability, is now approximately $455/st, up from about $320/st on September 1. This is mainly due to decreasing scrap prices. Thus, steel mills should consider hedging production and raw material usage for 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

4/4/2024: AEGIS Factor Matrices: Most important variables affecting metals prices 4/3/2024: Important US Economic Data (AEGIS Reference) 2/27/2024: Aluminum Consumers Should Still Implement Hedges, Even Though Russia Sanctions Mean Little 2/2/2024: China's Real Estate Woes Provide Opportunity for Copper Consumers 1/25/2024: Aluminum Starts 2024 On a Down Note, But Potential Supply Shocks Give Consumers a Reason to Hedge |

|||||

Notable News |

|||||

|

4/5/2024: Zambia's copper output may rise to 1 mln tons by 2026 as mines expand 4/4/2024: Ford delays some North American electric SUV, truck production 4/3/2024: Ivanhoe Mines Reports Q1 2024 Production Results for the Kamoa-Kakula Copper Complex 4/1/2024: Weak supply and demand to prevent aluminum prices from going up 3/31/2024: Nippon Steel emphasises its 'deep roots' in the US as it pursues U.S. Steel deal 3/30/2024: Russia's Nornickel: Some EU clients refuse to buy products made of Russian metal 3/29/2024: US talks often with Congo's Gecamines on cobalt and copper, official says 3/29/2024: Chile's Codelco posts 2023 profit dip as production falls |

|||||