|

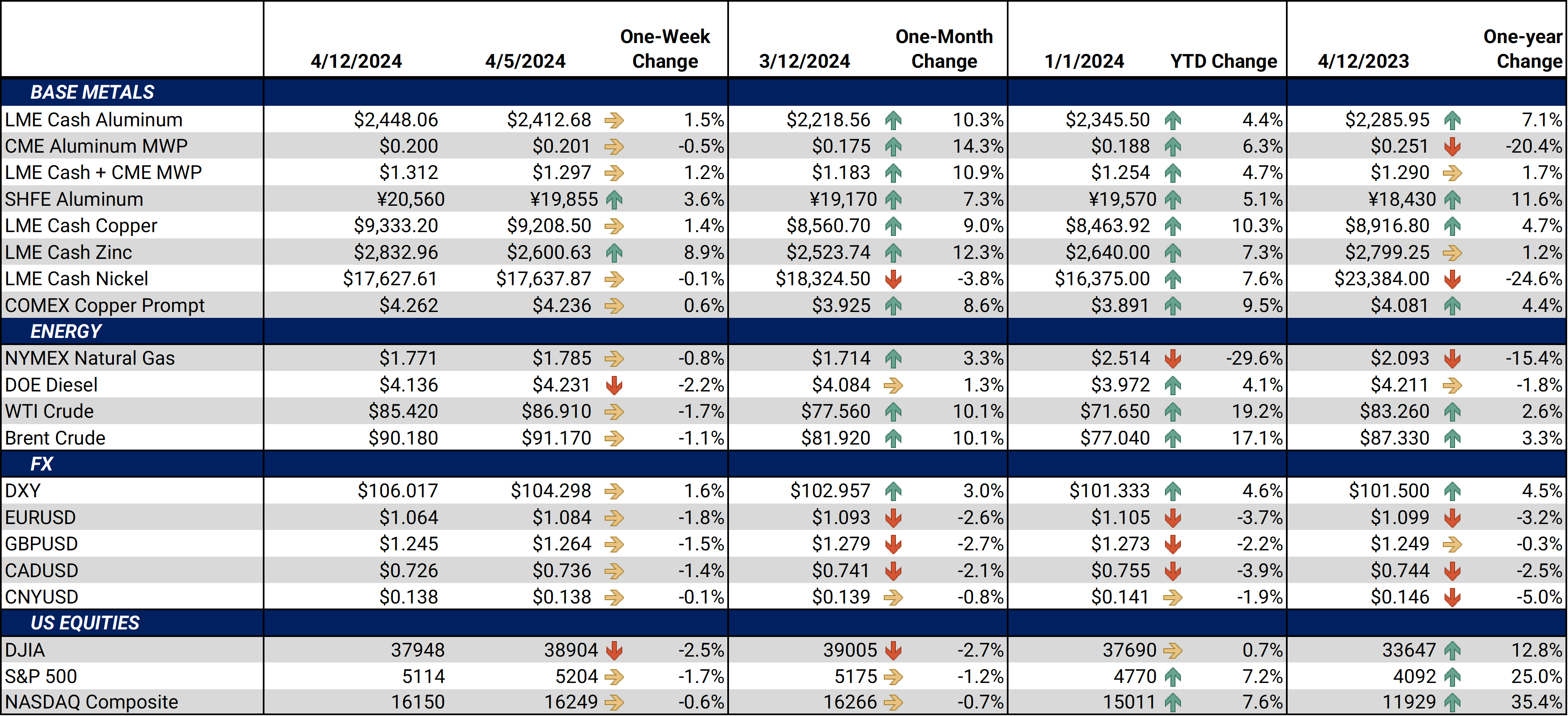

Aluminum Investment funds have now built their largest long position in LME Aluminum since February 2023, according to the LME’s most recent COT report, out Tuesday. As of last Friday, investment funds, generally speculators in metals markets, are net long approximately 56,250 contracts, having bought over 38,000 (net) contracts last week alone, making it the largest week-over-week net position change in recent memory. Given that investment funds can have an oversized influence on metals prices, this could be why LME aluminum rallied nearly 5% last week. (Source: LME) |

|

|

Alcoa, America’s largest aluminum producer, has put its troubled Spain-based San Ciprian operation up for sale and expects to receive bids by June, the company announced late last week. The company has already started reaching out to potential buyers and working with the Spanish government on the sale process. Due to soaring electricity costs and unprofitability, the San Ciprian facility was temporarily shuttered for several years. (Source: Bloomberg) Aluminum Company of China (Chalco), the country’s top state-owned aluminum producer, could have lower growth compared to its private-owned peers, according to an analysis from Bloomberg. This is mainly because Chalco remains dependent upon outsourced bauxite, leading to higher costs. Chalco, like its domestic competitors, should benefit from recent economic stimulus measures, Bloomberg also stated. (Source: Bloomberg) Last month, China’s primary aluminum smelters produced 3.555 million mt, up 4% compared to last March, according to Shanghai Metal Market estimates. For April, SMM predicts the country will have 3.49 million mt, down slightly from a month prior. This is mainly due to an expected smelter shutdown in the Sichuan province and a slower-than-expected smelter restart in Inner Mongolia. Previously curtailed production in Yunnan Province, the country’s top production region, is also slowly coming back online. (Source: SMM) The forward curve for the CME Midwest Premium (MWP) has been in a very tight range since early January and remains in a contango throughout 2024. The prompt month April contract currently hovers near 20 cents, while the December ’24 contract is trading near 22 cents. If you have exposure to the CME MWP market or need advice on how to trade in this contango market, please reach out to AEGIS for strategies. (Source: CME) |

|

Copper LME Copper continued its rally this week amid persistent supply fears. Several major global copper miners struggle with production issues, which has forced many of China’s refined copper producers to slash output. The benchmark LME 3M contract surged over 5% last week on these concerns and made 22-month highs this week. (Source: Bloomberg) The LME Copper Cash – 3M spread, a key gauge of spot demand, continues to sink to record lows. As of this writing, the LME copper cash contract is trading at an approximate $124/mt discount to the benchmark 3M, nearly the lowest level since at least 1994. This suggests that spot demand has slumped while prices have surged. (Source: LME) Like aluminum, investment funds added to their long position in LME Copper last week, boosting prices by 5%. According to the same COT report out Friday, investment funds are now net long 40,325 contracts, having purchased approximately 5,180 (net) contracts last week. Since copper and aluminum continue to rally this week, investment funds have likely added to their significant long position in both metals. (Source: LME) Chile’s Codelco, the world’s largest copper miner, produced nearly 300,000 mt last quarter, 99% of their internal goal, its CEO announced late last week. For 2024, the company expects to produce 1.33 million tons and 1.39 million tons. Even though Codelco is essentially making its production goals, it is still well off the pace of recent years and continues near 25-year lows. In 1Q2023, Codelco produced 352,000 mt. Codelco has struggled with many production issues in recent years, including poor weather and worker strikes. (Source: Bloomberg) With new investments and mine expansions, Zambia’s copper production could reach 1 million mt by 2026, the country’s Finance Minister proclaimed late last week. Production could rise to 3 million mt by the end of the decade, he also stated. 2022 the country produced 763,000 mt but slipped to 698,000 mt due to weather and financing issues. Despite the recent setbacks, Zambia is the second-largest copper producer in Africa and is becoming an im |

|

Other Important LME and CME Metals

|

|

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,494/mt, up $43.5/mt on the week. Aluminum prices were up this week. Compared to last week, the futures forward curve has shifted vertically higher by approximately $45/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 20.0¢/lb this week. The CME Midwest Premium market is now in a contango from the April ‘24 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $9,457.5/mt, up $128/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted vertically higher by approximately $130/mt and remains in contango throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Depending on their risk tolerance, consumers might consider strategies that use only swaps, options, or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $17,797/mt, down $7/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower by a mere $10/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $45/T, down $8/T on the week. Steel mill profit margins improved dramatically throughout 3Q and 4Q2023 and are also starting 2024 on a good note. The CME HRC Steel – CME MW Busheling Fe Scrap spread, which is generally used as a gauge for steel mill profitability, is now approximately $440/st, up from about $320/st on September 1. This is mainly due to decreasing scrap prices. Thus, steel mills should consider hedging production and raw material usage for 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

4/10/2024: AEGIS Factor Matrices: Most important variables affecting metals prices 4/3/2024: Important US Economic Data (AEGIS Reference) 2/27/2024: Aluminum Consumers Should Still Implement Hedges, Even Though Russia Sanctions Mean Little 2/2/2024: China's Real Estate Woes Provide Opportunity for Copper Consumers 1/25/2024: Aluminum Starts 2024 On a Down Note, But Potential Supply Shocks Give Consumers a Reason to Hedge |

|||||

Notable News |

|||||

|

4/11/2024: Chile's copper output up 9.8% in February, Codelco production dips -Cochilco 4/11/2024: U.S. Department of Justice opens probe into Nippon Steel's U.S. Steel deal, Politico reports 4/9/2024: China March aluminum output and April forecast 4/9/2024: Gold hits record high for eighth session in a row 4/8/2024: AI could add 1 million tons to copper demand by 2030, says Trafigura 4/8/2024: US must boost Africa ties to secure key minerals, report says 4/5/2024: Zambia's copper output may rise to 1 mln tons by 2026 as mines expand 4/4/2024: Ford delays some North American electric SUV, truck production |

|||||