|

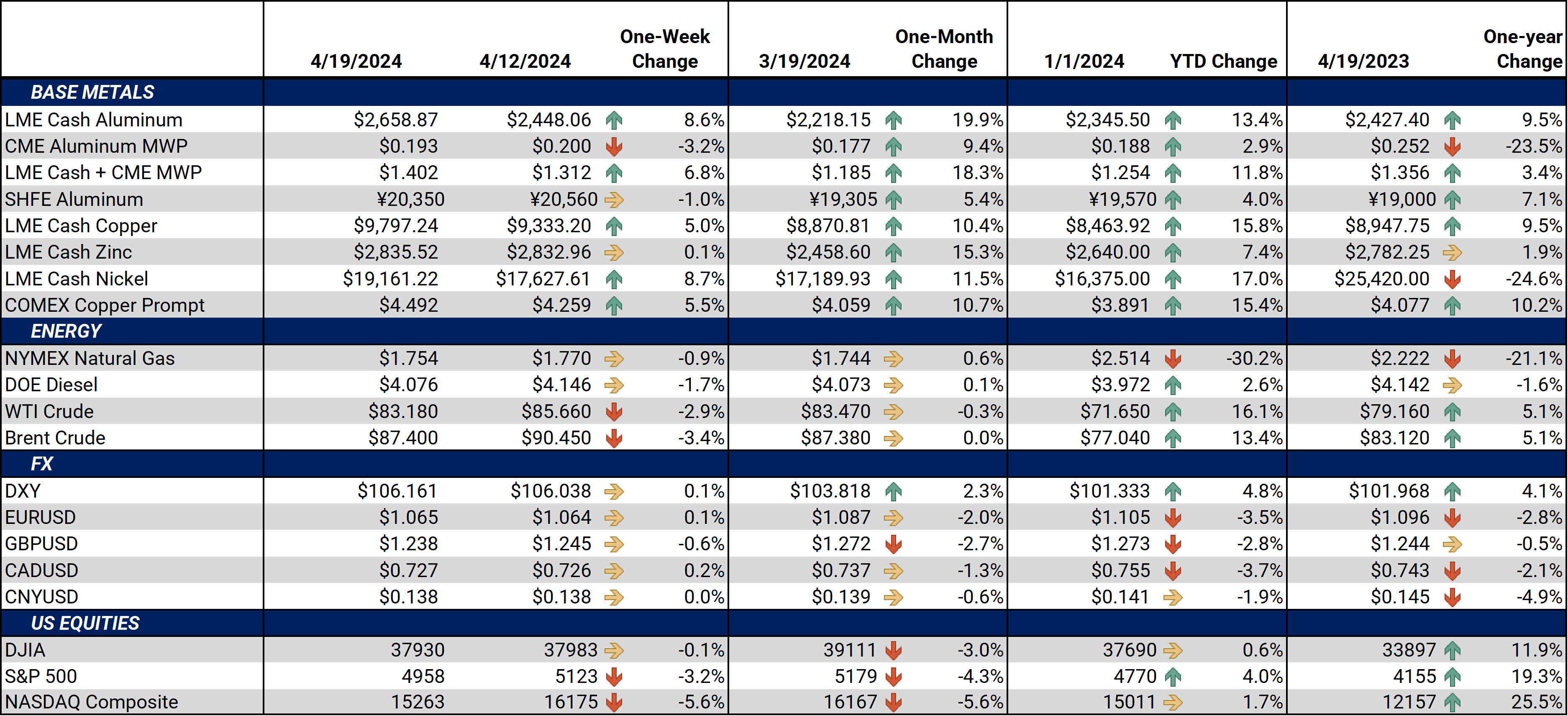

Aluminum Late last Friday afternoon (US time), the US & UK governments announced they were banning imports of all newly produced Russian metals, effective immediately. At essentially the same time, the LME declared that Russian aluminum and other metals produced after April 13, 2024, cannot be used for deliveries into LME warehouses. Despite the ban on newly produced aluminum, the LME is bracing itself for a possible influx of “old” Russian aluminum, its CEO warned and acknowledged on Saturday morning. This shouldn’t dramatically affect US imports, as the US has imported only a negligible amount of Russian aluminum in 2023 and 2024. For more information on these bans, or if you want a copy of the governmental or LME press releases, please contact AEGIS. (Sources: LME, Bloomberg) |

|

|

LME Aluminum prices briefly rallied almost 9% on Monday morning (UK time) after the US, UK, and LME all banned the import or delivery of newly produced Russian aluminum. This knee-jerk reaction quickly cooled, and aluminum finished up approximately 3% on Monday afternoon. Meanwhile, market analysts are mixed about the wider implications these new rulings will have. In an emailed note to Bloomberg, Morgan Stanley stated, “While the new restrictions do not stop the trade of Russian metal, we could see some temporary upside support for prices of copper, aluminium and nickel…. if the ban on delivery into LME and CME warehouses makes traders and users less willing to handle Russian material and disrupts broader trade flows.” Meanwhile, Citigroup proclaimed, “We think the net impact is positive for LME-traded primary aluminum, copper and nickel flat prices as it shifts the prior discount for new Russian units of these metals off-exchange and creates vulnerability to near-dated spread tightness through future inventory cancellations. However, the measures are not meaningfully targeting physical trade of units outside the LME warehouse system, which should moderate the scale of the price impact. We think the measures are intended to (and will) drive deeper discounts for new Russian metal production versus global prices by constraining options for their sale and finance." (Source: Bloomberg) In response to the US, UK, and LME import and delivery ban on Russian-produced aluminum, Rusal proclaimed these actions would not impact sales. “The announced actions have no impact on Rusal's ability to supply since Rusal's global logistic delivery solutions, access to banking system, overall production and quality systems are not affected. The U.S. determination does not impose any new prohibitions or requirements relating to the processing, clearing or sending of payments by any intermediary banks." Rusal is the largest primary aluminum producer outside of China. The company is also the largest foreign supplier to the Chinese market. (Sources: Reuters, China Customs) Investment fund positioning in LME aluminum surged again last week, according to the LME’s most recent COT report. As of last Friday, investment funds, which are generally speculators in metals markets, are net long approximately 75,720 contracts, making this the largest net long position they have had in nearly two years. Given the price surge this week amid the US, UK, and LME’s ban on imports and deliveries of newly produced Russian aluminum, it's likely that investment funds added to this already significant long position this week. (Source: LME) President Biden is proposing new 25% tariffs on Chinese-produced aluminum and steel products, he proclaimed during a campaign speech in Pennsylvania on Wednesday. This is approximately three times higher than the current tariff. US officials will also launch an investigation into China’s shipbuilding industry. Imports of Chinese aluminum and steel products have dropped substantially in recent years, but the new measures will further strengthen the current anti-dumping safeguards, the officials stated. (Source: Bloomberg) |

|

Copper LME Copper has surged to a 22-month high this week, but some analysts caution about the recent strength. In a note from late last week, Macquarie Bank stated, “The underlying narrative remains very positive, both from a challenged supply perspective and with regards to cyclical improvements in global growth. However, the near-term move looks to be driven by financial flows, both discretionary and systematic moment driven, and is arguably getting ahead of itself now.” (Source: Bloomberg) Like aluminum, investment funds continue to buy LME copper, albeit at a lower volume. Last week, according to the same COT report, these funds added approximately 4,500 (net) contracts to their long position. This brings the total net long position to about 44,800 contracts, the highest level since early 2021. AEGIS cautions that the position in early 2021 was a record, and it is unclear if funds will set a new record in the coming days or weeks. (Source: LME) Rio Tinto, a top copper supplier, recently reiterated that investment in mining projects remains lackluster and far below what the world needs to supply the energy transition. "The gap is humungous, and I am actually very worried about whether we will be able to close (it). The mining industry has reduced its investments significantly since the 2015-2016 period ... We're hundreds of billions of dollars below what we need.” These comments were made at the Ecosperity conference in Singapore on Monday. (Source: Reuters) Zambian copper miners continue to struggle with production due to ongoing electricity supply issues. On Wednesday, the country’s power utility announced force majeure to several important copper mines due to ongoing drought that has hindered hydroelectricity production. Zambia is an important emerging copper producer and is the second largest in Africa, but it has struggled in recent years due to these weather and electrical issues. (Source: Bloomberg) Due to the significant rally over the past several weeks, several large Chinese copper smelters will boost exports. According to anonymous sources quoted by Bloomberg, two of them are planning to ship 10,000 mt to either LME or SHFE warehouses. China remains the net importer of refined copper, but some producers ramp up exports when the arbitrage is advantageous. (Source: Bloomberg) |

|

Other Important LME and CME Metals

|

|

|

|

|

|||||

|

|

|||||

LME Aluminum |

|||||

|

LME Aluminum 3M settled at $2,669/mt, up $175/mt on the week. Aluminum prices were up this week. Compared to last week, the futures forward curve has shifted vertically higher by approximately $175/mt. It remains in a steep contango, meaning nearby prices are lower than forward prices. Aluminum consumers concerned about increasing prices might consider hedging future needs by buying swaps or call options. Depending on risk tolerance, end-users might consider strategies that use only swaps or options or a combination of both. The aluminum market has sufficient liquidity to use swaps and options. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

Midwest Premium |

|||||

|

Prompt month CME MWP last traded/settled at 19.3¢/lb this week. The CME Midwest Premium market is now in a contango from the April ‘24 contract on forward. The CME Midwest Premium swap market is thinly traded, with no options market. Hedging in this thinly traded market is challenging, so we recommend using limit orders. Please get in touch with AEGIS for specific strategies that fit your operations. * Please note all these charts are for desktop only. * |

|||||

LME Copper |

|||||

|

LME Copper 3M settled at $9,876/mt, up $418.5/mt on the week. Compared to last Friday, LME Copper's forward curve has shifted vertically higher by approximately $420/mt and remains in contango throughout 2024 and 2025. The copper market has sufficient liquidity to use swaps and options. Depending on their risk tolerance, consumers might consider strategies that use only swaps, options, or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations.

|

|||||

|

|||||

|

LME Nickel 3M settled at $19,326/mt, up $1,529/mt on the week. As prices were down this week, nickel’s forward curve has also shifted vertically lower by a mere $10/mt. It remains in a steep contango, meaning that nearby prices are lower than futures prices. The nickel market has sufficient liquidity to use swaps and options. Depending upon your risk tolerance, consumers might consider strategies that use only swaps or options or a combination of both. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

|

|

|||||

CME Hot Rolled Coil (HRC) Steel |

|||||

|

Prompt month HRC Steel last traded/settled at $843/T, down $2/T on the week. Steel mill profit margins improved dramatically throughout 3Q and 4Q2023 and are also starting 2024 on a good note. The CME HRC Steel – CME MW Busheling Fe Scrap spread, which is generally used as a gauge for steel mill profitability, is now approximately $435/st, up from about $320/st on September 1. This is mainly due to decreasing scrap prices. Thus, steel mills should consider hedging production and raw material usage for 2024. For most steel producers, this would consist of buying CME MW Busheling Scrap swaps and selling CME HRC swaps. Options are available for CME HRC, but they are relatively illiquid. Please get in touch with AEGIS for specific strategies that fit your operations. |

|||||

|

|

|||||

AEGIS Insights |

|||||

|

4/17/2024: AEGIS Factor Matrices: Most important variables affecting metals prices 4/3/2024: Important US Economic Data (AEGIS Reference) 2/27/2024: Aluminum Consumers Should Still Implement Hedges, Even Though Russia Sanctions Mean Little 2/2/2024: China's Real Estate Woes Provide Opportunity for Copper Consumers 1/25/2024: Aluminum Starts 2024 On a Down Note, But Potential Supply Shocks Give Consumers a Reason to Hedge |

|||||

Notable News |

|||||

|

4/18/2024: Exclusive: Mexico, facing US pressure, will halt incentives to Chinese EV makers 4/17/2024: US to reimpose oil sanctions on Venezuela over election concerns 4/17/2024: Biden calls for higher tariffs on Chinese steel 4/17/2024: Russia is in close contact with metals industry after sanctions, Kremlin says 4/17/2024: Glencore acts to profit from LME post-sanction rule change 4/16/2024: Japan's Nissan bets on solid-state batteries, gigacasting for next-gen EVs 4/16/2024: Carbon capture will not play major role in steel decarbonisation, report says 4/15/2024: 'No immediate supply-demand shock' from LME ban on Russian metals, Goldman says 4/15/2024: Exclusive: Russia and China trade new copper disguised as scrap to skirt taxes, sanctions 4/15/2024: Global mining investment too low to support energy transition, Rio Tinto chairman says 4/15/2024: North Carolina approves mining permit for Tesla supplier Piedmont Lithium 4/13/2024: LME Press Releases 4/12/2024: United States and United Kingdom Take Action to Reduce Russian Revenue from Metals |

|||||