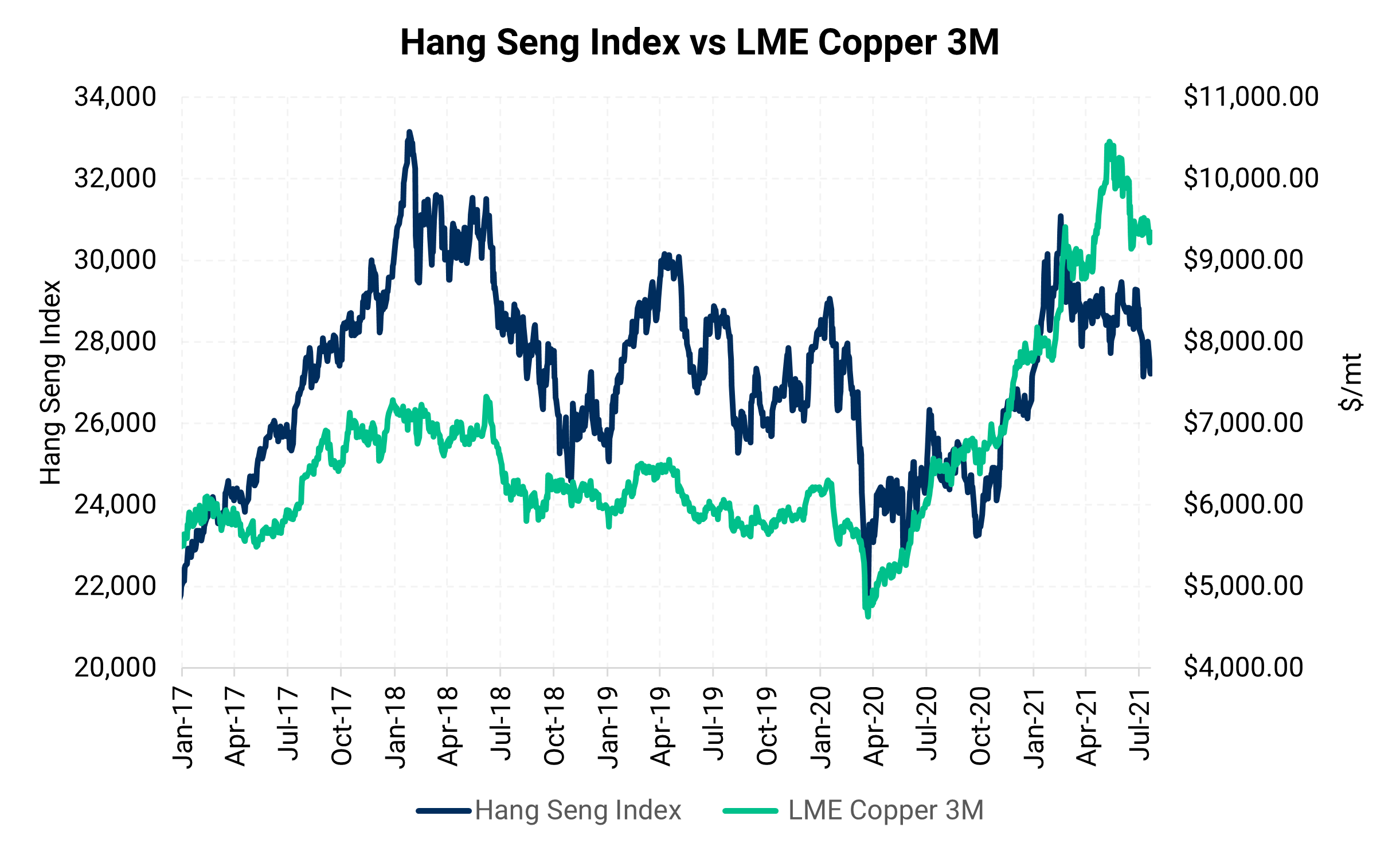

Copper and China's Hang Seng Index (HSI) move by some of the same economic forces. The correlation between the HSI and copper broke its long-standing relationship earlier this year, but as both begin to trend down, the market may be concerned about copper demand.

|

Summary:

- The Hang Seng Index is the most watched stock index from China, and is widely considered to be the most accurate representation of the country's economy.

- Copper is a staple of China's economy, so the HSI and copper are normally fairly well correlated.

- A tight copper market and strong demand in early 2021 led to the metal outperforming the HSI.

- The government is now aiming to rein in copper prices as the economy begins to slow.

- For more AEGIS commentary on China's efforts to address economic growth and metals prices, go here.

|

| |

|

AEGIS Conclusions: We have written several research articles on the Chinese economy (please see and ) where we provide economic data which suggests that their economy is slowing. The Chinese government has implemented several policies aiming to stimulate growth and rein in copper prices, including opening metal reserves. However, as copper is a key input of China's economic engine, it is hard to stimulate the economy and rein in copper prices at the same time. Moreover, copper could keep moving lower if China continues to see lackluster growth or copper demand begins to fall.

|

| |