US Producer Price Index, a leading indicator of inflation, comes in lower than expected. |

||

|

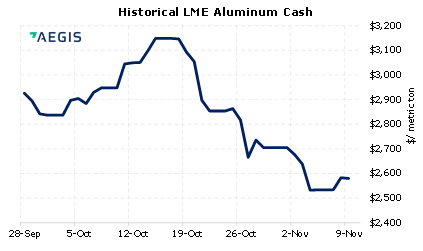

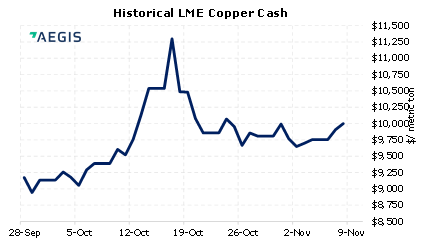

US Producer Price Index (PPI) data was +8.6% Y/Y in October; in-line with the analysts’ estimates of +8.7%. A rising PPI may signal higher consumer prices in the future. End users concerned with continued upside price risks could consider standard hedging strategies, such as call options, or swaps on LME Aluminum or Copper. Please contact AEGIS for specific strategies that fit your operations. (11/09/2021) |

|

|

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

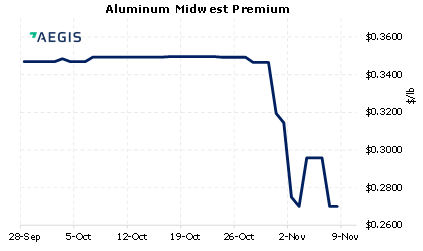

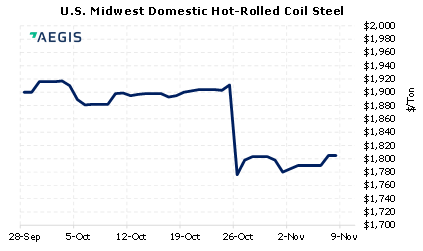

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

11/01/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 10/28/2021: AEGIS Factor Matrices: Most important variables affecting metals prices 10/14/2021: Is It Wise to Hedge HRC Steel with Crude Oil? |

||

|

|

||

Important Headlines & Economic Data |

||

|

AISI Steel Capability Utilization Rate Investing.com Economic Calendar 11/08/2021: China’s daily coal production hits new high of 11.93 mln tons, further ensuring energy supply 11/07/2021: China’s coal imports in October nearly doubled from a year ago 11/06/2021: Honda Motor (HMC) Q2 2022 Earnings Call Transcript 11/05/2021: Honda profit dips 30% as chip crisis hits output, sales |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||