HRC Steel futures are steady as industry participants uncertain of price outlook. |

||

|

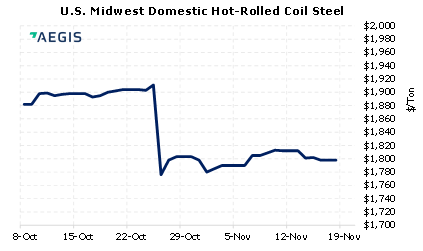

After a record rally in 2021, HRC Steel futures have stabilized in recent weeks. However, a recent survey by Steel Market Update shows that steel buyers are largely uncertain on future price direction. Half of the survey participants are predicting continued price gains; the other half predicts price losses. Bullish buyers cite demand, outages and the infrastructure bills for potential price gains. Bearish buyers cite lower automotive production, higher import volumes and new production capacity for potential price losses. (11/19/2021) |

|

|

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

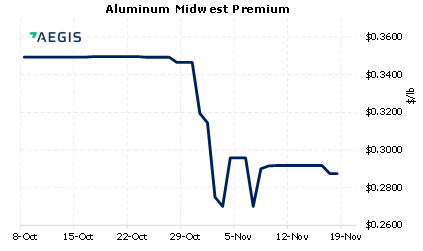

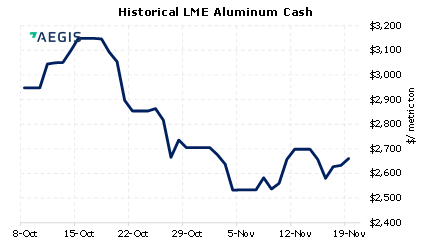

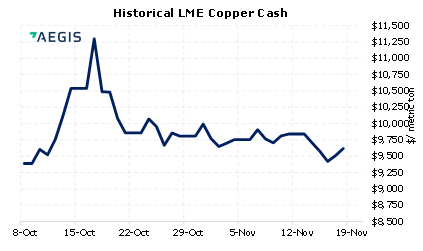

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

11/15/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 11/12/2021: AEGIS Factor Matrices: Most important variables affecting metals prices 10/14/2021: Is It Wise to Hedge HRC Steel with Crude Oil? |

||

|

|

||

Important Headlines & Economic Data |

||

|

AISI Steel Capability Utilization Rate Investing.com Economic Calendar 11/18/2021: Copper falls to one-month low 11/17/2021: Steel prices dominate manufacturing news in 2021 11/16/2021: METALS-Shanghai aluminium hits near six-month low as stockpiles rise 11/15/2021: Falling stocks pose problems for London Metal Exchange 11/15/2021: Here's what's in the bipartisan infrastructure package 11/15/2021: US states and cities are already making big plans for the $1 trillion infrastructure bill 11/15/2021: U.S., Japan to Discuss Lifting Tariffs on Aluminum, Steel as China Ramps up Production 11/15/2021: Japan-US to resolve issue over US “section 232” tariffs on steel and aluminium imports 11/15/2021: METALS-Copper prices ease on firm dollar, weak Chinese property data 11/12/2021: Lithium prices keep rising on the strength of the Chinese market

|

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||