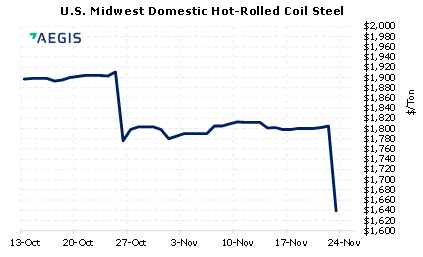

American HRC Steel prices continue sideways trend despite rising prices in China. |

||

|

Steel and iron ore prices in China have rallied this week after their central bank stated that economic stimulus might be coming soon. China’s financial regulators have also requested that some banks issue more real-estate related loans. However, steel prices in the US have stalled in recent weeks as our demand outlook is unclear. Likewise, a strengthening dollar could also be weighing on prices. Due to the Thanksgiving holiday, no Metals First Look will be produced on Thursday morning. (11/24/2021) |

|

|

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

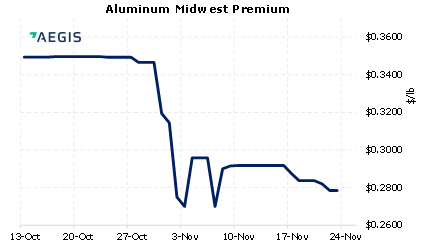

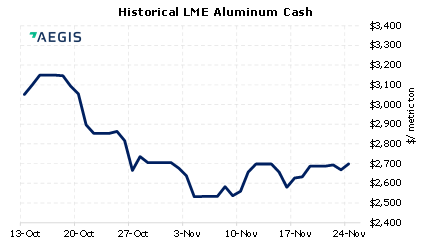

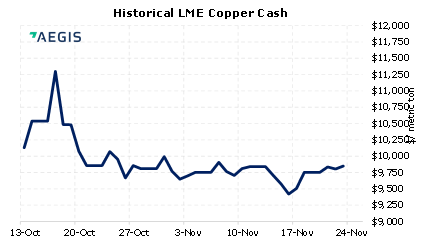

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

11/15/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 11/12/2021: AEGIS Factor Matrices: Most important variables affecting metals prices 10/14/2021: Is It Wise to Hedge HRC Steel with Crude Oil? |

||

|

|

||

Important Headlines & Economic Data |

||

|

AISI Steel Capability Utilization Rate Investing.com Economic Calendar 11/22/2021: Zinc price jumps as Glencore cuts production in Italy 11/22/2021: The $5 billion hoard of aluminium the world wants but can't have 11/21/2021: Steel prices could trend ‘much higher’ compared to the last 10 years, major Indian steelmaker says 11/19/2021: Aluminium jumps on supply worries after report of China smelter blast

|

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||