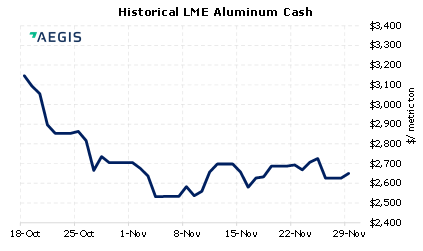

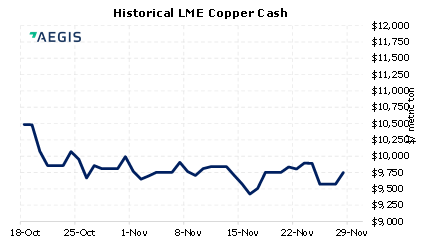

LME Copper and Aluminum prices bounce as market weighs the effects of omicron COVID variant. |

||

|

Metals prices are up this morning; however, market participants are still uncertain the impact the newly found omicron variant of COVID-19 may have on metals demand. The World Health Organization stated that there is “no information to suggest that symptoms associated with Omicron are different from those from other variants." Demand for metals may deteriorate if economic activity slows. (11/29/2021) |

|

|

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

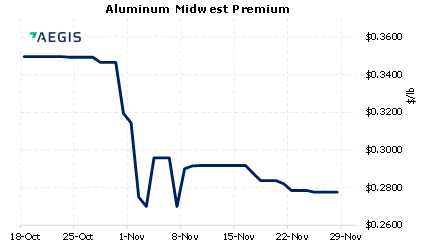

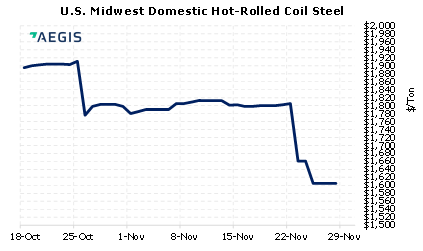

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

11/15/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 11/12/2021: AEGIS Factor Matrices: Most important variables affecting metals prices 10/14/2021: Is It Wise to Hedge HRC Steel with Crude Oil? |

||

|

|

||

Important Headlines & Economic Data |

||

|

AISI Steel Capability Utilization Rate Investing.com Economic Calendar 11/29/2021: Dow futures rebound by 200 points after Friday’s big sell-off as investors reassess omicron risk 11/26/2021: Copper price sinks as new covid variant spooks markets

|

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||