Demand for platinum is expected to increase in 2022. |

||

|

Platinum, which is used in many industrial applications such as cars and electronics, has been on a price downtrend throughout most of 2021. However, the World Platinum Investment Council expects platinum demand in the automotive sector to rebound in 2022 as it is a cheaper alternative to palladium. This could put CME platinum futures back on the upswing. (11/30/2021) |

|

|

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

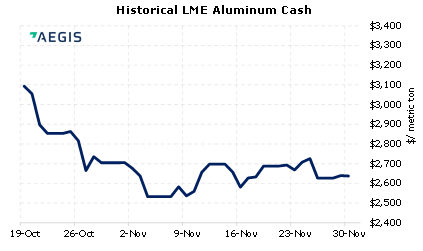

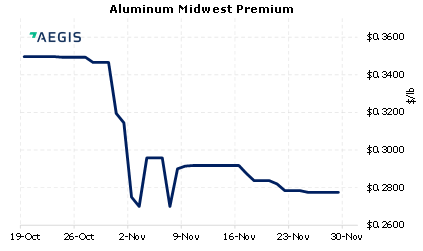

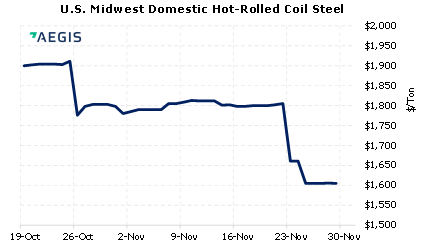

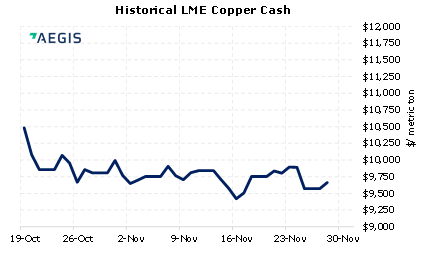

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

11/15/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 11/12/2021: AEGIS Factor Matrices: Most important variables affecting metals prices 10/14/2021: Is It Wise to Hedge HRC Steel with Crude Oil? |

||

|

|

||

Important Headlines & Economic Data |

||

|

AISI Steel Capability Utilization Rate Investing.com Economic Calendar 11/29/2021: Gold SWOT: Platinum demand from auto sector expected to rise next year 11/29/2021: Iron ore price back above $100 despite Omicron variant fears 11/29/2021: Copper price rises as markets assess Omicron variant impact 11/29/2021: Dow futures rebound by 200 points after Friday’s big sell-off as investors reassess omicron risk 11/26/2021: Copper price sinks as new covid variant spooks markets |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||