The world’s largest copper producer is predicting lower prices in 2022. |

||

|

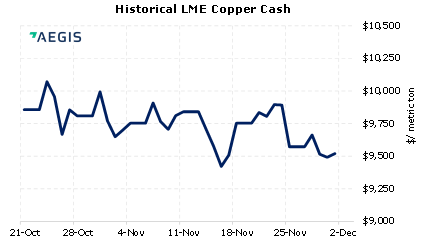

Yesterday, the CEO of Chilean copper producer Codelco stated the company has predicted copper will fall to between $3.80 and $3.90 per pound ($8,340/mt to $8,600/mt) in 2022. This is down from current level of $4.26 per pound ($9,400/mt). The company believes that supply will outstrip demand until 2024, hence lower prices are predicted. The company produced 1.6 billion tonnes in 2020 and is on pace to produce similar volumes this year. Copper consumers may view forecasts such as the Codelco one as an argument not to hedge. AEGIS urges a statistical approach that measures how much you should hedge to reach your financial goals if prices move against you. (12/2/2021) |

|

|

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

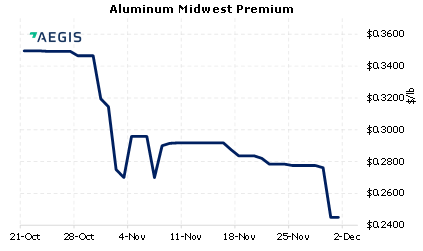

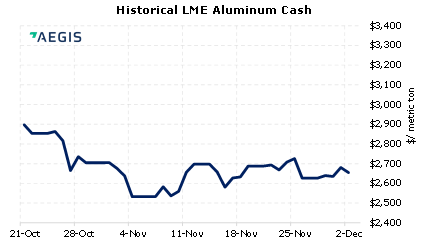

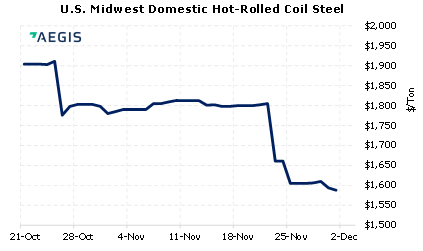

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

11/30/2021: Section 232 Tariffs: Most relevant developments (AEGIS Reference) 11/30/2021: Will the Omicron COVID Variant Impact South African Metals Production or Exports? 11/24/2021: AEGIS Factor Matrices: Most important variables affecting metals prices |

||

|

|

||

Important Headlines & Economic Data |

||

|

AISI Steel Capability Utilization Rate Investing.com Economic Calendar 12/1/2021: Codelco, world's largest copper producer, expects prices to fall in 2022 11/30/2021: Tin prices gain momentum as Indonesia mulls tin, copper export bans 11/30/2021: Minerals Council South Africa applauds mining industry’s vaccination milestone 11/29/2021: Gold SWOT: Platinum demand from auto sector expected to rise next year 11/29/2021: Iron ore price back above $100 despite Omicron variant fears 11/29/2021: Copper price rises as markets assess Omicron variant impact 11/29/2021: Dow futures rebound by 200 points after Friday’s big sell-off as investors reassess omicron risk 11/26/2021: Copper price sinks as new covid variant spooks markets |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||