|

LME Nickel 3M last traded at $46,200/mt, up $17,070/mt on the day, as of 7:15AM CST. This is the highest level since 2007. Like aluminum and copper, nickel has rallied as the Russia-Ukraine conflict could strain supplies. Several major shipping companies have stopped booking shipments to and from Russia. Traders recently cited by Bloomberg fear that Russian nickel might be excluded from the market, and consumers would need to source metal from other suppliers. Russia was the world’s third-largest nickel miner in 2019, with about 10% of global mine production that year, according to USGS data. Prices for nickel might also stay elevated if warehouse stocks continue to fall. Warehouse stocks are considered a measure of the balance of supply and demand. LME Nickel stocks were 76,830 mt on Monday, the lowest level since 2019. Consumers who are concerned about their nickel input costs might consider purchasing swaps or call options. Please note that doing so might incur losses if prices decrease. Please contact AEGIS for specific strategies that fit your operations. (3/7/22) |

|

|

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

03/02/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 02/15/2022: Section 232 Tariffs: Most relevant developments (AEGIS Reference) |

||

|

|

||

| Important Headlines | ||

|

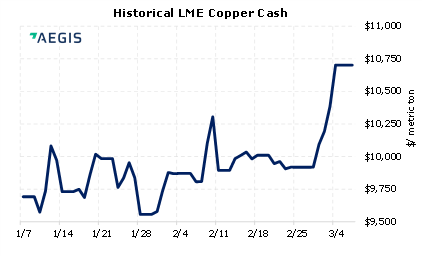

3/4/2022: Copper price hits all-time high as warehouses empty out 3/4/2022: Factbox: Commodity supplies at risk after Russia invades Ukraine 3/3/2022: Russia-Ukraine tension may give rise to a new commodity world order |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||