The LME is closed on Thursday, June 2, and Friday, June 3, due to bank holidays and Queen Elizabeth's Platinum Jubilee. Since we are halfway through 2022, we thought it would be an opportune time to see how metals prices are shaping up so far this year.

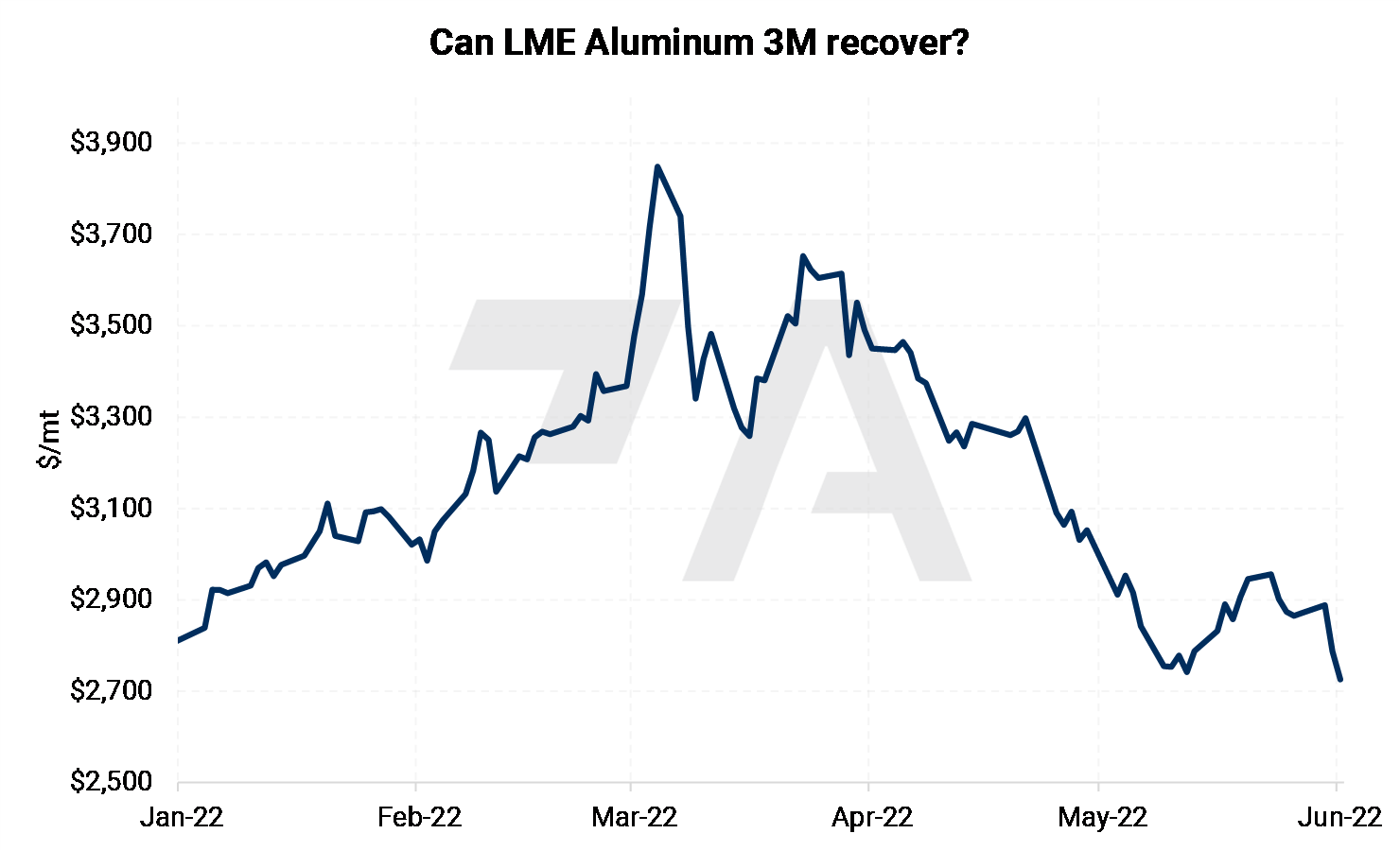

| Starting with aluminum, the rally that we saw in the first quarter peaked in early March, mere weeks after the start of the Russia-Ukraine conflict. Rusal, which is Russia's largest aluminum producer and a major exporter, had some problems with securing raw materials; however, those issues quickly subsided as China came to its rescue. Also, softening demand, specifically in Asia, has weighed on prices. The LME 3M contract is now down about 3% on the year. |

|

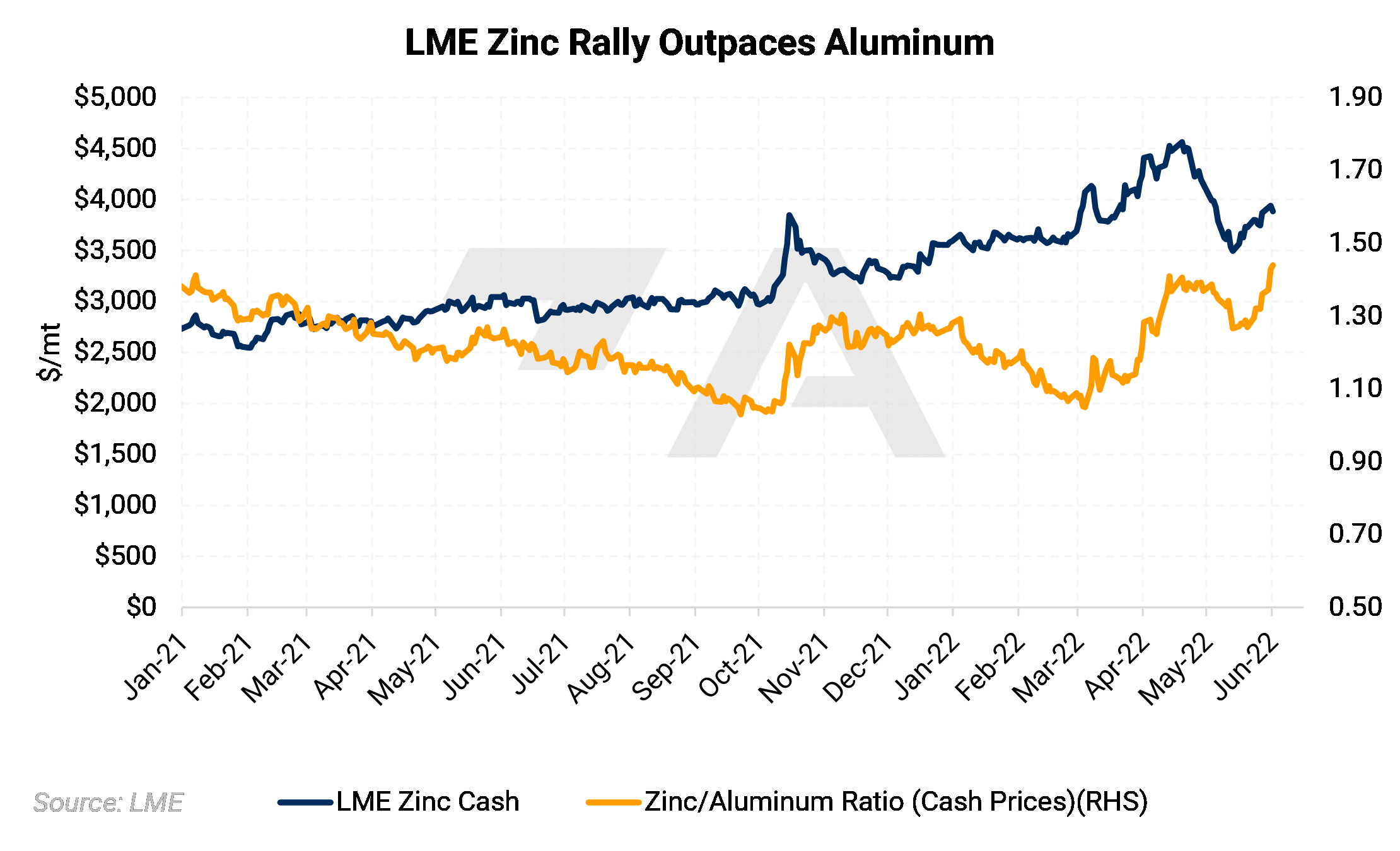

| Zinc prices are positive so far. However, we should keep an eye on the zinc/aluminum cash ratio. This ratio has been rangebound this year, between 1.0 and 1.45, and is currently at 1.44. Historically this ratio rarely exceeds 1.6. This could keep a cap on zinc prices, if end-users switch to cheaper aluminum. (For a more detailed look into this ratio and other zinc fundamentals, please see our LME Zinc Price and Fundamentals Dashboard). |

|

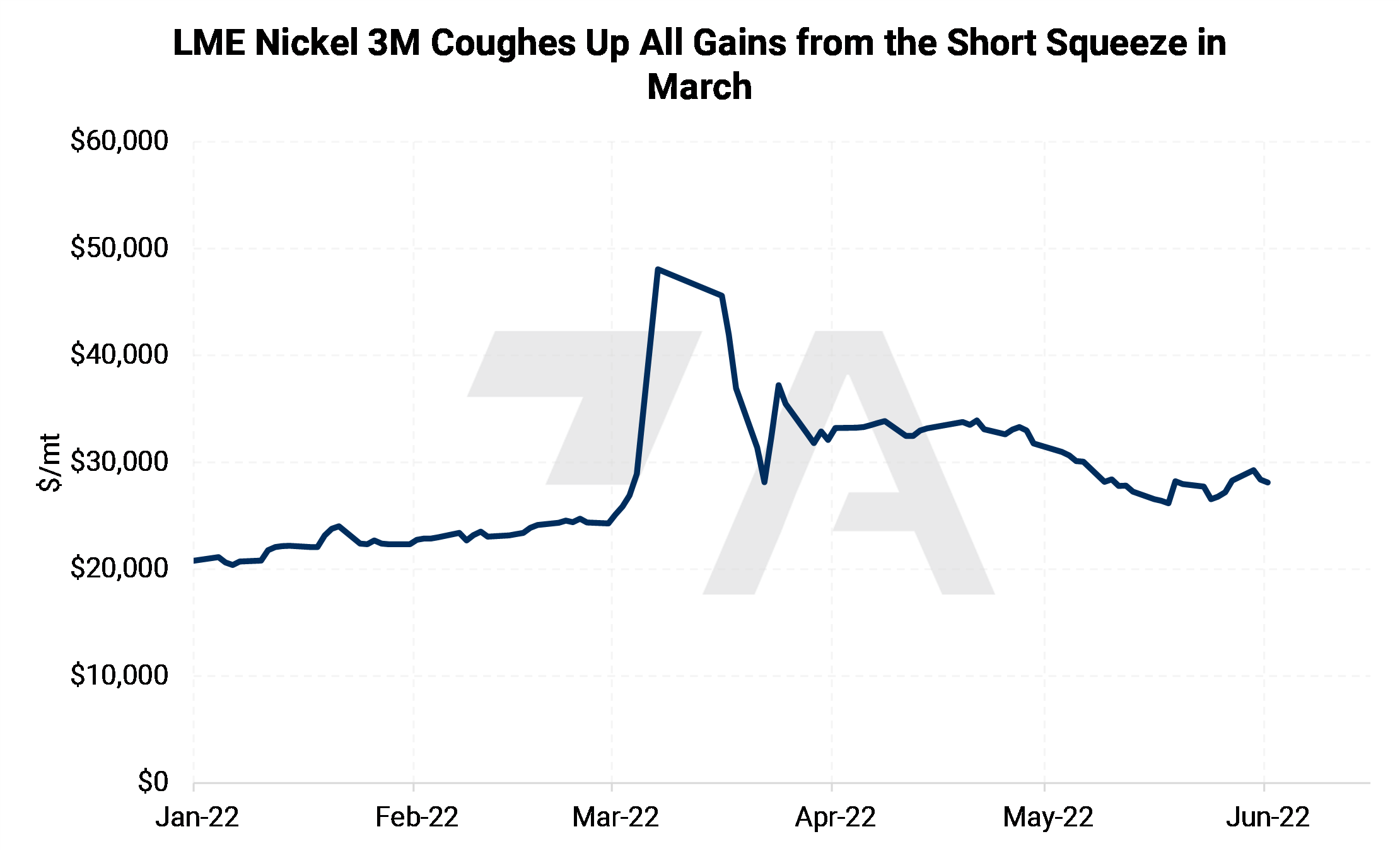

| Nickel prices have been on a wild ride this year. An epic "short squeeze" of a large Chinese producer sent the market to $55,000/mt in early March. Prices have settled down since then, but are still up about 35% this year. (For more details on what happened in early March, please see our March 11, 2022, Weekly Dashboard). |

|

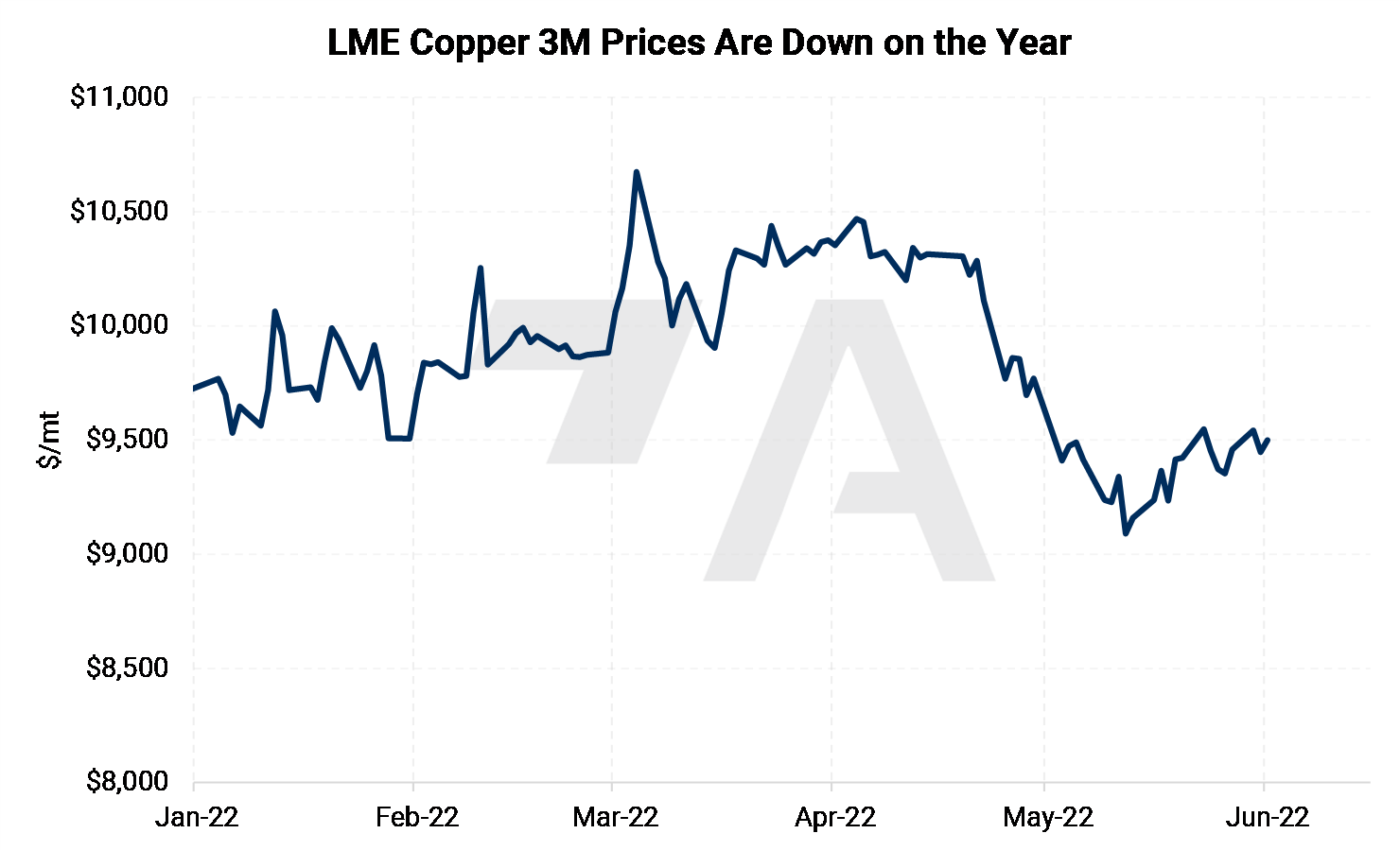

| Similar to aluminum, COVID lockdowns in China have weighed on copper demand. Despite production issues in Peru, copper prices are down just over 2% this year. |

|

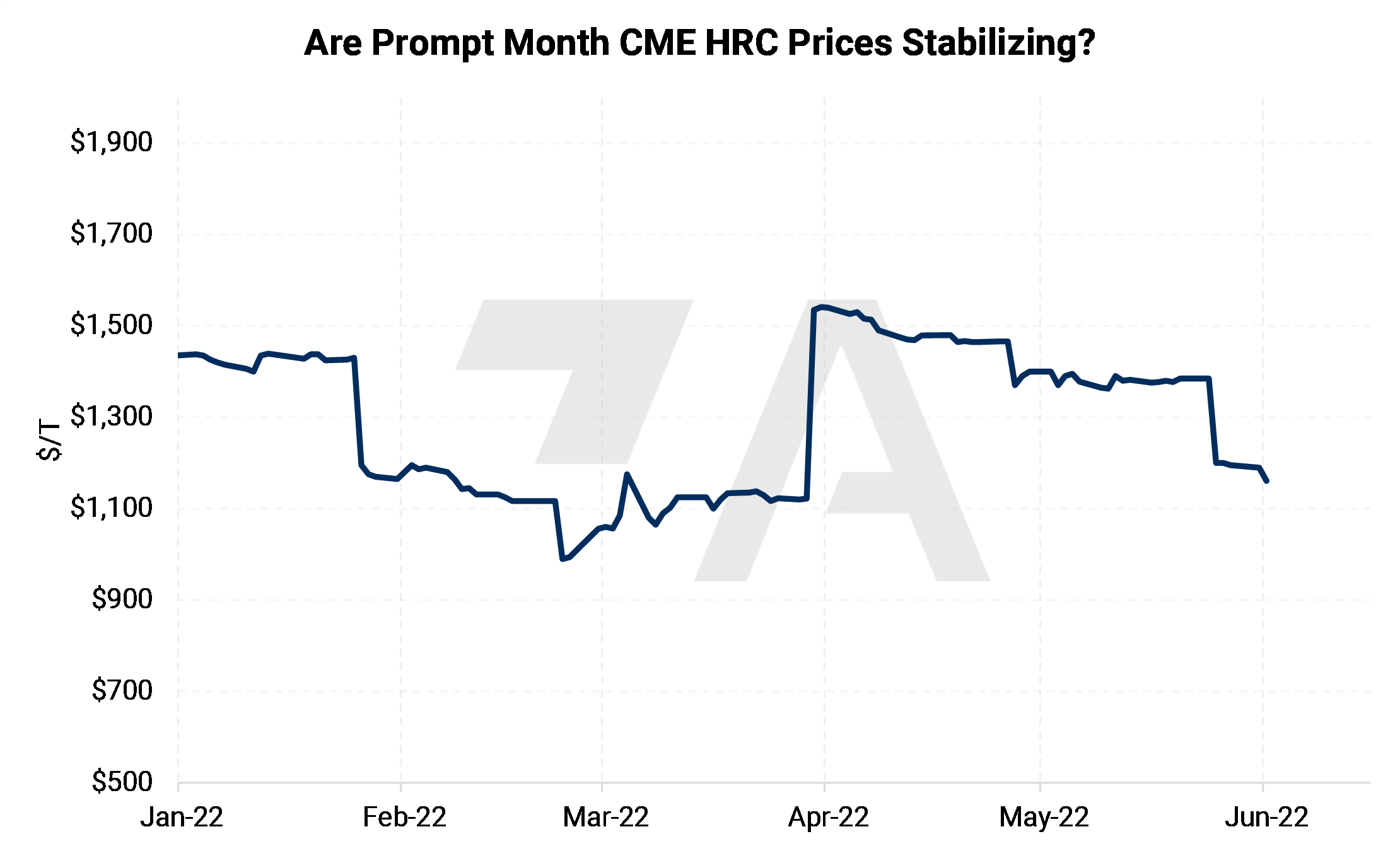

| CME HRC Steel prices have stalled after last year's unprecedented rally. A global semiconductor shortage has tempered automotive production, and is likely weighing on steel demand and prices. |

|

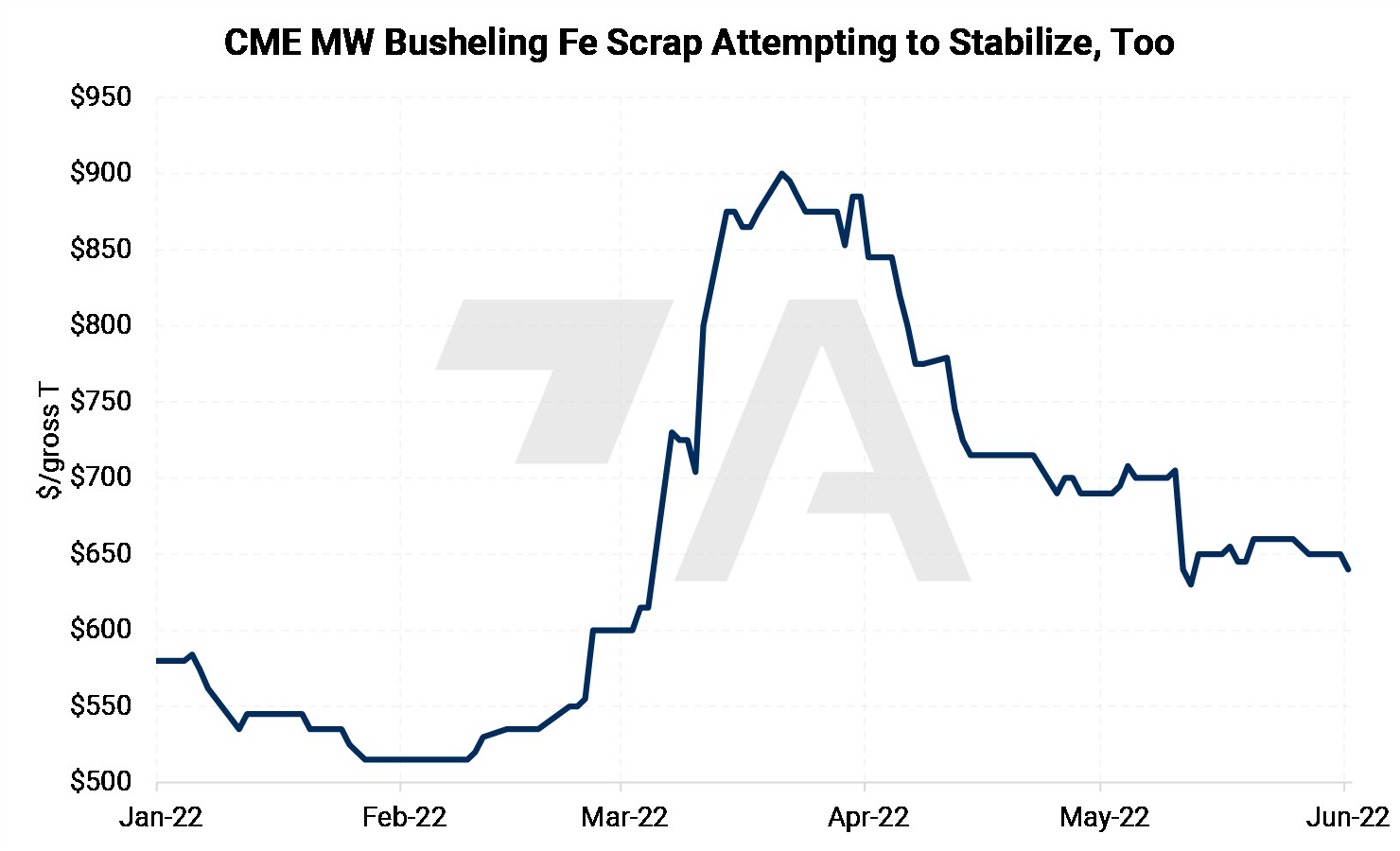

| Unlike HRC Steel, busheling scrap prices are still slightly positive so far. |

|

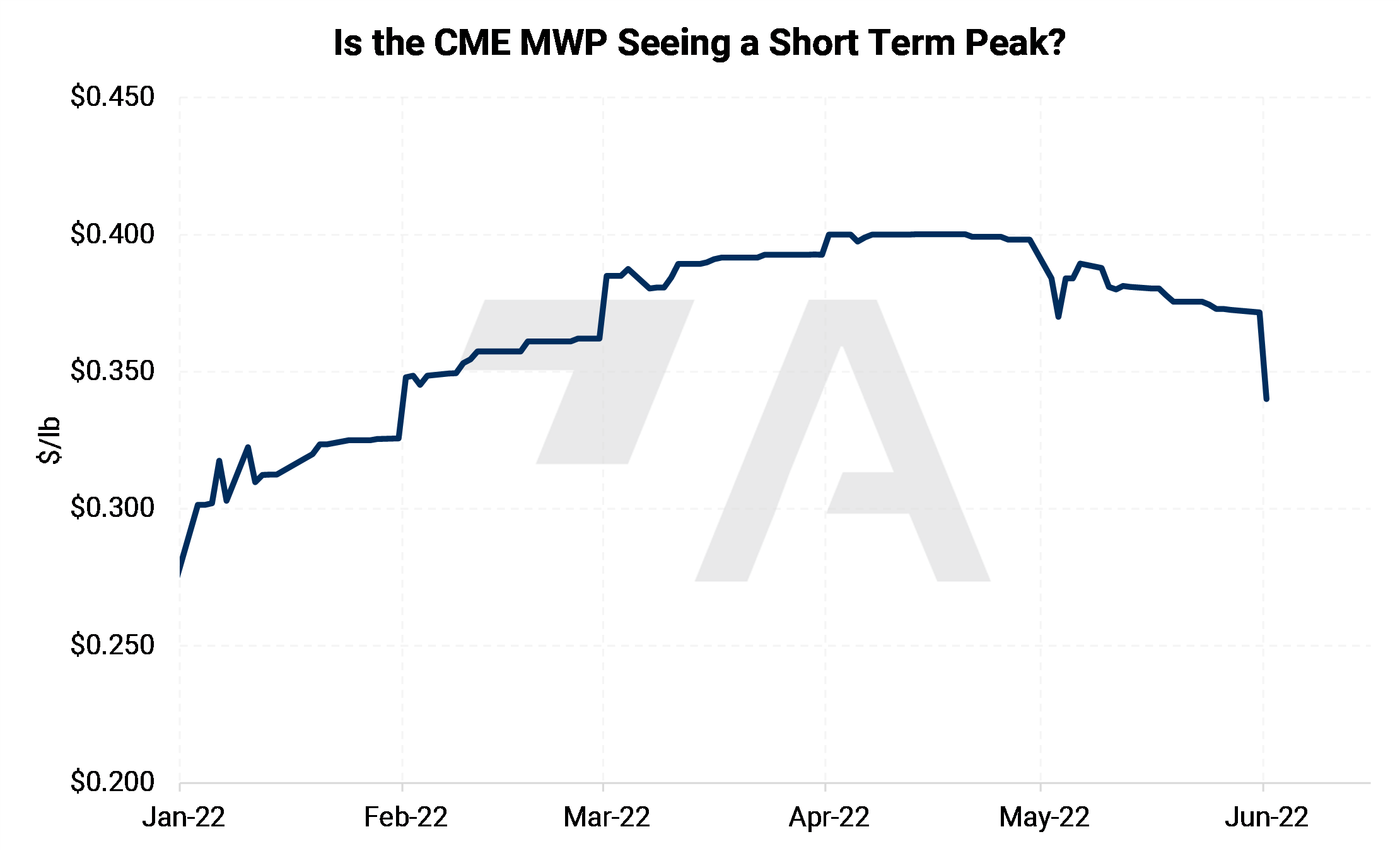

| Unlike global aluminum prices, the CME Aluminum Midwest Premium prices are still positive for the year. US aluminum demand has remained strong while demand in other regions (namely Asia) has softened. However, prices have dropped from their peak in early April. |

|

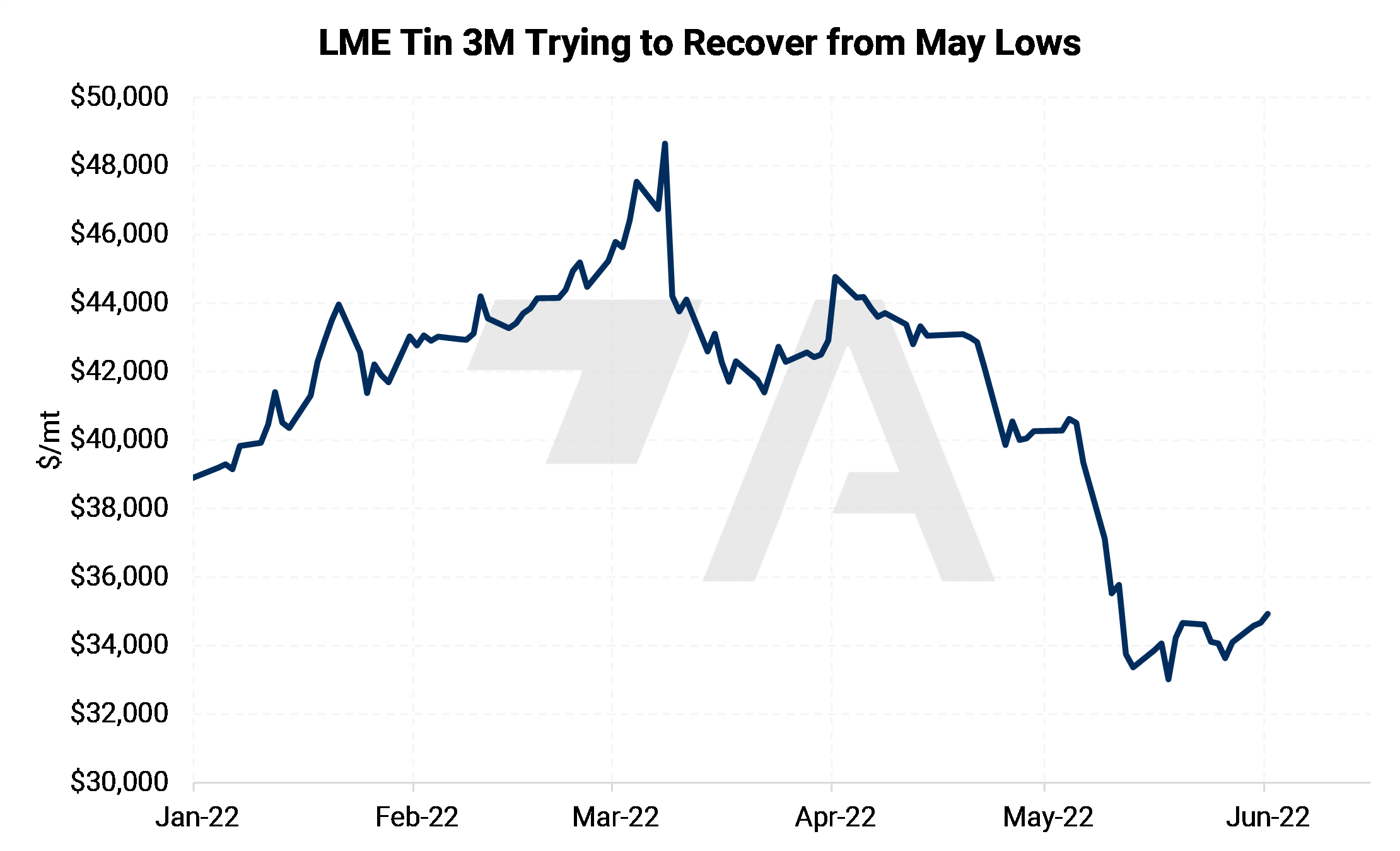

| Finally, LME tin prices are down nearly 10% this year. Indonesia, which is the world's largest exporter, has increased shipments this year. However, their president recently announced that the country might ban tin exports starting in 2024. |

|

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities. |