|

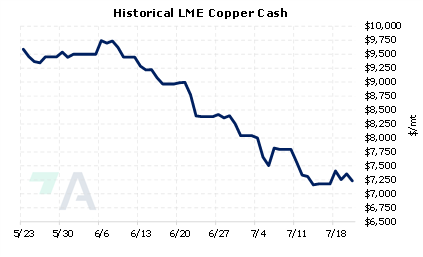

If BHP is correct, inflationary pressures, supply chain constraints, and labor market tightness could affect mining production in 2023. This could put upward pressure on copper prices. The company stated its concerns about 2023 production in its 2022 Operational Review that was released on Tuesday. They also expect that the European energy crunch, Ukrainian war, and central bank interest rate hikes could impede global economic growth in 2023. However, BHP believes that Chinese stimulus measures to be a positive influence on the global economy. |

|

|

|

Copper end-users that are concerned about higher prices might consider applying hedges that provide upside price protection, such as buying swaps or call options, both of which would establish a maximum price. Such positions are basic for end-user hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. (7/21/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

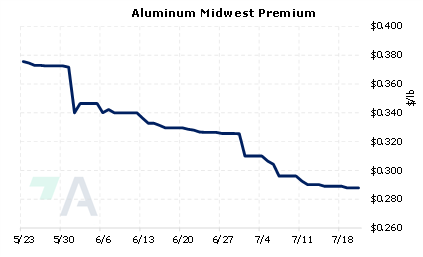

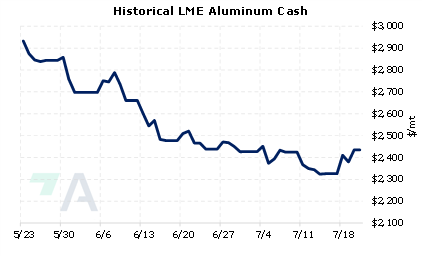

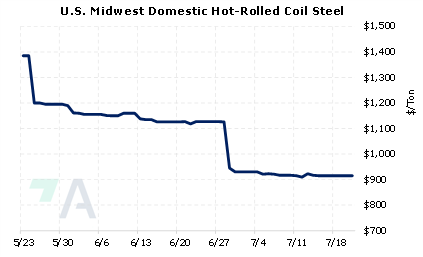

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

07/20/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 07/20/2022: Interest in Hedging Cobalt is Increasing 07/07/2022: Have Copper Prices Begun to Find a Bottom? |

||

|

|

||

| Important Headlines | ||

|

7/19/2022: China’s homebuyers are running out of patience with the real estate slump 7/19/2022: Two giant miners warn of tougher times as world demand wavers 7/18/2022: China scrambles to defuse alarm over mortgage boycotts and banks runs 7/18/2022: China raises loan-support efforts for developers amid mortgage boycott 7/18/2022: Estimated NorthAm auto losses rise 7/18/2022: Commodity Tracker: 5 charts to watch this week 7/17/2022: Mongolia says Russia-China gas pipeline will break ground in 2024 7/17/2022: CMOC's Congo mine suspends copper and cobalt exports

|

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||